SEC vs. Ripple lawsuit closed-door meeting could result in resolution, XRP hovers around $0.62

- Ripple and the SEC have a scheduled closed-door meeting on July 25, a resolution in the lawsuit is expected.

- XRP hovers around $0.62 early on Thursday, sustaining recent gains.

- XRP traders anticipate an end of the SEC lawsuit by July 31, per Attorney Fred Rispoli’s recent comments.

Ripple (XRP) hovers above key support at $0.62 as traders await a resolution in the US Securities & Exchange Commission (SEC) lawsuit. The meeting is scheduled to occur behind closed doors on July 25.

According to pro-crypto attorney Fred Rispoli, the lawsuit against Ripple could end by July 2024.

Daily digest market movers: Ripple lawsuit could see resolution soon, traders await meeting outcome

- The SEC and Ripple are preparing for a closed-door meeting scheduled for July 25.

- The agenda of the meeting is unknown, and it is expected that progress will be made either on settlement or resolution talks between the two parties.

- Attorney Fred Rispoli has predicted that the Ripple lawsuit could end soon, and Judge Analisa Torres could rule on the case by the end of July.

- In a recent interview with Bloomberg, Ripple CEO Brad Garlinghouse said that he cannot comment on “settlement” however, he expects a resolution soon.

- Ripple pocketed a partial victory when Judge Analisa Torres ruled that XRP was not a security in July 2023.

- The judge is expected to rule on a fine to be imposed on Ripple for alleged violation of securities laws.

- It remains to be seen whether the regulator appeals Judge Analisa Torres’ ruling.

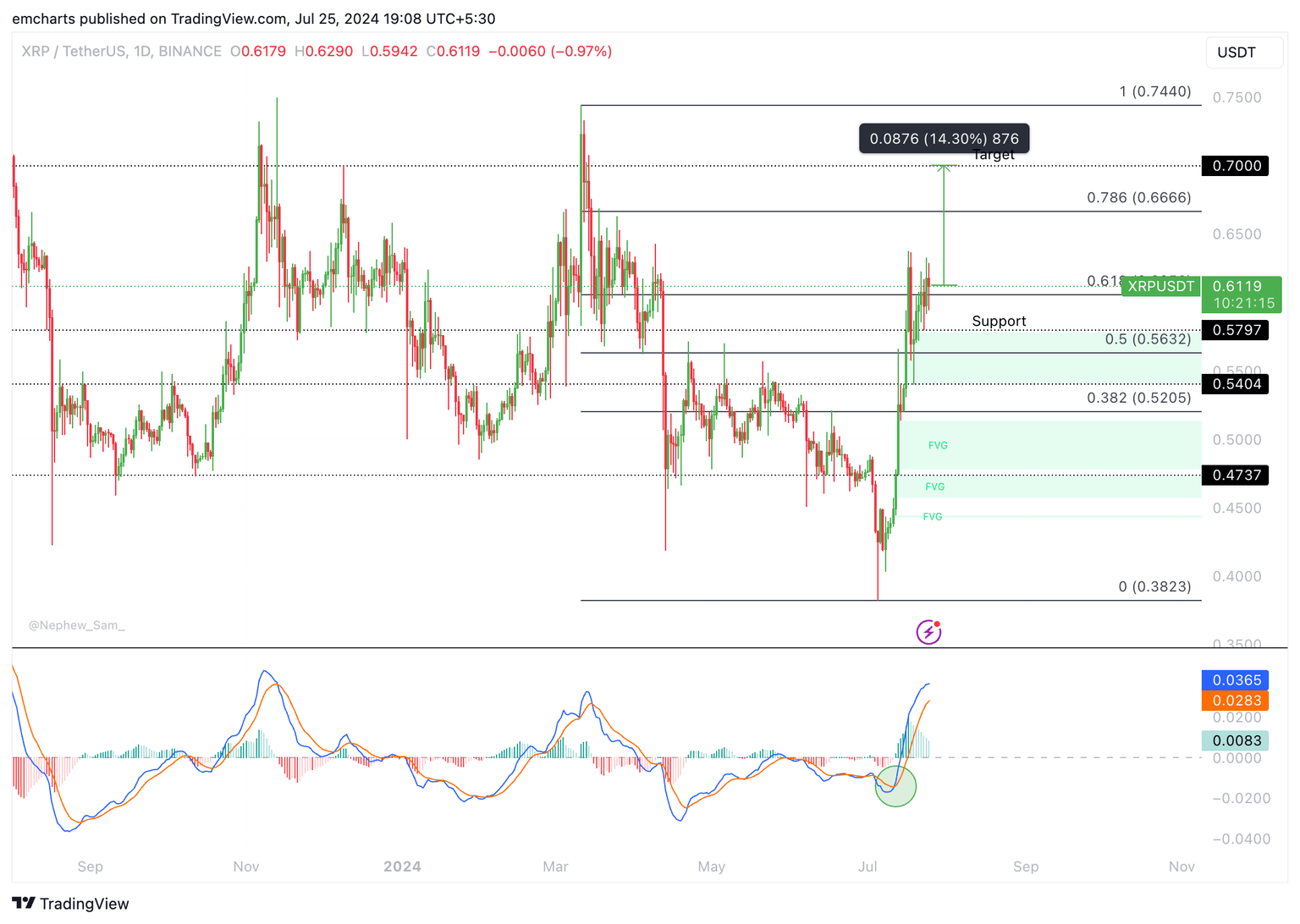

Technical analysis: XRP could extend gains by nearly 15%

Ripple has been in an upward trend since July 8, and the altcoin could extend gains by another 14.30% to hit its target of $0.70. The $0.60 is a psychological support level for Ripple. The altcoin could find support at $0.5632, and $0.5797, the two levels are significant as the first represents 50% Fibonacci retracement level of the decline from the March 11 top of $0.7440 to the July 5 low of $0.3823.

The momentum indicator, Moving Average Convergence Divergence (MACD), signals underlying positive momentum in Ripple price trend.

XRP/USDT daily chart

A daily candlestick close below the support at $0.5797 could invalidate the bullish thesis for Ripple.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.