Sei price deviation below range high may mean only one thing for SEI holders – 18% crash

- Sei price has slipped below the range low and is down 20% from its all-time high of $1.03.

- Failure to overcome the range high at $0.88 will signal that an 18% crash is on the horizon for SEI.

- A successful flip of the $0.88 resistance level into a support floor will invalidate the bearish thesis.

Sei (SEI) price has had a shocking and awe-inspiring rally over the past few weeks and has raked in 345% gains in the past two months. But the recent developments suggest SEI could be ready to slide lower.

Also read: SEI ventures into decentralized AI with Nimble, SEI price poised for rally

Sei price in a tough spot

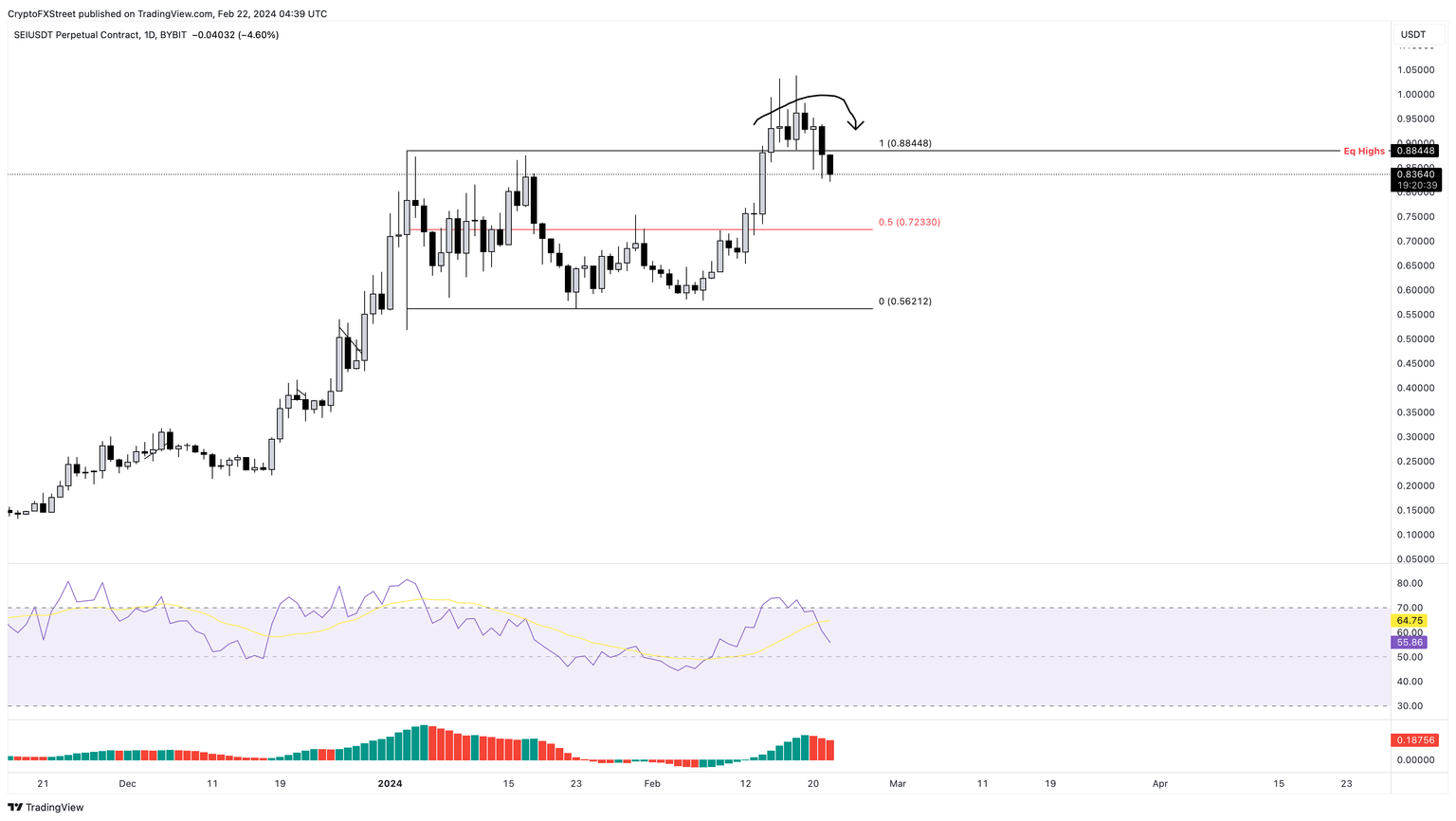

Sei price set up a local top at $0.88 on January 3, which led to a retracement that created the range low of $0.56. After a brief consolidation, SEI took off, breaching the all-time high at $0.88 and setting up a new one at $1.03. But things took a quick turn as holders began realizing profits, which pushed the altcoin below the range low.

As Sei price trades below $0.88, a pullback is likely to push the altcoin back to retest the range high. A rejection here could be a sell signal, suggesting an 18% crash to the aforementioned range’s midpoint at $0.72.

The higher highs formed on January 3 and February 18 do not confirm the Relative Strength Index’s (RSI) lower highs. This divergence is bearish and the result of which is the 20% crash witnessed so far. But this sell signal, coupled with rejection at $0.88, could put the final nail in SEI holders’ coffin and potentially trigger an 18% crash.

In some cases, Sei price could drop even lower and sweep the range low at $0.56.

SEI/USDT 12-hour chart

While the bearish outlook for Sei price makes sense from a logical standpoint, if Bitcoin price triggers a rally here, it could threaten bears’ plans. In such a case, if SEI successfully flips the $0.88 resistance level into a support floor with a daily candlestick close, it will invalidate the bearish thesis.

This development could see Sei price attempt to rally 17% and revisit the all-time high at $1.03.

Also read: Sei Price Prediction: SEI recovery rally to face stiff hurdles at $0.700

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.