SHIB vs PEPE: Why Pepe could never dethrone Shiba Inu

- Shiba Inu is back ahead of Pepe in market cap. The latter’s utility shortage has proven to be a vibe killer among community members.

- PEPE creation was to rival SHIB and outperform the dog-themed token amid market excitement.

- The massive ongoing dip has delivered the sensational crypto below the $700 million market cap bar.

Shiba Inu (SHIB) has regained its position of favor ahead of Pepe (PEPE) after the hype and meme frenzy drove the latter to unprecedented levels. However, as the excitement subsides, PEPE has retracted from its ark rival, SHIB, faster than most assets.

Also Read: Andrew Tate participates in meme coin fever, promises to pump “shitcoins”

Shiba Inu’s expected rival runs out of gas

Shiba Inu’s expected rival, Pepe, has dropped below the $700 million market capitalization as the sensational meme coin continues to suffer massive dips. The plunge comes in the wake of a declining hype around the token’s emergence and the overall bearishness in the market.

Notably, PEPE was originally designed to compete against SHIB, but the recent turn of events has had Pepe lag behind with no regard to its meteoric yet short-lived rally witnessed over the past few weeks. Nevertheless, its remarkable performance at the time cannot be overlooked, as the astonishing spring to a market cap above $1.8 billion on May 5 made several investors rich. This walk of fame also saw the meme coin secure a position among crypto’s top-40 list of assets by valuation.

The epic surge of the meme coin was caused by speculative demand, partly fueled by the growing hype around the digital asset. Nevertheless, with the hype waning daily, investors are also exiting in troops.

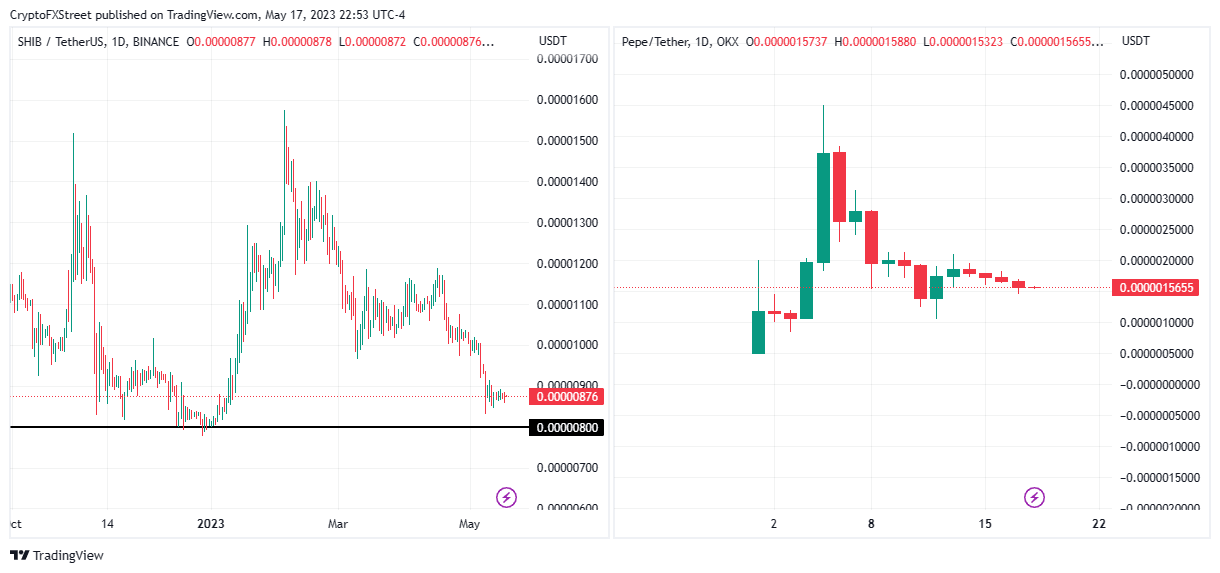

Thus far, Pepe is down over 16% over the last week, while Shiba Inu is down 2%, with a market cap of $665.05 million and $5.18 billion, respectively. As a hedge against more dips, Shiba Inu price continues to hold above the $0.000008 support level, with the market cap above $5 billion, keeping the dog-themed token among the crypto top 15 by valuation.

SHIB/USDT 1-day chart, PEPE/USDT 1-day chart

On the other hand, Pepe’s market cap represents a decline of about 65% from the $1.825 billion peak recorded on May 5. As a result, the hyped meme coin has rescinded to position 72 in terms of market capitalization.

Data from crypto market intelligence resource, Kaiko, shows that most investors are betting against PEPE, as Open Interest (OI) for the PEPE/USDT perpetual jetted to around $70 million this past weekend, with short positions dominating.

PEPE-USDT perpetual futures open interest on Binance was nearly $70 million over the weekend, with shorts outweighing longs. pic.twitter.com/MPIzZghjjx

— Kaiko (@KaikoData) May 17, 2023

SHIB vs. PEPE: Implications of lack of utility

The value drop and massive shifts in statistics for Pepe are owed to its lack of real-world utility, which has earned the token a place among the biggest losers over the last 24 hours, shedding almost 10%. Simply put, investors are fleeing the PEPE market because it lacks a real-life application.

To put this in perspective, consider PEPE vis-à-vis SHIB and Dogecoin (DOGE), which have actual use cases as accepted payment modes among utilities. Further, the SHIB community is pushing to integrate the Shibarium ecosystem’s layer-2 (L2) solution and SHIB: The Metaverse. These moves would increase the real-world utility of Shiba Inu further.

Also Read: Best time to invest in Pepe, expert insights from former Dogecoin millionaire

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.