SEI Network sees nearly 175,000 weekly active users after founder teases “big things” are coming

- SEI Network noted nearly 22,000 new users and nearly 175,000 active users in the past week.

- SEI co-founder teases “big things” are coming, likely referring to the deployment of Sei V2.

- SEI price dipped nearly 2% on Monday after yielding nearly 13% weekly gains for holders.

SEI, a Cosmos-based blockchain witnessed nearly 175,000 weekly active users on its network in the past week. SEI recorded 21,700 new users in the week of the Chinese New Year. The community is anticipating the rollout of the Sei V2 testnet, expected in early 2024.

SEI price declined nearly 2% on Monday after yielding double-digit weekly gains to holders.

Also read: XRP price drops slightly as SEC v. Ripple lawsuit heads towards end of discovery phase

SEI sees massive spike in user activity

Aaron Sage, a crypto expert shared details of user activity on the SEI network in the past week. According to Sage’s recent tweet, SEI recorded 21,700 new users, and 174,200 active users in the week ahead of the Chinese New Year. The total number of users on SEI reached 950,300 as of February 11.

The Cosmos-based chain has attracted a large volume of users as the anticipation surrounding its V2 testnet increases. The project announced in an official blog post that the V2 testnet will be released in early 2024 and a mainnet release will follow in the first half of 2024.

SEI user statistics in the week of Chinese New Year

SEI co-founder Jayendra Jog teased the arrival of “big things” in the network in his recent tweet.

Gm Seiyans big things coming soon

— Jay (@jayendra_jog) February 11, 2024

Jog is likely referring to V2 testnet, an event that is highly anticipated in the Cosmos-based blockchain’s community.

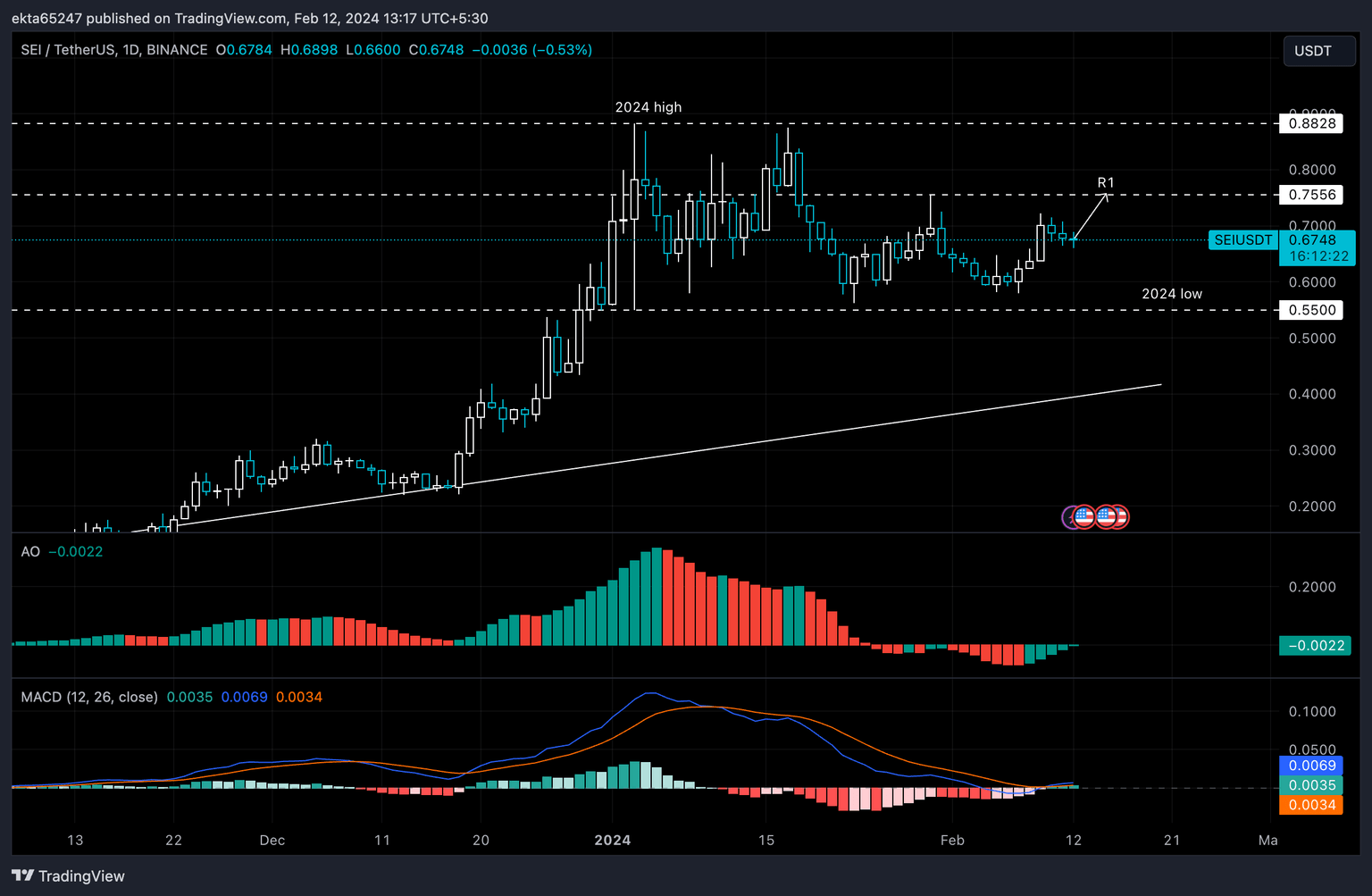

SEI price could rally 12%

SEI price is currently in an uptrend. SEI has traded sideways since hitting its 2024 peak of $0.8828 on January 3. The Awesome Oscillator (AO) is flashing green bars, confirming that the SEI price uptrend is in place. The Moving Average Convergence/ Divergence (MACD) shows green bars, there is positive momentum and SEI price could continue climbing higher.

SEI price could face resistance at R1, $0.7556, a level that has acted as resistance for the asset throughout the end of January and early February. This would represent a 12% rally in SEI.

SEI/USDT 1-day chart

SEI price could drop to its 2024 low of $0.5500 in the event of a decline.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.