Sandbox Price Prediction: SAND bulls prepare for 38% upswing

- Sandbox price is preparing for a major rally to set a new record high.

- If the bullish chart pattern is robust, a 38% surge could be on the radar.

- A slice above $6.96 could unlock significant gains for SAND.

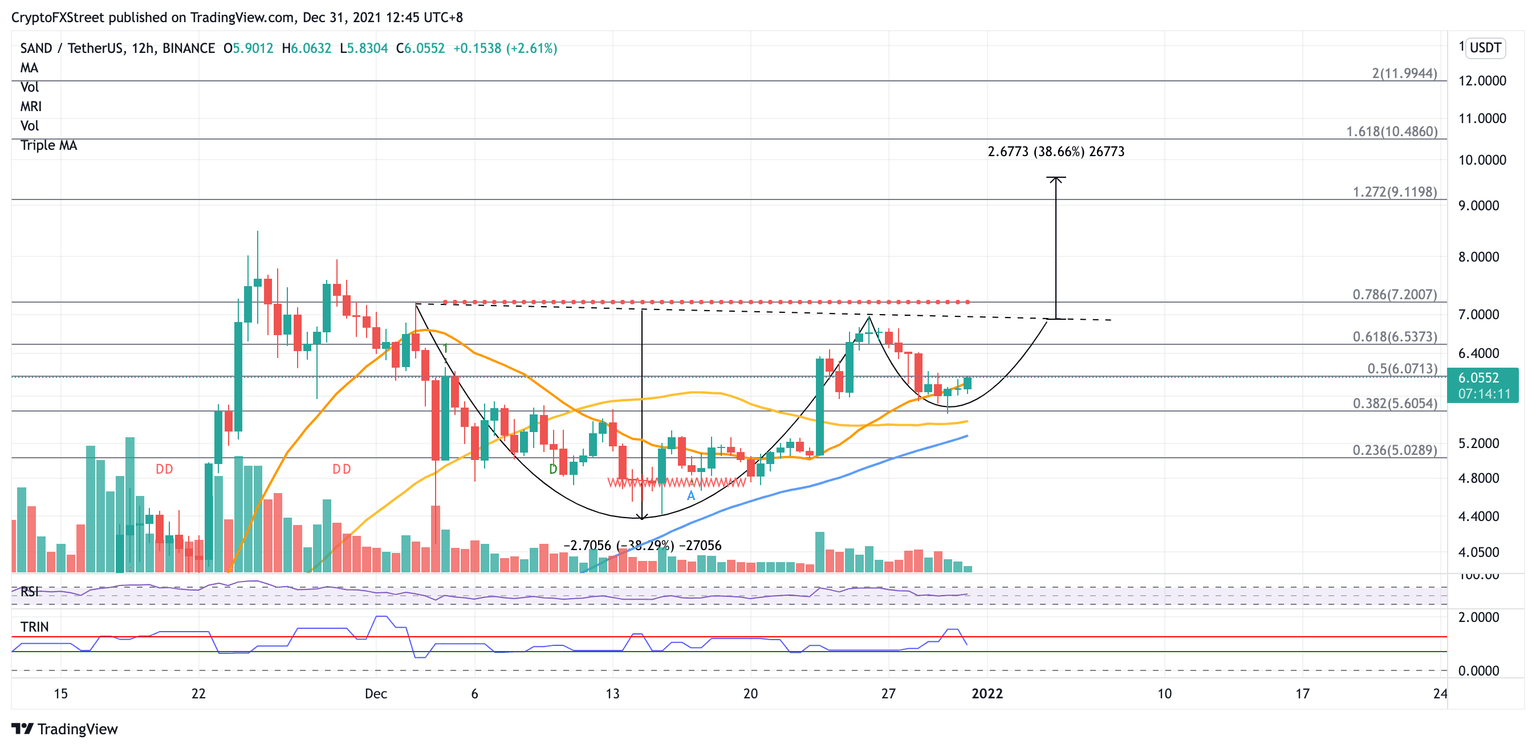

Sandbox price is forming a bullish chart pattern that could send SAND surging 38% toward $9.60. As long as the token manages to stay above the December 30 low at $5.55, the optimistic target could still be in the offing.

Sandbox price set sights on $9.60 next

Sandbox price is forming a cup-and-handle chart pattern on the 12-hour chart, projecting a 38% ascent toward $9.60 from the neckline at $6.96.

Sandbox price will face immediate resistance at the 50% retracement level at $6.07, then at the 61.8% Fibonacci retracement level at $6.53. The toughest obstacle for SAND to overcome is the neckline of the governing technical pattern at $6.96.

If Sandbox price manages to slice above the upper boundary of the prevailing chart pattern, the 38% climb could be on the radar. SAND will face an additional hurdle at the 78.6% Fibonacci retracement level, coinciding with the resistance line given by the Momentum Reversal Indicator (MRI) at $7.20.

Sandbox price must also tackle the November 29 high at $7.93, then the November 25 high at $8.51 next. The 127.2% Fibonacci extension level would then act as a headwind for SAND at $9.11 before the aforementioned optimistic target could be reached.

SAND/USDT 12-hour chart

If a spike in sell orders occurs, Sandbox price will slide toward the nearest support at the 21 twelve-hour Simple Moving Average (SMA) at $5.97. An additional line of defense may emerge at the December 30 low at $5.55. However, investors should note that if SAND falls below the aforementioned foothold, the bullish outlook would be invalidated.

Sandbox price could then slide further to discover support at the 38.2% Fibonacci retracement level at $5.60, then at the 50 twelve-hour SMA at $5.45, then at the 100 twelve-hour SMA at $5.27.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.