SEC calls spot Bitcoin ETF filings inadequate; Bitcoin price nearly crashed below $30,000

- The Securities and Exchange Commission might bring the next bearish crypto wave over the market.

- The regulatory body stated that these ETFs were neither clear nor comprehensive, making them inadequate for filing.

- Bitcoin price, although it did not have an explosive reaction, briefly dipped below the $30,000 mark.

The Securities and Exchange Commission (SEC) took another shot at the crypto market on Friday, going after the recently hyped spot Bitcoin ETFs. The regulatory body already taking heat from the crypto market for its regulation by enforcement strategy might create some more adversaries.

Read more - Fidelity Investment set to file for spot Bitcoin ETF following BlackRock’s lead

SEC says Bitcoin ETF filings are not clear

According to a report from the Wall Street Journal, the SEC stated that the multiple applications filed for spot Bitcoin ETFs do not meet the agency’s standards. The regulatory body went on to add that the applications were also neither sufficiently clear nor comprehensive, making them inadequate for approval.

This means that these filings from BlackRock, Fidelity and others could be susceptible to rejection unless the SEC comes forwards and states the necessary changes. But given the history of the regulatory body, that is far more likely to happen than the ETFs being approved without any hiccup.

This would be a repeat of January 2022 when the SEC similarly rejected spot Bitcoin ETF filings from the likes of Fidelity.

Per the Commission, the filings did not meet the standards designed to prevent fraudulent and manipulative practices and protect investors and the public interest. These comments were shared by the SEC with the exchanges Nasdaq and Cboe Global Markets. All three entities are yet to make any official comment regarding the same.

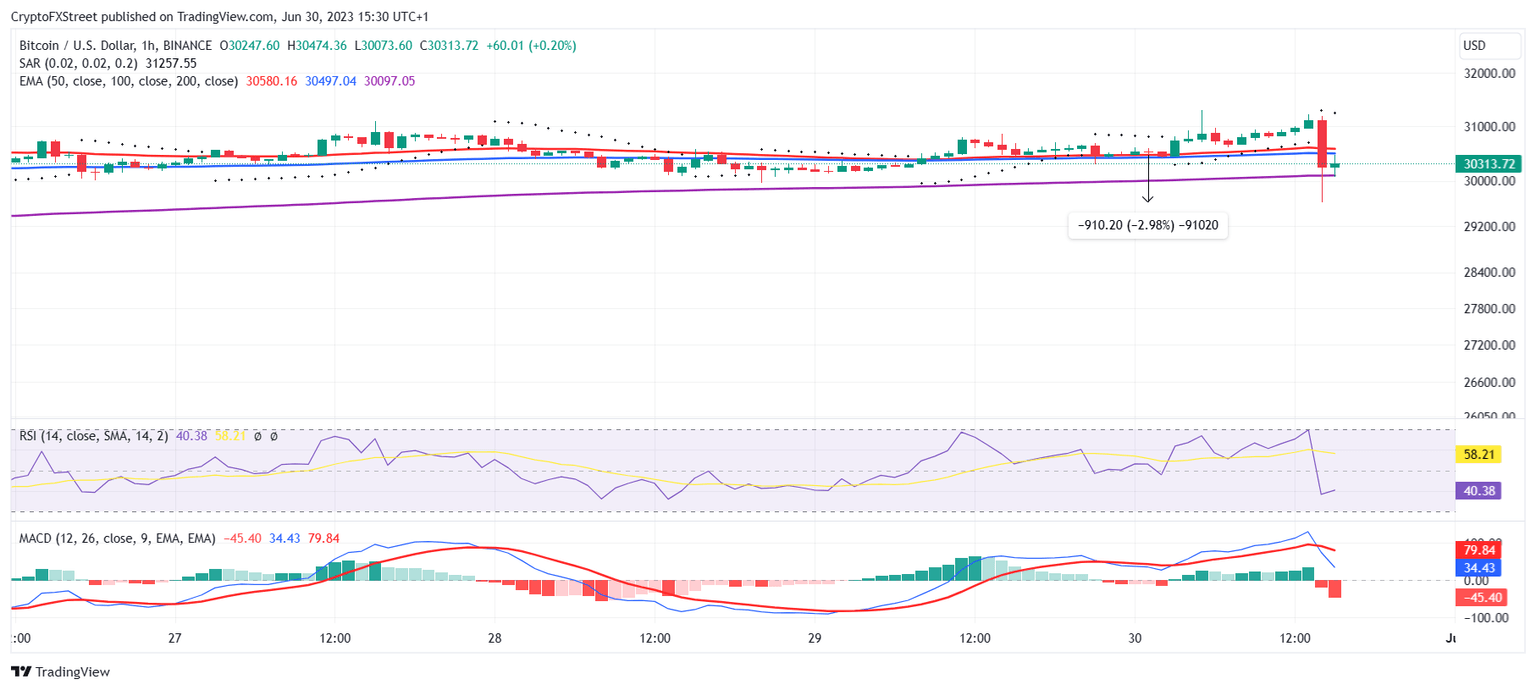

The crypto market was quick to react even before assimilating the situation, which led to a sharp decline in Bitcoin price initially. The cryptocurrency fell below $30,000 before bouncing back to trade at $30,313 at the time of writing.

BTC/USD 1-hour chart

If the drawdown were to stick and extend further, the anticipated corrections would have been initiated. As is the sideways movement by some of the biggest cryptocurrencies in the market has raised concerns.

A decline at this time would have washed the bearish wave over the crypto market, leading to unprecedented losses for investors. However, as long as BTC stays above $30,000, the crypto market is unlikely to take a beating.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.