Sandbox price finds stable support as SAND readies to rebound

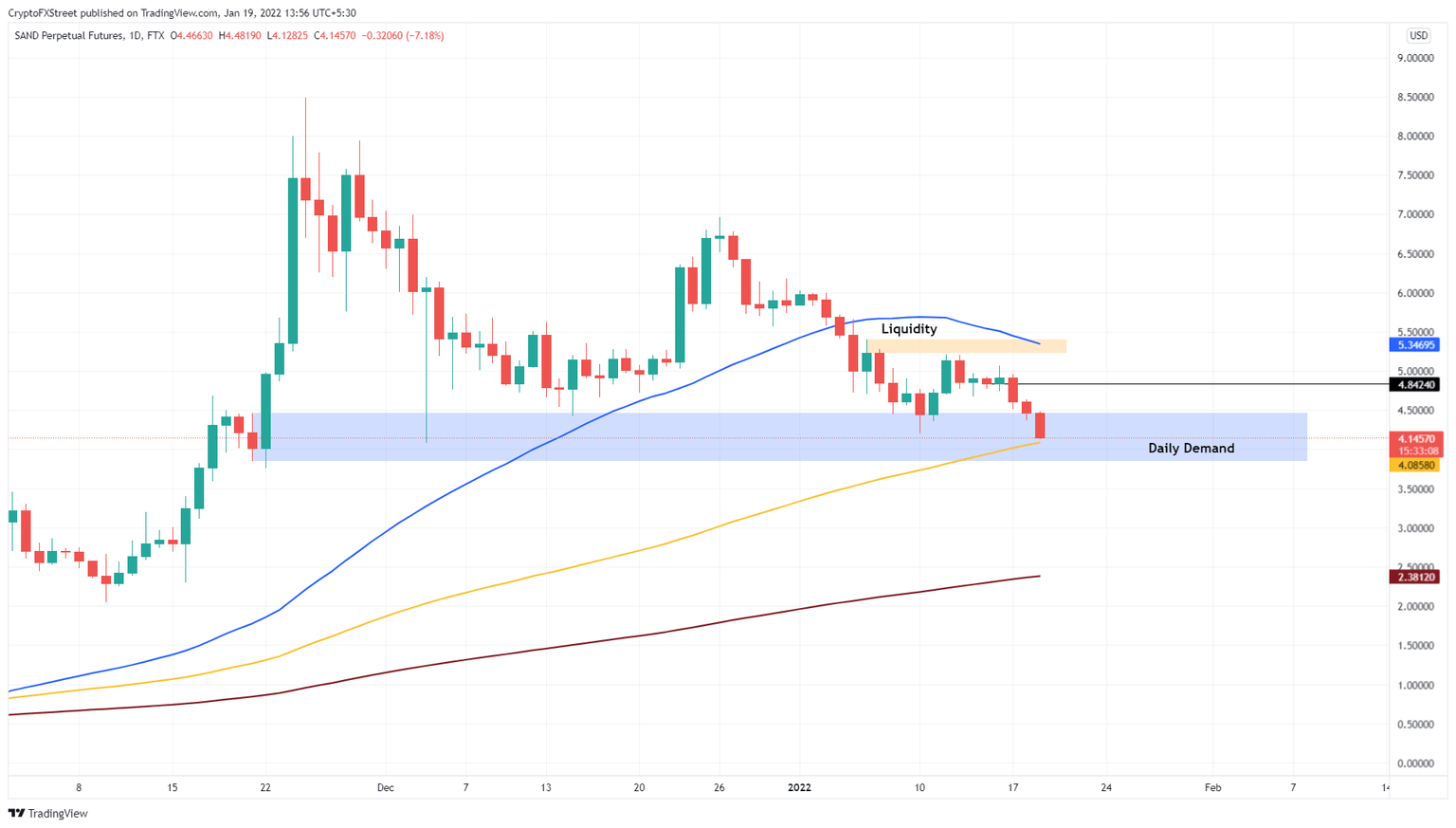

- Sandbox price is revisiting the $3.85 to $4.46 demand zone, providing a buying opportunity.

- Recovery from this area of support could kick-start a 30% ascent to $5.23.

- A daily close below $3.85 will invalidate the bullish thesis for SAND.

Sandbox price is bouncing off a confluence of support, suggesting that an uptrend is likely. Investors can expect SAND to face a minor blockade before reaching the next significant hurdle.

Sandbox price eyes reversal

Sandbox price dropped 20% over the past week and is currently testing the 100-day Simple Moving Average (SMA) at $4.08 present inside the daily demand zone that extends from $3.85 to $4.46.

The confluence of two support levels suggests an uptrend is likely. Investors can open a long position at the current level - $4.15 and anticipate a 17% move to $4.84. If the bullish momentum is enough, SAND will clear this hurdle and make a run for the $5.23 ceiling.

The buy-stop liquidity resting above this barrier will make an attractive target for market makers who will likely push the Sandbox price above it. In such a scenario, market participants could book profits at $5.23 after a 30% ascent.

SAND/USDT 1-day chart

While things are looking bullish for Sandbox price, a breakdown below the 100-day SMA at $4.08 will indicate increased seller activity. A daily candlestick close below the demand zone’s lower limit at $3.85 will create a lower low, invalidating the bullish thesis. Investors can place their stop-losses at or below $3.85.

This development could see Sandbox price revisit the 200-day SMA at $2.38.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.