SEC vs. Ripple case, two key decisions awaited by XRP holders

- Eleanor Terret, a fox reporter shared the two key decisions in the SEC vs. Ripple lawsuit that are currently awaited by XRP holders.

- The Judge’s decision on the US Securities and Exchange Commission’s motion to seal its opposition to John Deaton’s request to file a brief is a key decision, still awaited.

- XRP price has exploded ahead of the court’s ruling in the lawsuit against the payment giant.

XRP holders are awaiting key decisions in the SEC vs. Ripple case. Experts believe judge Sarah Netburn could rule on the two key decisions in the lawsuit against payment giant Ripple.

XRP holders await the court's decision in SEC vs. Ripple lawsuit

Eleanor Terret, a Fox reporter recently tweeted that two key decisions in the SEC vs. Ripple lawsuit could arrive by the end of the week. Judge Sarah Netburn could rule on the US regulator’s motion to seal its opposition to John Deaton’s request to file an amicus (expert) brief as early as the end of the week.

The Fox reporter highlighted the pending decision on whether William Hinman, Former Director of the Securities and Exchange Commission's Division of Corporation Finance’s emails and documents fall under attorney-client privilege.

What are we waiting for in the @SECGov vs. @Ripple lawsuit? Two things:

— Eleanor Terrett (@EleanorTerrett) June 21, 2022

1) Judge Netburn's decision on whether the Hinman emails and docs fall under attorney-client privilege.

2) Judge Torres's decision on the SEC's motion to seal its opposition to @JohnEDeaton1 request to file

The US regulator has made numerous efforts to conceal emails with contents of Hinman’s speech. Experts argue that the SEC redacted the contents of Exhibit O, that contain expert testimony that John Deaton wants to file under Amicus brief. The SEC has argued that Hinman’s emails and documents are covered by attorney-client privilege after the argument of deliberate process privilege (DPP) was rejected by the court.

Earlier this month, Judge Sarah Netburn conducted a conference call where the 10 documents were perused and this assisted the court in the decision, ahead of a ruling.

XRP price explodes ahead of key ruling

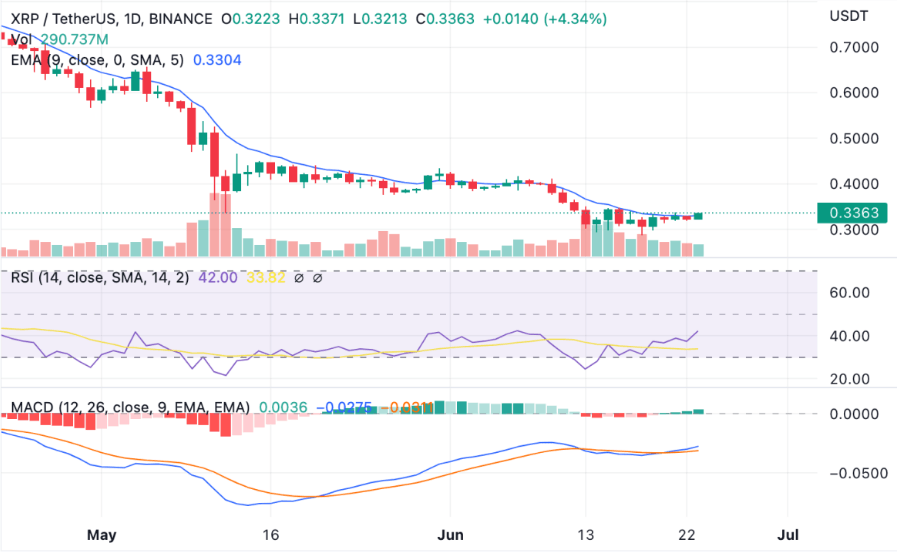

Analysts have evaluated the XRP price chart and predicted a continuation of the altcoin’s uptrend. Analysts at Crypto Politan believe the 24-hour RSI indicates that market valuation reveals XRP is in the overnought zone. If XRP price sustains above $0.336, it could revisit resistance at $0.40, in the current uptrend.

XRP-USDT price chart

FXStreet analysts identified what XRP price needs to do to wipeout its losses. For more information, watch this video:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.