Senator Warren says spot Bitcoin ETF approval is wrong even as first-day volume hits $4.6 billion

- Senator Elizabeth Warren took to X to say that the SEC is wrong in approving spot Bitcoin ETF applications.

- The statement comes after a last-ditch effort to block the approval using Better Markets failed this past week.

- The first trading volume of spot Bitcoin ETFs crossed $4.6 billion, with Grayscale dominating about half of it.

Spot Bitcoin ETFs received approval, and users began trading the investment products in the last 48 hours. The event marked a historic moment for the crypto market, even as many people attempted to stop the ETFs from seeing the light of day, such as Senator Elizabeth Warren, who continues to criticize it.

Senator Warren calls SEC wrong

Senator Elizabeth Warren, famous for her stance against the crypto space, took to X, formerly Twitter, to comment on the recent approval of spot Bitcoin ETFs. Warren stated that the Securities and Exchange Commission (SEC) was wrong in giving the applications a green light.

She stated,

"The SEC is wrong on the law and wrong on the policy with respect to the Bitcoin ETF decision.

If the SEC is going to let crypto burrow even deeper into our financial system, then it's more urgent than ever that crypto follow basic anti-money laundering rules.

This statement from the Senator comes after a final attempt at blocking the approval by Better Markets, known to be supported by Warren, failed this week. The non-profit entity filed a supplemental letter to the Secretary of the SEC asking them to reject the spot BTC ETF applications.

The SEC, however, obliged by the law, had to approve the applications following its loss in the lawsuit filed by Grayscale for rejecting the initial applications of converting its Grayscale Bitcoin Trust (GBTC) into a spot ETF.

Interestingly, Grayscale, which made the ETF become a reality, also came out on top on the first day of trading.

Grayscale leads spot Bitcoin ETF trading

According to Bloomberg ETF analyst James Seyffart, the total volume generated on the first day of spot Bitcoin ETF trading stood tall at $4.6 billion. The first 30 minutes alone witnessed $1.2 billion worth of trading, with Grayscale leading the charge since the first minute.

Per closing time, Grayscale's GBTC accounted for about half of the entire trading volume, coming up to $2.32 billion, and BlackRock (IBIT) took the second place, registering $1.03 billion in volume.

Here's the #Bitcoin ETF Cointucky Derby data via trading volume on day 1 (more volume will continue for a little while).

— James Seyffart (@JSeyff) January 11, 2024

Total Volume was over $4.6 Billion with $GBTC about half of it. BlackRock & Fidelity went 1 & 2 absent GBTC. pic.twitter.com/t70MzyQfZW

Fidelity, ARK Invest, and Bitwise came in at the third, fourth, and fifth spot, all noting more than $100 million but less than $1 billion in volume, while the rest of the applicants failed to cross the $100 million mark.

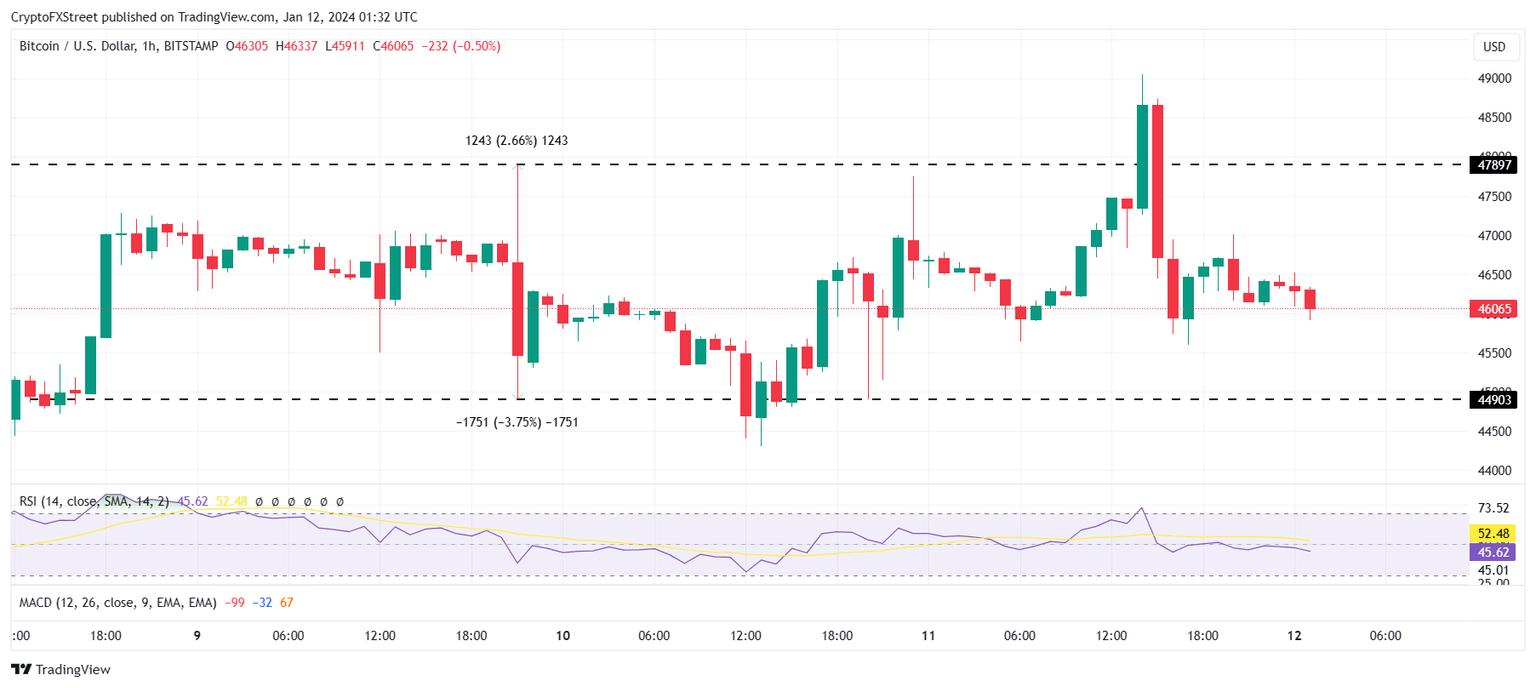

Bitcoin price interestingly did not show much change on January 11 despite the initial volatility. BTC shot up to mark an intra-day trading high of $49,000 but came back down to trade at $46,070 at the time of writing.

BTC/USD 1-hour chart

Bullishness is still expected out of the spot Bitcoin ETF hype, with BTC forecasted to hit $50,000. However, it might take some time before the cryptocurrency manages to flip this price level into a support floor.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.