Ethereum breaches key support as SEC delays ETF decision

- SEC delays decision on Ethereum ETF S-1 drafts as analysts shifted their potential launch date again.

- Ethereum whale risks liquidation if ETH declines to $2,984.

- Ethereum breaches key support amid key insight from CME open interest.

Ethereum is down more than 5% on Thursday following the Securities & Exchange Commission's (SEC) failure to approve ETH ETF issuers' S-1 drafts. Meanwhile, the recent decline has strengthened the bearish outlook after ETH moved below a key support level, sparking $90 million in long liquidations.

Daily digest market movers: SEC yet to approve ETH ETF

Despite its light comments on issuers’ S-1 drafts, the SEC has yet to approve spot ETH ETFs following the US Independence Day holiday. As a result, Bloomberg analyst James Seyffart shifted his over/under date for a potential approval to next weekend.

The SEC approved spot ETH ETF issuers' 19b-4 filings in May, but also need to sign off on their S-1s before the products go live.

Nate Geraci, President of ETF Store, noted that the SEC expects issuers to amend their S-1s by July 8, with another round of filings potentially due around July 12. This "would theoretically mean launch week of July 15" for spot ETH ETFs, wrote Geraci in an X post.

Meanwhile, following the recent market decline, a whale who longed ETH via the Compound protocol is about to be liquidated, according to data from Lookonchain. The whale deposited 12,734 ETH worth $40 million to Compound and borrowed $31.4 million worth of dollar-denominated stablecoins with a health rate of 1.06. The whale risks liquidation if the price of ETH drops to $2,984.

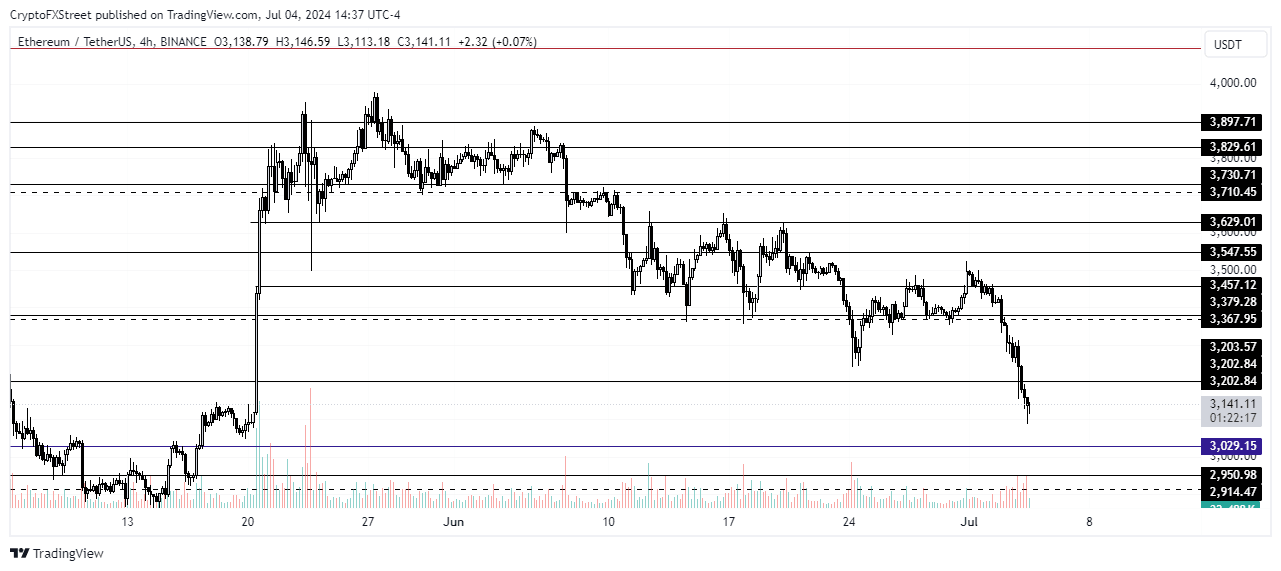

ETH technical analysis: Ethereum bears lead market amid slight bullish sentiment from US investors

Ethereum is trading around $3,132 on Thursday, down more than 5% on the day. The decline wiped out more than $90.81 million worth of long positions from the market, bringing the total ETH liquidations to $102.48 million in the past 24 hours.

ETH has now breached the $3,203 key support level, strengthening its bearish outlook. With the move, ETH has fully balanced the market inefficiency from itsprice spike following news of the SEC's U-turn on spot ETH ETFs.

ETH/USDT 4-hour chart

ETH may test the $3,029 support level in the next few hours. A bounce from this level will cool the bearish momentum. However, a move below it may see ETH seeking support around the $2,852 price level.

In the past 24 hours, Ethereum's futures open interest (OI) across top exchanges declined by almost 5%. Open interest is the number of outstanding contracts in a derivatives market that are yet to be settled.

While the move signified wider risk aversion from traders, Ethereum's CME OI was an outlier, rising almost 1% in the last 24 hours. This indicates that US investors may be slightly bullish despite declining prices due to expectations of spot ETH ETFs' launch.

Another key insight is that spot ETH ETFs may experience impressive flows using the rising ETH CME OI as a proxy to measure investors' sentiment. As a result, ETH may take bears by surprise and rally past its yearly high, invalidating the bearish thesis.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it is the second largest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that make it popular among developers.

Ethereum uses decentralized blockchain technology, where developers can build and deploy applications that are independent of the central authority. To make this easier, the network has a programming language in place, which helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows inter-user transactions.

Staking is a process where investors grow their portfolios by locking their assets for a specified duration instead of selling them. It is used by most blockchains, especially the ones that employ Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For most long-term cryptocurrency holders, staking is a strategy to make passive income from your assets, putting them to work in exchange for reward generation.

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an event christened “The Merge.” The transformation came as the network wanted to achieve more security, cut down on energy consumption by 99.95%, and execute new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are less entry barriers for miners considering the reduced energy demands.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi