SHIB price plunges after Vitalik Buterin dumps dog-themed tokens

- Vitalik Buterin received Shiba Inu tokens at his public wallet address as part of a burn mechanism.

- The meme-coin mania has caused Ethereum gas fees to rise again, and now Buterin has decided to ditch the dog-themed tokens.

- Shiba Inu price dropped by over 40% in the past 24 hours as the Ethereum co-founder cleaned out his crypto wallet.

Vitalik Buterin, co-creator of Ethereum, recently became one of the world’s richest people with a net worth topping $21 billion. Although the recent price hike of Ethereum boosted Buterin’s total assets, only $1.3 billion resulted from his ETH holdings. The rest of his fortune was made up of dog-themed tokens that he was gifted.

Vitalik Buterin regifts his dog coins

The Shiba Inu cryptocurrency creators announced in April that they had transferred half of all SHIB in circulation to Buterin. Under this process, the founders believe that they could legitimize the token and protect the circulation.

Shiba Inu, a meme token that was launched as a Dogecoin rival, recently climbed into the top 20 cryptos by market capitalization from the social media-driven frenzy. The token, which positions itself as the “DOGE killer,” surged this week after listing on multiple crypto exchanges, including Binance, OKEx and FTX. Chinese traders have propelled SHIB price higher, with Huobi witnessing the largest share of Shiba Inu trading volume in the past week.

Meme coins were being pushed on social media platforms like TikTok, where retail traders searched for the next Dogecoin. With the hype around canine-themed tokens and the artificially low circulation of Shiba Inu, the token received a massive publicity wave, with dozens of other dog coins created and transferred to Buterin’s public wallet as a burn activity.

At this time, the markets were unaware of what Buterin could do with the holdings of these tokens. A SHIB holder even managed to turn $17 into $6.5 million at one point as Shiba Inu price rose to an all-time high at $0.00003791.

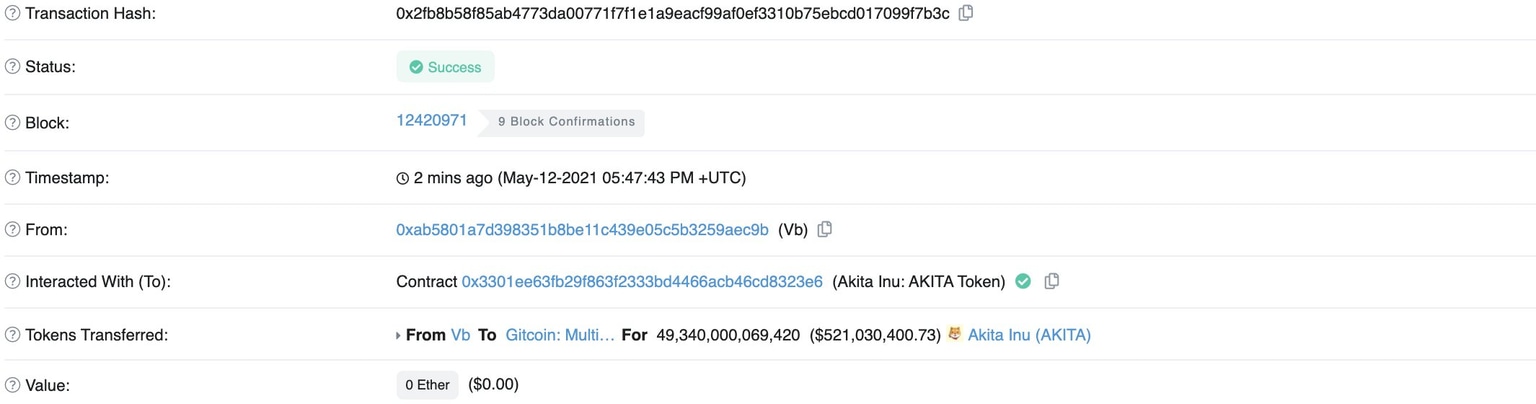

The Ethereum co-creator recently decided to dump the dog tokens, pulling the rug on all of the canine-themed gifts. According to Etherscan, Buterin donated 50 trillion SHIB to the India Covid Relief Fund founded by Polygon founder Sandeep Nailwal. He also set around $431 million of AKITA to public Ethereum-based fundraising platform Gitcoin.

Buterin's transaction to Gitcoin

Buterin also removed liquidity from various pools on top of transferring his holdings of the dog coins to charities. In another transaction, he converted $2 million SHIB on UNiswap to Ether and transferred significant amounts of other canine-themed tokens, including Dogelon, CoShi Inu, AkarmaruUNI and many others.

The meme-coin frenzy has caused Ethereum gas fees to surge, which could be one of the reasons incentivizing Buterin to strike back. SHIB price plunged by over 40% in the past 24 hours, reaching $0.00001787 at the time of writing. Other dog tokens have shed more than half of their market value and could lower the canine coin mania that has captivated the crypto market in the past few weeks.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.