While Bitcoin's (BTC) bear market has paused, the shares in Grayscale Investment's bitcoin trust (GBTC) are yet to find relief.

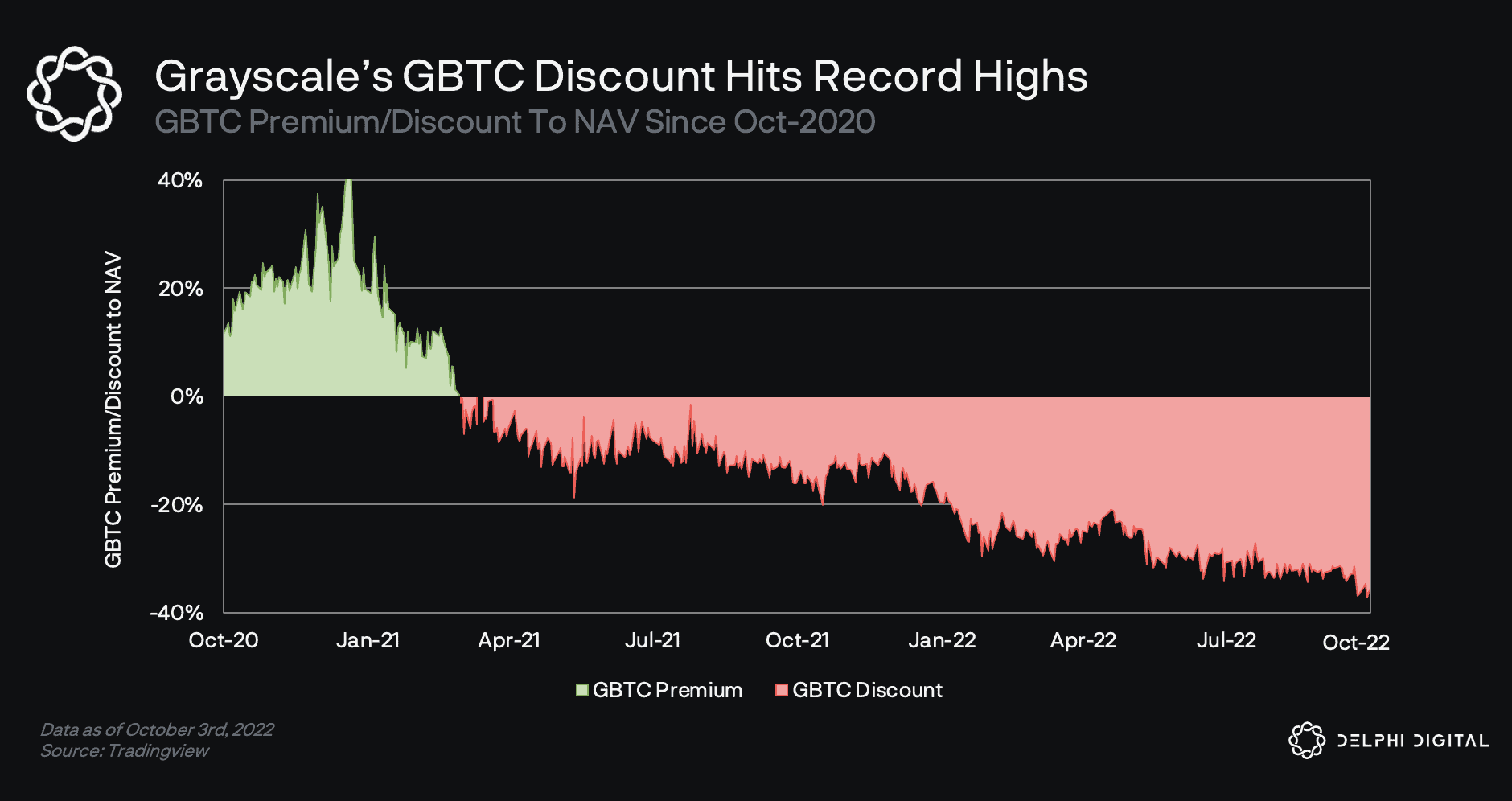

The discount in GBTC shares relative to the underlying cryptocurrency held in the fund widened to a record 36.2% on Sept. 30, according to data tracked by Delphi Digital. GBTC shares slipped into the discount category in February last year and have traded lower than the fund's net asset value (NAV) ever since.

The GBTC is one of the most widely tracked funds in the crypto market, as the trust has been the preferred venue for institutional investors to gain exposure to bitcoin without having to purchase or take custody of the cryptocurrency.

So, it's natural to assume that the continued widening of the GBTC discount stems predominantly from the absence of institutional demand. However, that's not necessarily true and persistent discount at least partly reflects the increasing availability of alternatives like exchange-traded funds (ETF).

"Some suggest that the increasing discount illustrates subsiding institutional interest in bitcoin, while others point to a wider offering of ETFs or alternative vehicles for BTC investment," Andrew Krohn, an analyst at crypto research firm Delphi Digital wrote to clients on Monday.

The shares slipped into a discount in February 2021. (TradingView/Delphi Digital) (TradingView, Delphi Digital)

The Grayscale Bitcoin trust is a close-ended fund, meaning BTC deposits remain locked forever. As of writing, the trust holds BTC 635,240, worth over $12 billion. That's roughly 3.3% of bitcoin's circulating supply.

Accredited investors can buy GBTC shares directly at the NAV by depositing bitcoin or U.S. dollars. The firm takes care of the custody and charges an annual management fee of 2% to investors. GBTC shares can be sold in the secondary market after a lock-in period of six months. So if prices fall within six months, all holders can do is sit and watch the value of their investment tank. The now-defunct crypto hedge fund Three Arrows Capital was one of the largest holders of GBTC.

The GBTC shares consistently traded at a premium before 2021. So, accredited investors purchased GBTC at NAV and sold those shares at a premium six months later, pocketing the difference. However, the so-called carry trade lost its shine once the premium flipped to discount in February 2021.

Besides, the launch of relatively cheaper ETFs in Canada, Europe and the U.S. later that year took away a significant chunk of demand from GBTC. While Grayscale doesn't allow redemptions and an ETF allows the market maker to create and redeem shares at will. So, traditional market funds and institutions prefer ETFs over close-ended funds like the Grayscale Bitcoin Trust.

In October last year, Grayscale filed with the U.S. Securities and Exchange Commission to convert the trust into a spot-based ETF. However, the regulator rejected Grayscale's application in June this year, stating that the fund manager failed to answer the SEC's questions about preventing market manipulation.

According to Krohn, the discount will evaporate quickly should the trust get a go-ahead from the regulator. However, as of now, investor interest in taking bullish exposure via GBTC remains at an all-time low.

All writers’ opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by CoinDesk constitutes an investment recommendation, nor should any data or Content published by CoinDesk be relied upon for any investment activities. CoinDesk strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.

Recommended Content

Editors’ Picks

SEC Chair Gensler hints at resignation amid lawsuit from 18 states accusing the regulator of unlawful overreach

In a filing on Thursday, 18 states, along with the DeFi Education Fund, issued a lawsuit against the Securities and Exchange Commission, alleging that the regulator's crackdown on the crypto industry has been unlawful and unconstitutional.

Bitcoin Price Forecast: BTC eyes $100K, what are the key factors to watch out for?

Bitcoin trades below $90K in the Asian session on Friday as investors realized nearly $8 billion in profits in the past two days. Despite the profit-taking, Bitwise CIO Matt Hougan suggested that BTC could be ready for the $100K level, fueled by increased stablecoin supply and potential government investment.

Ethereum Price Forecast: ETH could rally to $4,522 despite mixed on-chain flows among investors

Ethereum is down over 1% on Thursday following record net inflows across ETH exchange-traded funds in the past six days. Despite the bullish market outlook, $300 million worth of unstaked ETH could hit the market and cause downward pressure on prices.

Crypto Today: Bhutan sells $33M BTC, McDonald’s launches NFTs, PEPE, SUI emerge top gainers

The aggregate cryptocurrency market capitalization shrank by 1.45% on November 14, reflecting a $42.6 billion dip. In the last 24 hours, 170,878 traders were liquidated to the tune of $485.13 million, per Coinglass data.

Bitcoin: Further upside likely after hitting new all-time high

Bitcoin hit a fresh high of $76,849 on Thursday as crypto-friendly candidate Donald Trump won the US presidential election. Institutional demand returned with the highest single-day inflow on Thursday since the ETFs’ launch in January.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.