Shiba Inu and Dogecoin crumble under pressure from Powell’s speech

- Jerome Powell’s speech at the Economic Symposium triggered a bloodbath in Shiba Inu and Dogecoin.

- The dog-themed cryptocurrencies are struggling to recover from the slump.

- Analysts have identified the specific market conditions needed for SHIB and DOGE to begin their recovery.

Shiba Inu and Dogecoin prices are struggling to recover from a slump after the recent bloodbath that hit the crypto market. The US Federal Reserve Chairman’s speech fueled the dip in dog-themed cryptocurrencies.

Also read: Bulls take Shiba Inu, Dogecoin price higher as financial leaders eye Jackson Hole

Shiba Inu and Dogecoin prices struggle to comeback

Dog-themed cryptocurrencies Shiba Inu and Dogecoin are considered speculative for their massive volatility. However, in the ongoing cycle, Shiba-Inu-themed cryptocurrencies failed to survive the bloodbath. The two meme coins suffered a decline that wiped out double-digit profits amassed by holders in the last two weeks.

Jerome Powell, chair of the US Federal Reserve shared a negative outlook on the US economy. Following Powell’s commentary on raising interest rates to control inflation, there was increased cautiousness among traders. Investors pulled out capital from Dogecoin and Shiba Inu, in response to the Federal Reserve’s hawkishness.

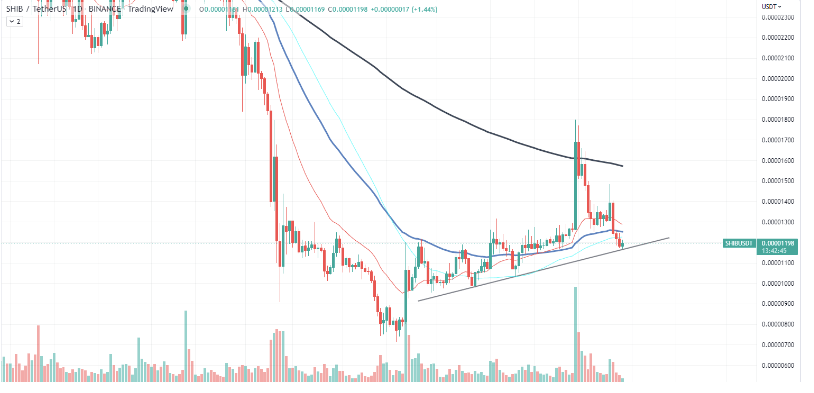

Analysts evaluated the Shiba Inu price chart and identified that the token has successfully bounced off the local support level. At UToday, analysts noted that Shiba Inu is moving on the trendline support formed in July 2022. The line is the last line of support for SHIB as the 50-day exponential and regular moving averages fail to hold large selling pressure from whales.

SHIB-USDT price chart

Kelvin Maina, leading crypto analyst at InvestingCube noted that Dogecoin price started its recovery today. Despite a 91.3% decline from it's all-time high, Dogecoin price has bullish potential according to analysts.

Several factors contributed to the decline in Dogecoin price, including the Federal Reserve’s hawkishness, whales shedding their portfolio and declining demand among investors. Maina argued that the DOGE price could decline to the $0.050 level. Once prices hit the support level, it can be considered a clear signal of further decline in DOGE. If Dogecoin price sustains above the support level and continues its uptrend, the outlook remains bullish.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.