Sandbox to trigger bullish move to $5 as SAND forms a reversal setup

- Sandbox price is on the verge of a massive bull rally as it forms a triple bottom setup.

- A spike in buying pressure could propel SAND by 57% to tag the $5 psychological support.

- A daily candlestick close below the $2.69 support level will invalidate the bullish thesis.

Sandbox price has set up a bottom reversal pattern on the daily chart, signaling a bullish outlook for itself. The latest retracement stabilized around a reliable support area, suggesting a bounce is around the corner.

Sandbox price to kick-start new uptrend

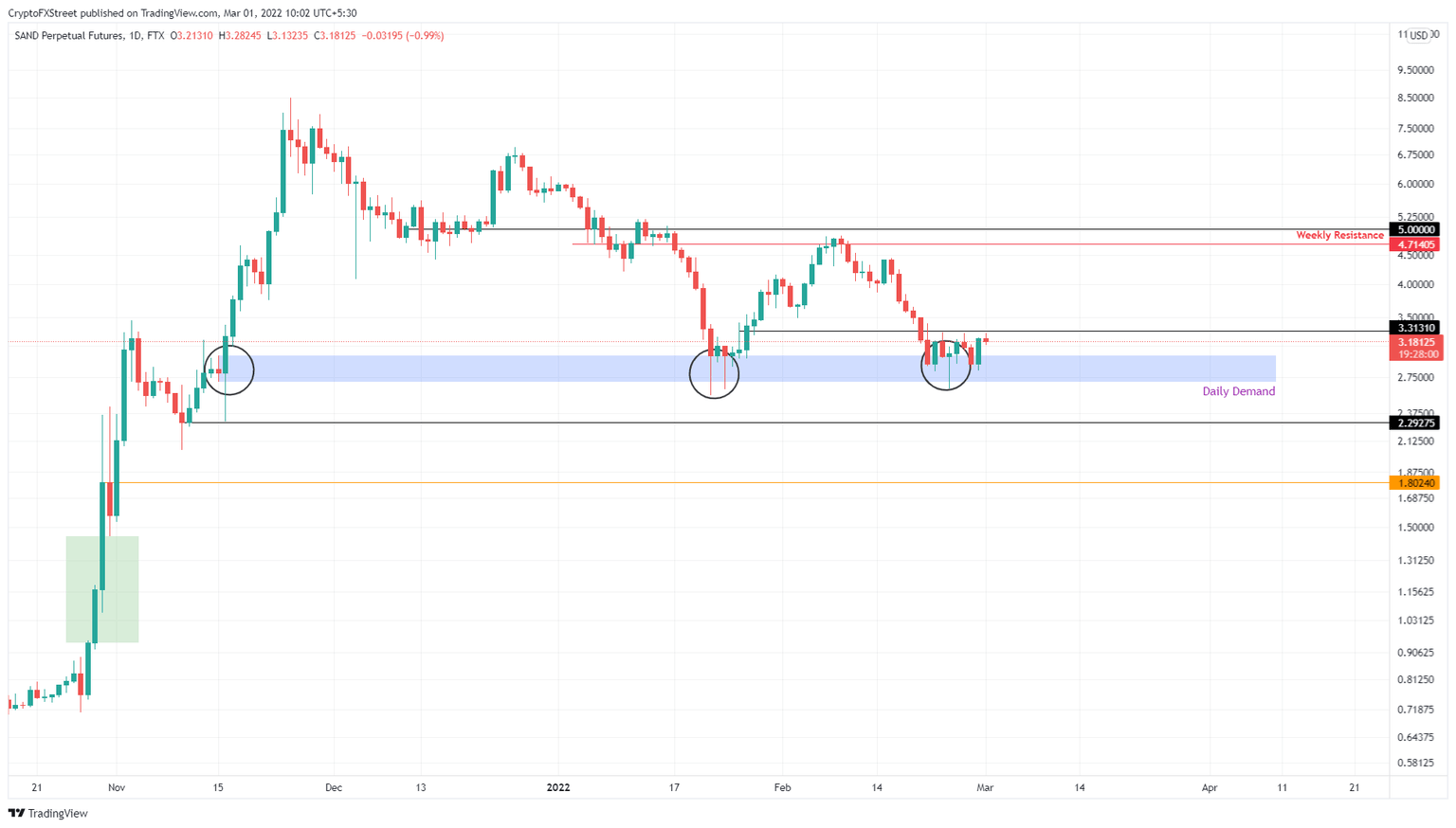

Sandbox price set a demand zone, extending from $2.69 to $3.00 on November 15, 2021, which allowed bulls to take a pit stop before propelling SAND to new highs at $8.48. This level has been significant as a retracement level for price since.

So far, Sandbox price has retested the said demand zone thrice, giving rise to a triple bottom setup. This technical formation indicates that the downtrend is at an end, and an uptrend will begin soon.

Supporting this outlook, Sandbox price has consolidated for roughly a week, indicating that a massive move awaits. A decisive breakout of the $3.31 hurdle will confirm a breakout and indicate that bulls are eyeing a retest of the weekly resistance barrier at $4.71.

While there is a good chance SAND will set up a local top here, an extension of the rally could see the altcoin tick the $5 psychological level. This extra climb would constitute a 58% ascent from the current position - $3.18.

SAND/USDT 1-day chart

On the other hand, if Sandbox price fails to move past $3.31, it will indicate a weakness among the buyers. In such a case, SAND could revisit the immediate support level at $2.69.

A daily candlestick close below the $2.69 foothold will create a lower low and invalidate the bullish thesis for Sandbox price. This development could see the altcoin crash to $1.80 in a dire scenario.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.