Shiba Inu accumulation at this level could yield maximum returns

- Shiba Inu price has rallied 21% since breaching a declining trend line on March 19.

- Another shift in market structure hints at a 30% return for SHIB.

- A daily candlestick close below $0.0000205 will invalidate the bullish thesis.

Shiba Inu price is arriving at a critical junction on its journey north. Flipping this hurdle into a support floor will be key to triggering further upside for SHIB.

Shiba Inu price at crossroads

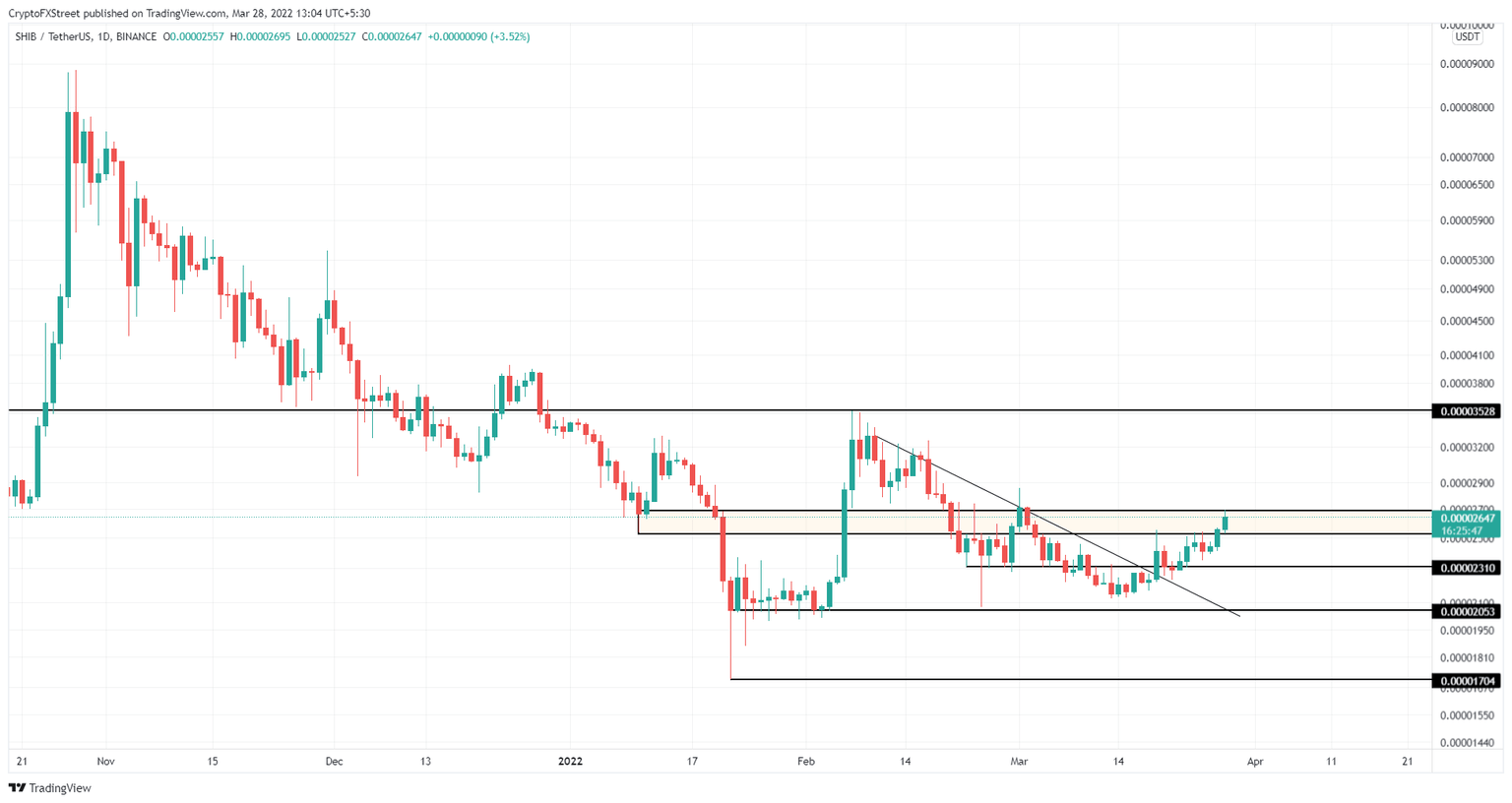

Shiba Inu price has rallied roughly 21% since breaking out of the downtrend on March 19. This reversal triggered bulls to propel SHIB past the $0.0000231 resistance barrier and retest the next hurdle that extends from $0.0000252 to $0.0000269.

This resistance area has been significant since January 10 when it has been absorbing the selling and buying pressure. Therefore, the recent retest puts Shiba Inu price at crossroads; a successful flip of this hurdle into a foothold will indicate that bulls are in control, and a failure will likely lead to a retracement to $0.0000231.

Either way, interested investors can accumulate SHIB at $0.0000231 and add to their position if SHIB can hold above $0.0000269. Such a development will open the path for bulls to make their way toward the next crucial barrier at $0.0000352.

In total, this run-up would constitute a 33% ascent from the current position and 52% from $0.0000231. Investors that entered long positions can book profits at this level.

SHIB/USDT 1-day chart

Regardless of the recent upswing, Shiba Inu price, like all altcoins, depends on the directional bias of Bitcoin. If BTC flash crashes, it will jeopardize the bullish outlook for SHIB.

A daily candlestick close below $0.0000205 will invalidate the bullish thesis for Shiba Inu price by producing a lower low. This development could also trigger a 17% crash to $0.0000170.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.