SBF sentenced to 25 years in prison after November conviction

- FTX founder Sam Bankman-Fried has been sentenced to a quarter century in prison.

- Manhattan court found SBF guilty of seven counts of fraud in 2023 and for the collapse of his crypto empire.

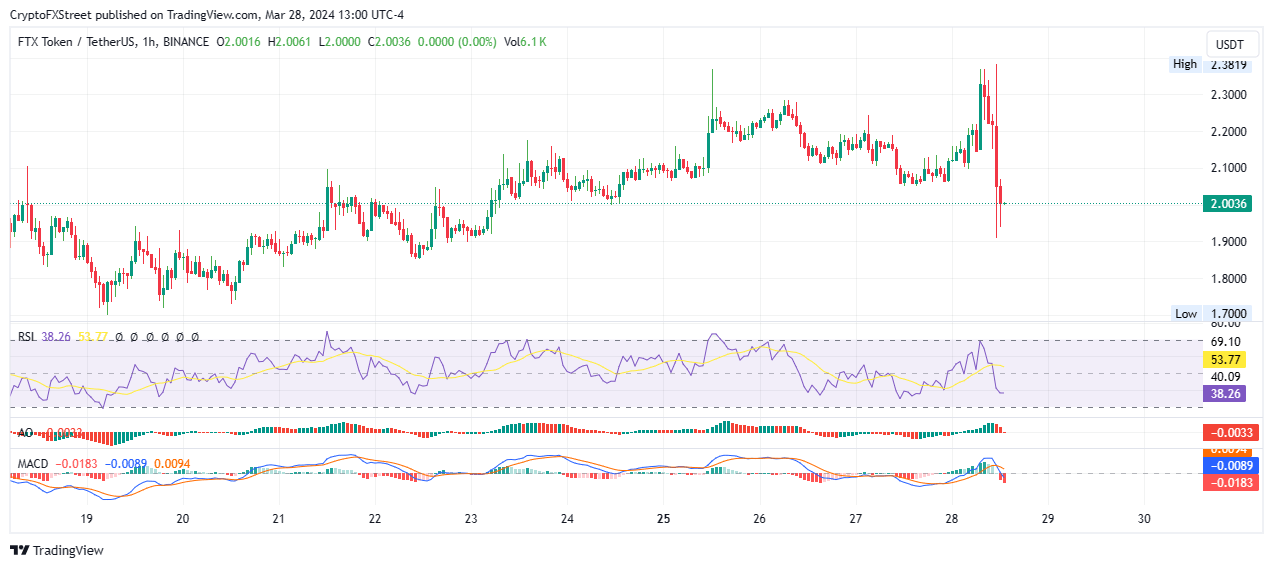

- FTX token FTT has dropped almost 5% in the immediate aftermath of the sentencing.

After around 450 days since his apprehension, the case against FTX founder Sam Bankman-Fried (SBF) has finally come to an end after a Manhattan court led by Judge Lewis Kaplan provided the sentencing.

Also Read: Solana price hits $200 ahead of SBF's sentencing

SBF to spend 25 years in prison

The same judge who was spearheading the case against SBF, Judge Kaplan, has today sentenced the FTX executive to 25 years in prison.

#breaking: Sam Bankman-Fried sentenced to 300 month - 25 years - in prison. Inner City Press live tweeted it, below https://t.co/8oYoCBP3mz

— Inner City Press (@innercitypress) March 28, 2024

It comes after the court found SBF guilty of seven counts of fraud in late 2023 that led to the collapse of the cryptocurrency exchange that he founded. Specifically, these charges included stealing customer assets when running FTX, as well as his deceit with the firm’s investors and creditors. Altogether, SBF was responsible for losses worth around $8 billion in customer assets.

“Samuel Bankman-Fried stole $8 billion dollars,” said Assistant United States District Attorney Nicolas Roos. “It was theft from customers spread all over the world. It was a loss that impacted people significantly and caused damage.”

Judge Kaplan described SBF as an extremely smart individual who suffers from autism..

Before the ruling, the judge concluded, “I’ve considered the guidelines and the 3553 factors. Much of what was said about the defendant's background is undisputed. He was privileged, had loving and devoted parents. He had every advantage they could confer on him. He went to MIT.”

The prosecution had called for a sentence of no less than 40 years but no more than 50 years. Bankman-Fried’s legal council, however, had asked for a prison sentence for the 32-year-old of between five to six years (64 to 78 months).

SBF’s remarks before sentencing

Inner City Press rendered severalSBF quotes from the sentencing:

- “It does not matter why things go bad, if you are the CEO, it is on you. I am not the one who matters the most at the end of the day... My useful life is probably over. I've long since given what I had to give. I can't do it from prison.”

- “I can't impact if I get 5 years or 40 years. I know how the prosecutors see me, the court, the media. I understand it. You referenced my test to the general counsel. I was trying to help - that's not how the prosecutors saw it, the media, that's that.”

- “At the end of the day, it looks like customers will finally get paid, current value of assets. It's true for lenders and investors as well. I guess I wish I had been able to do more to help that. I think I failed at that. I'm not sure why, but I do think I did.”

- “There is an opportunity to do what I thought I would do for the world, not what I ended up doing. If people do what they can for the world, hopefully I can see their success not just my own failures.”

FTX token FTT is down almost 5% in the aftermath of the ruling to trade at $1.99 at the time of writing.

FTT/USDT 1-day chart

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.