- Prosecutors defied a court-issued ban on late-night submissions, filing a five-page evidentiary letter at 11PM on Friday.

- The new evidence includes SBF's tweet(s) "convincing Marc-Antoine Julliard not to withdraw funds on November 6 and 7, 2022.

- Julliard had testified, citing relentless, high-priced marketing to take a chance on crypto trades within the exchange as thieving strategy.

Sam Bankman-Fried (SBF) trial took a break for the weekend after BlockFi CEO Zac Prince’s testimony, with a standing moratorium or ban for late night submissions. Prince had detailed the lending firm’s exposure to FTX, revealing at least $850 million in loans issued to FTX between July and early November.

Also Read: BlockFi CEO Zac Prince in court after Caroline Ellison as SBF trial continues

SBF trial prosecutors submit new evidence at odd hours

SBF prosecutors went against a court-issued embargo, that no filings should be made late in the night. According to reports by Mathew Russell Lee of the Inner City Press, the prosecuting attorneys filed a five-page evidentiary letter at 11 p.m. on Friday highlighting that SBF's tweet(s) convinced Julliard not to withdraw funds.

Prosecutor's latest filing, October 13 11 PM

Marc-Antoine Julliard is one of the witnesses who took the stand last week before day three revelations from Adam Yedidia, former FTX software engineer and SBF’s friend from their days at MIT. Julliard, a London-based commodities broker and cocoa trader, told the court he had essentially been deceived by FTX’s relentless, high-priced marketing to take a chance on crypto trades within the exchange.

Specifically, Julliard had mentioned an advertisement in the Gisele Bündchen magazine, SBF’s hobnobbing with Bill Clinton and Tony Blair, venture capital firms pouring money into FTX, and the defendant’s tweets about using crypto “for good.” According to Julliard, these are the factors that drove him to buy into FTX.

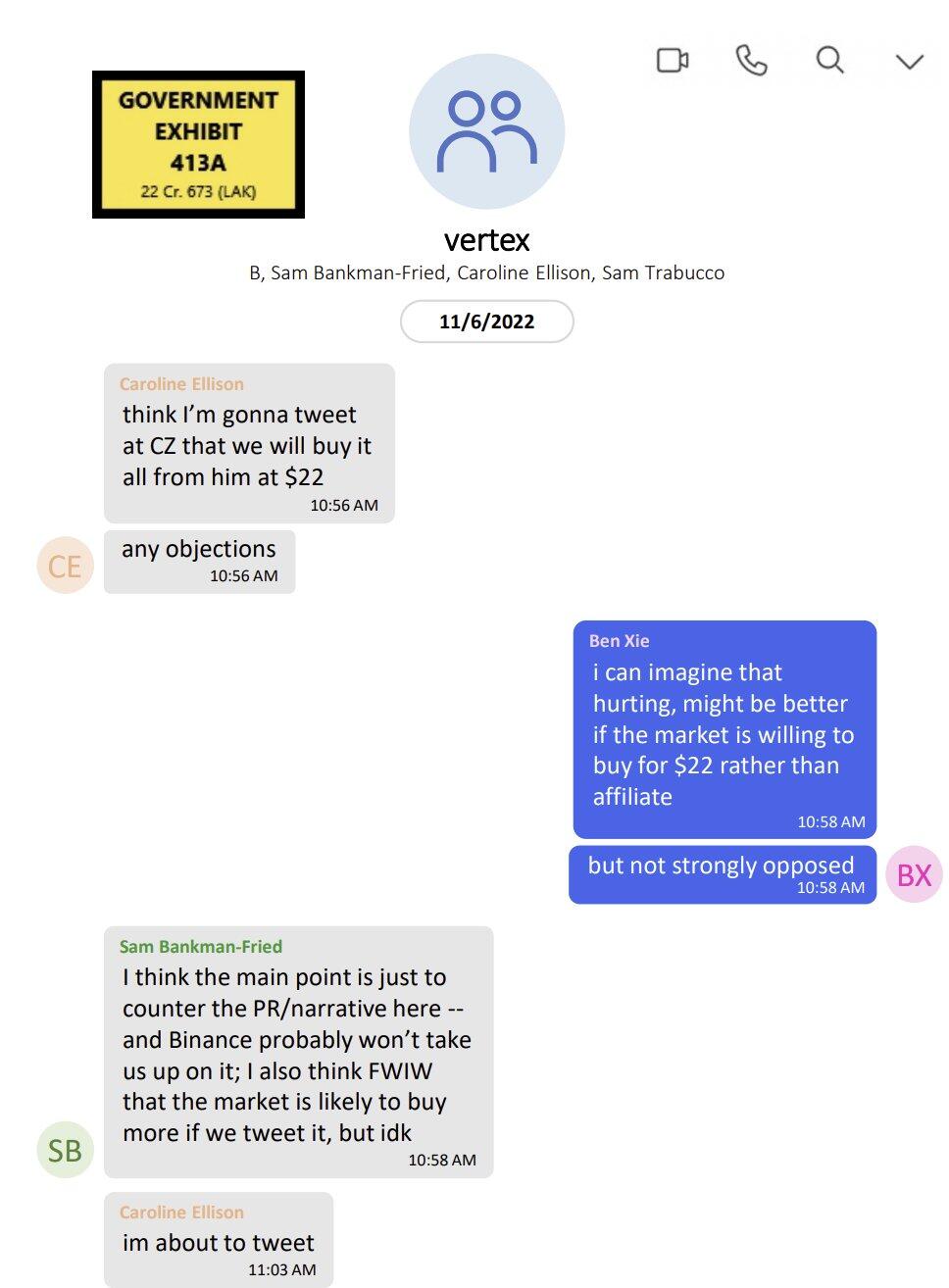

Julliard had assets totaling about $100,000, between his four Bitcoins (BTC) and a $20,000 fiat account, but did not withdraw his holdings from the exchange even after seeing the doubts cast on Bankman-Fried’s business in early November. This was because in the same week, SBF posted on Twitter, now X, that “he taking care of it and everything was fine.” Tweets were provided as exhibits. Julliard later realized the magnitude of the trouble in FTX by around November 8, but then it was too late. His withdrawal requests were not being processed by the app.

To this day, Julliard has never been able to recover his money.

Prosecutors claim SBF "lied to the world" to gain influence and riches. His defense says it is just entrepreneurial mistakes.

Sam Trabucco

Still, Sam Trabucco remains a person of interest in the SBF trial. The former Alameda co-CEO has not been indicted for his violation of the FCPA as part of the FTX / Alameda Chinese bribe. While some attribute this to his exiting the firm months before the November implosion, a recent revelation cites him among participants or members in a November goup chat.

November group chat

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Axiom’s volume surpasses $100M as meme trading platform war escalates on Solana

Axiom meme coin trading volume hit $101 million for the first time, surpassing other platforms on Solana. Axiom accounts for 30% of the ecosystem’s trading users, followed by Photon and Bullx at 24% each.

Bitcoin aiming for $95,000 as Global M2 money supply surges

Bitcoin (BTC) price edges higher and trades slightly above $85,500 at the time of writing on Tuesday after recovering nearly 7% the previous week. The rising Global M2 money supply could be a favorable signal for both Gold and Bitcoin.

Top 3 gainers Brett, Story and Virtuals Protocol sparkle as Bitcoin eyes $90,000

Cryptocurrencies have sustained a buoyant outlook since last week as US President Donald Trump’s tariff war was paused for 90 days, except for China, propping global markets for lifeline relief rallies.

Three altcoins to watch this week: ALGO, MANA and JASMY show bullish signs

Algorand, Decentraland and JasmyCoin hovers around $0.19, $0.27, and $0.015 on Tuesday after a double-digit recovery last week. ALGO, MANA and JASMY approach their key resistance levels; breakout suggests a rally ahead.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.