SEC rejects SkyBridge application for spot Bitcoin ETF citing market manipulation concerns

- The US SEC has rejected another spot Bitcoin ETF application, stating that it had failed to meet certain requirements.

- The regulatory agency stated that there were concerns about the lack of resources dedicated to prevent manipulative acts.

- Bitcoin price slid 9% to a swing low of $39,262 following the rejection.

The United States Securities & Exchange Commission (SEC) rejected a spot market Bitcoin exchange-traded fund (ETF) application from First Trust Advisors and SkyBridge. The securities regulator stated that the ETF was unable to meet the requirements to prevent fraudulent and manipulative acts and practices.

Another spot Bitcoin ETF gets rejected

Skybridge Capital, run by former White House communications director Anthony Scaramucci, previously hoped to have the Bitcoin ETF application approved by the end of last year. The SEC has been reluctant to approve a spot BTC ETF over concerns of potential price manipulation in the cryptocurrency market.

The SEC has recently rejected a rule change allowing the listing and trading of First Trust SkyBridge Bitcoin ETF Trust shares, citing similar reasons for disapproving spot BTC ETFs in the past.

The securities regulator has extended its review period twice to decide on approving or disapproving the proposed rule change in July and November before the final decision was made on January 20. SkyBridge first applied to list a spot Bitcoin ETF on the New York Stock Exchange (NYSE) in March last year.

The agency further explained that the NYSE did not meet the requirements of listing a financial product under the Exchange Act, as exchanges that seek to list a Bitcoin ETF would need to have a “comprehensive surveillance-sharing agreement with a regulated market of significant size related to the underlying or reference BTC assets.”

Bitcoin price plunges 9%

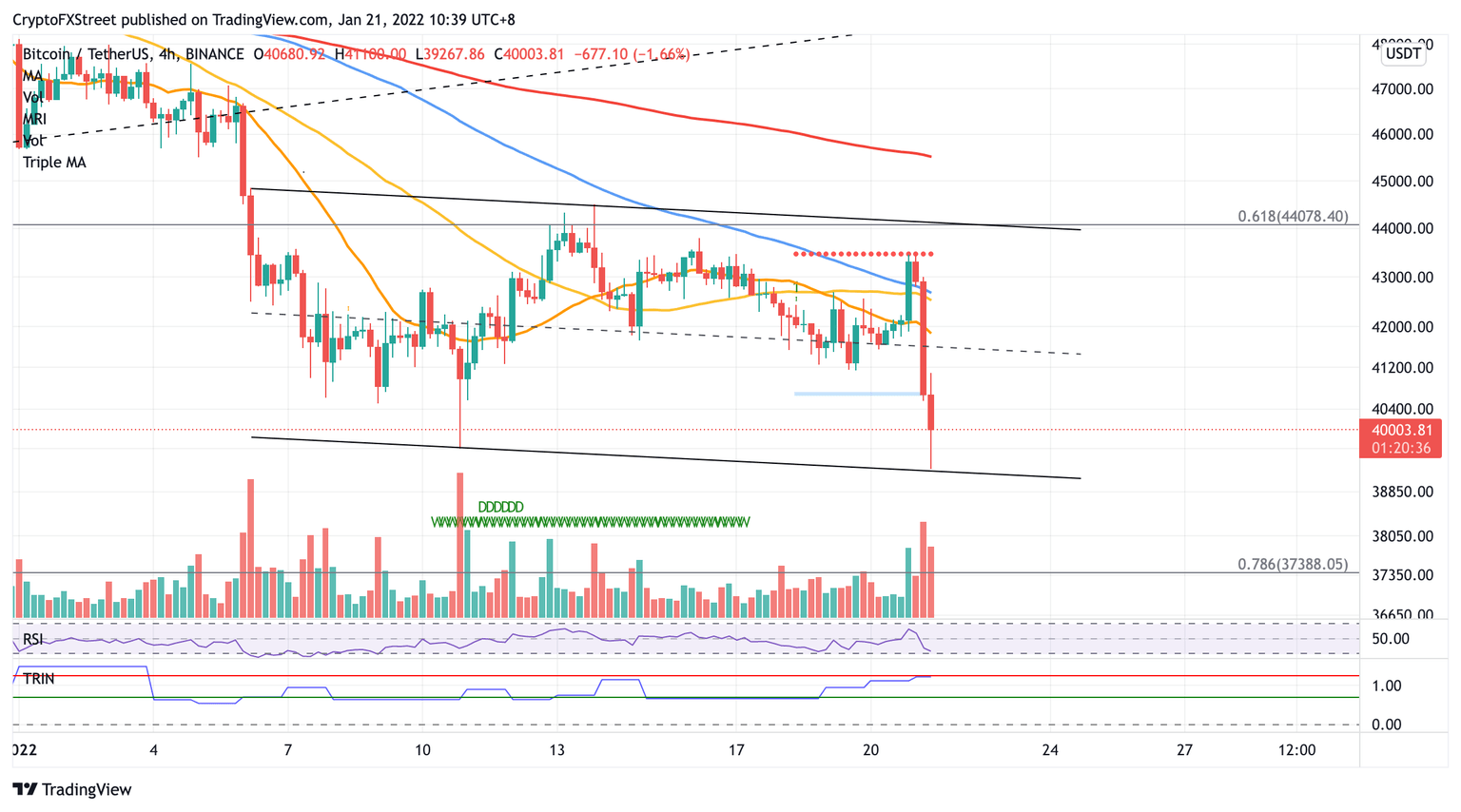

Bitcoin price fell significantly following the rejection of the SkyBridge BTC ETF by the SEC, reaching a swing low at $39,262. A descending parallel channel has formed on the 4-hour chart and the leading cryptocurrency is testing the reliability of the support at the lower boundary of the prevailing chart pattern.

Bitcoin price could consolidate within the boundaries of the governing technical pattern, but if selling pressure continues to increase, the bellwether cryptocurrency could fall toward the 127.2% Fibonacci extension level at $37,702.

BTC/USDT 4-hour chart

If the bulls manage to reverse the period of underperformance, Bitcoin price will face resistance at the 78.6% Fibonacci retracement level at $40,375 before reaching the 61.8% Fibonacci retracement level at $41,300, coinciding with the middle boundary of the governing technical pattern.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.