-

Shiba Inu price returns to a technical Point and Figure bull market.

-

Initial pullback expected before another push higher.

-

50% upswing expected upon confirmed bullish breakout.

Shiba Inu price has likely found a bottom and is likely to begin the next phase of a new upswing. A double-bottom was formed at $0.0000375 and it held as support.

Shiba Inu price spike over 15%, bulls attempt to maintain gains

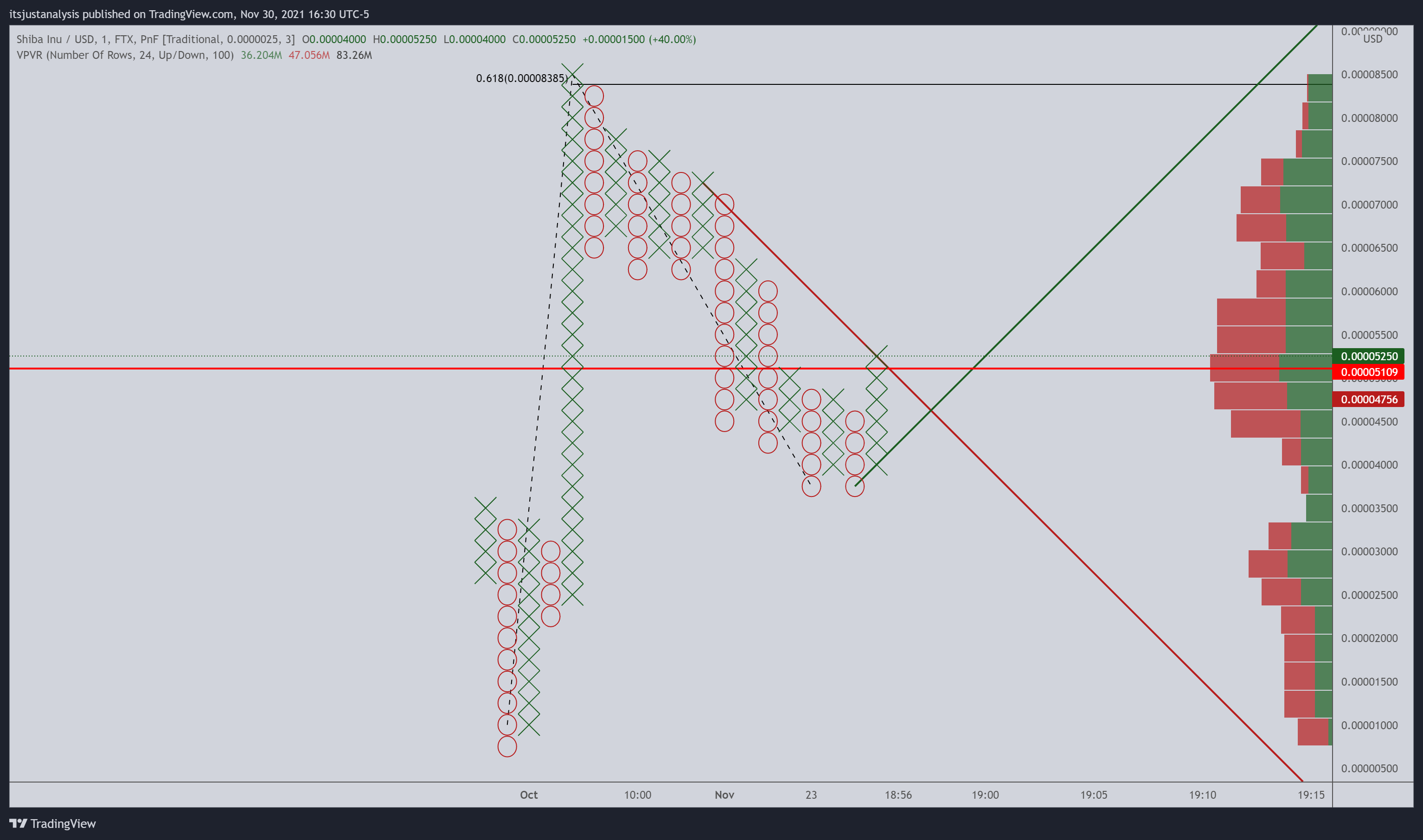

Shiba Inu price has a good reason to be bullish. The most critical price confluence zone on the $0.0000025/3-box reversal Point and Figure chart is the intersection of the 2021 Volume Point Of Control (red horizontal line) and the dominant bear market angle (red diagonal line) at $0.0000050. Since hitting and poking above that angle, Shiba Inu has converted into a dominant bull market.

Note: In Point and Figure Analysis, price action is always in a bull market or bear market. Bull and bear markets can switch very frequently.

Traders should expect Shiba Inu price to pullback anywhere between $0.0000450 to $0.0000425 to hold as support before re-entering long. If the new bull market trend line (green diagonal line) holds as support, then a swift trip to $0.000075 is next.

SHIBA/USDT $0.0000025/3-box Reversal Point and Figure Chart

However, traders should be cautious of the current setup. If Shiba Inu price were to fall below the new bull market angle and form a triple bottom at $0.0000375, SHIB could be in some serious trouble. Conversely, a move lower to $0.0000350 would confirm the break of a triple-bottom and fulfill the requirements of a Bullish Fakeout pattern. Shiba Inu could move as low as $0.0000100 if that were to occur.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

XRP gains as traders gear up for futures ETFs debut this week

XRP climbs over 3% on Monday, hovering around $2.33 at the time of writing. The rally is likely catalyzed by key market movers like XRP futures Exchange Traded Funds (ETFs) approval by the US financial regulator, the Securities and Exchange Commission (SEC), and a bullish outlook.

Bitcoin Price Forecast: BTC eyes $97,000 as institutional inflow surges $3.06 billion in a week

Bitcoin (BTC) price is stabilizing above $94,000 at the time of writing on Monday, following a 10% rally the previous week. The institutional demand supports a bullish thesis, as US spot Exchange Traded Funds (ETFs) recorded a total inflow of $3.06 billion last week, the highest weekly figure since mid-November.

Ethereum Price Forecast: ETH ETFs post first weekly inflows since February

Ethereum (ETH) recovered the $1,800 price level on Saturday after US spot Ether ETFs (exchange-traded funds) recorded their first weekly inflows since February.

Defi Development Corporation files to offer $1 billion in securities to boost its Solana holdings

Defi Development Corporation (formerly Janover) filed a registration statement with the Securities & Exchange Commission (SEC) on Friday, signaling its intent to offer and sell a wide range of securities, including common and preferred stock, debt instruments and warrants for the purchase of equity

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.