- SEC v. Ripple lawsuit Judge Analisa Torres rules in favor of Ripple redacting documents connected with Daubert motions.

- Ripple scored a small win in the court case, protecting remittance network confidential business interests, third-party privacy.

- XRP price outlook is bearish this week as the altcoin trades below the 50-day Exponential Moving Average, close to the weekly low.

The US Securities and Exchange Commission (SEC) v. Ripple lawsuit dragged forward with a small win in favor of the remittance company. Judge Analisa Torres ruled in favor of payment giant Ripple, allowing the firm to redact documents submitted in connection with the Daubert Motion.

The motion is of a special kind and is used to exclude the testimony of an expert witness who does not possess the requisite level of expertise.

Also read: XRP Price Forecast 2023: Ripple gears up for a bright future if it wins legal battle with SEC

SEC v. Ripple lawsuit makes strides in favor of the remittance network

The SEC v. Ripple lawsuit is one of the most closely scrutinized legal battles in the crypto ecosystem. Since the US financial regulator filed charges against Ripple and its executives, the court case has dragged on for nearly two years.

The end is nowhere in sight as both parties submit a joint motion for a time extension until January 13 to file the Daubert motion and accompanying exhibits with redactions. The latest update in the legal tussle is in favor of the payment giant as presiding Judge Analisa Torres allowed the firm to preserve the privacy of involved third parties and its business, redacting documents submitted for the Daubert motion.

The XRP community is watching the lawsuit for small wins in favor of the cross-border remittance firm, one of the largest public holders of the third-largest altcoin. While the XRP community remains bullish on the altcoin, large wallet investors continue its accumulation.

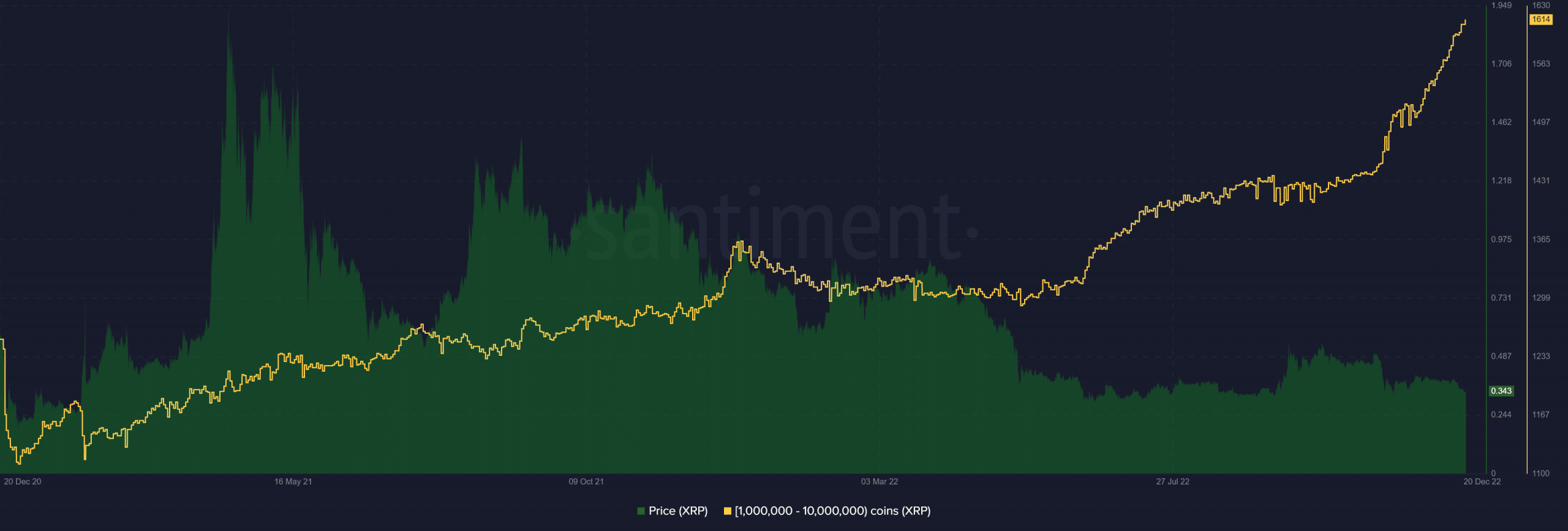

Data from crypto intelligence tracker Santiment revealed a spike in the number of shark and whale addresses holding XRP. Accumulation has been in an uptrend, despite the ups and downs in the lawsuit filed by the US Securities and Exchange Commission.

Addresses holding between 1 million and 10 million XRP

XRP addresses holding between 1 million and 10 million tokens have surged from 1,500 in November to 1,614. The price outlook on the altcoin is bearish for the week and bullish for Q1 2023 based on technical indicators.

XRP price outlook is bearish for the week

Ripple’s legal counsel is defending the firm against the charges filed by the US Securities and Exchange Commission, in a long and arduous battle with the financial regulator. Despite the throes of the legal tussle, large wallet investors continued scooping up XRP.

The long term price outlook on XRP is bullish as the altcoin forms a falling wedge on its chart. For the current week, XRP price is trading below its 50-day Exponential Moving Average (EMA). The 50-day EMA at $0.3552 is acting as resistance for the altcoin since W1 December 2022.

XRP/USDT 4H price chart

The altcoin is close to the lower trendline forming the falling wedge and XRP is likely to find support at the weekly low, $0.3440. If XRP nosedives from this level, it could plummet to the monthly low of $0.3160.

If XRP Ledger’s native token breaks past the 50-day EMA and climbs towards the upper trendline forming the falling wedge, it would signal a trend reversal. A decisive close after breaking past the upper trendline could invalidate the bearish thesis for XRP price.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin, Ethereum and XRP steady as China slaps 125% tariff on US, weekend sell-off looming?

The Cryptocurrency market shows stability at the time of writing on Friday, with Bitcoin (BTC) holding steady at $82,584, Ethereum (ETH) at $1,569, and Ripple (XRP) maintaining its position above $2.00.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Bitcoin, Ethereum, Dogecoin and Cardano stabilize on Friday as crypto market capitalization steadies around $2.69 trillion. Crypto traders are recovering from the swing in token prices and the Monday bloodbath.

Can FTX’s 186,000 unstaked SOL dampen Solana price breakout hopes?

Solana price edges higher and trades at $117.31 at the time of writing on Friday, marking a 3.4% increase from the $112.80 open. The smart contracts token corrected lower the previous day, following a sharp recovery to $120 induced by US President Donald Trump’s 90-day tariff pause on Wednesday.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.