Sei Price Prediction: A bounce from here could signal a bullish trend for SEI

- Sei price is holding above critical support at $0.4732 based on recent price action

- SEI could rise to $0.8000 amid rising momentum and two buy signals in the works.

- A break and close below $0.4000 would invalidate the bullish thesis.

Sei (SEI) price is nurturing a recovery rally after a fall of nearly 40% starting April 9. With the SEI bulls defending against further downside, the altcoin could be primed for a growth in bullish momentum.

Also Read: SEI, Omni Foundation propose standard to unify Ethereum NFTs

SEI could rally 40% if altcoins show strength

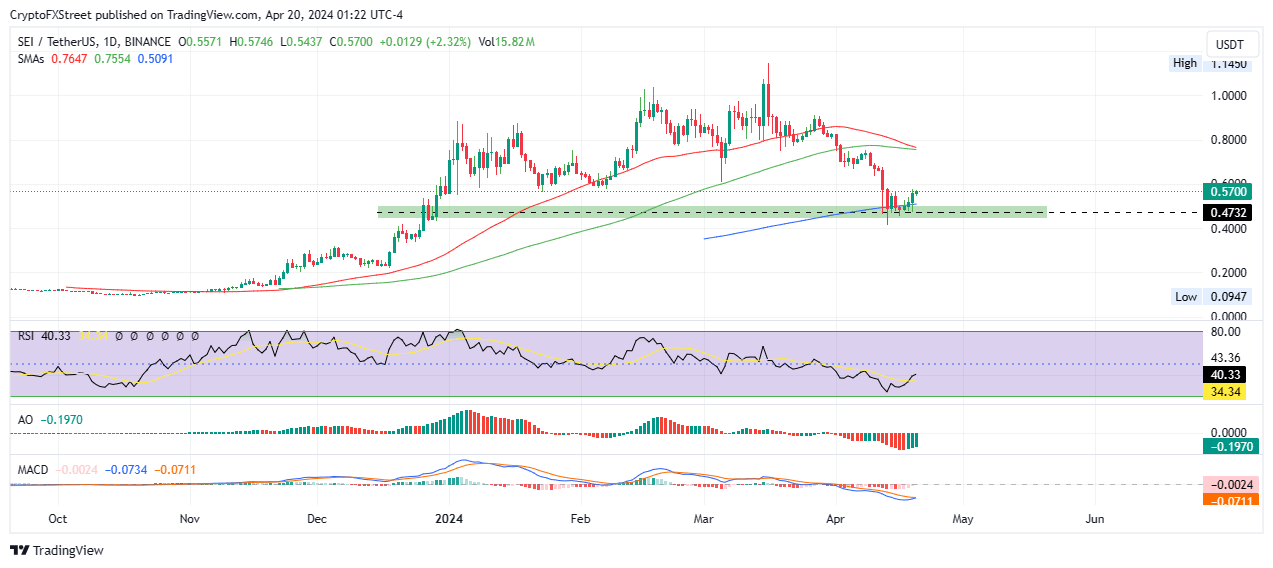

Altcoins could have their rally now that the Bitcoin halving has concluded. For the Sei price, this could mean a climb of around 38% as bulls defend against further downside. On the 1-day timeframe, the altcoin is at a make-or-break support level of $0.4732 based on recent price action. A bounce from here could signal a bullish trend ahead.

If the SEI bulls can muster enough strength to stay above this support zone, it would provide a good jumping-off point for the Sei price to keep the momentum going. Already, the altcoin has flipped the 200-day Simple Moving Average (SMA) into support, with eyes now set on the $0.8000 target. Such a move would denote a climb of almost 38% above current levels. To get here, however, the bulls must overcome the resistance confluence between the 100- and 50-day SMA at $0.7554 and $0.7647 respectively.

Notice also that both the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) are flirting with a confirmed bullish cross over above their respective signal lines, interpreted as buying signals.

In a highly bullish case, the Sei price could shatter the $0.8000 blockade, extending the gains to tag the $1.0000 psychological level, or in a highly bullish case, reach to reclaim the $1.1450 range high.

SEI/USDT 1-day chart

On the other hand, if bulls begin to cash in on the nearly 20% gains made over the past four days, the Sei price could drop. A daily candlestick close below the $0.4000 psychological level would invalidate the bullish thesis.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.