Sandbox price bound for another 30% gains as SAND finds support

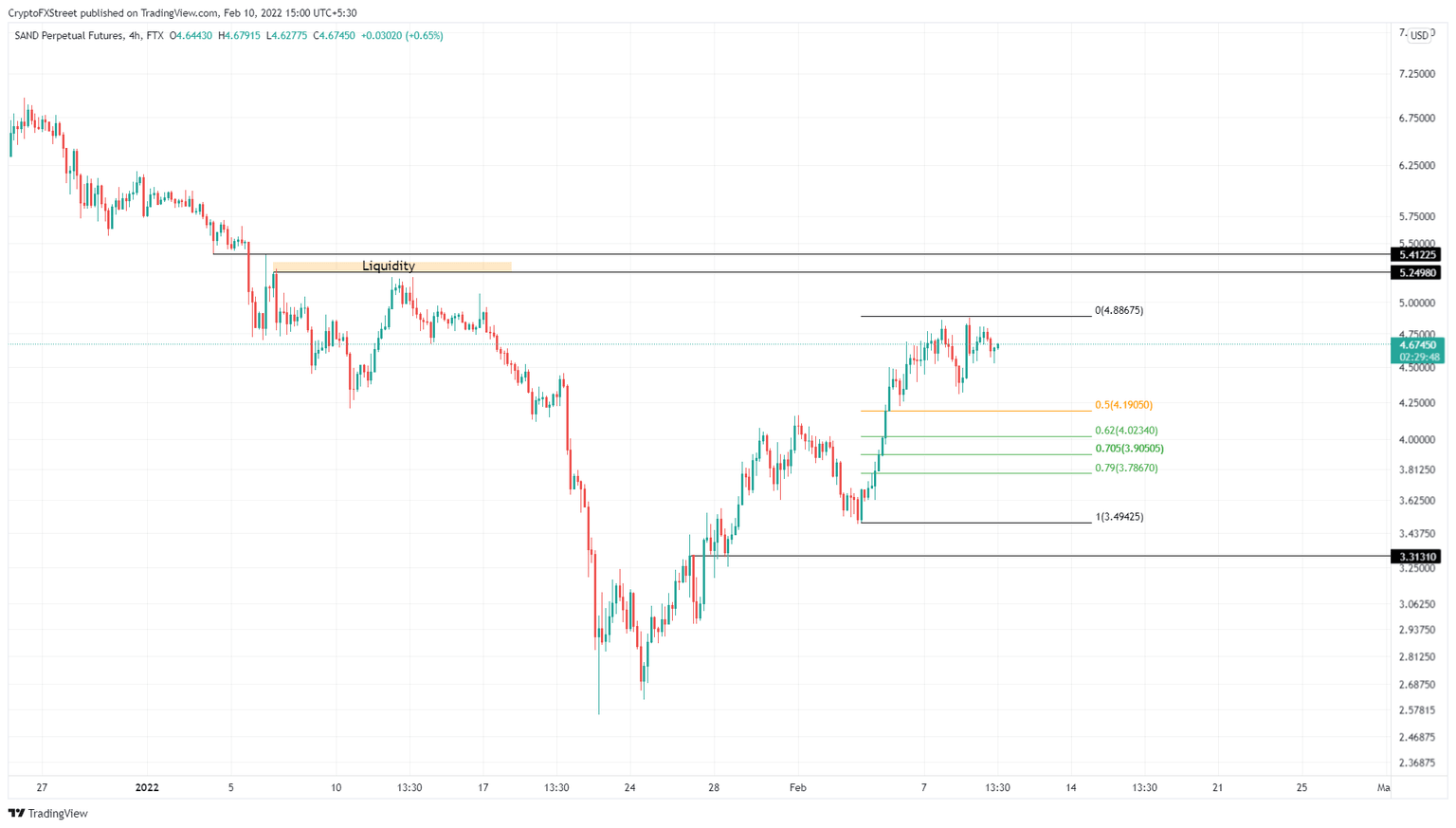

- Sandbox price needs to stabilize around the trading range’s midpoint at $4.20 before a new uptrend.

- A bounce off this barrier is likely to propel SAND by 30% to $5.41.

- A four-hour candlestick close below the range low at $3.49 will invalidate the bullish thesis.

Sandbox price action is seeing a lot of chop after hitting a high on February 9. The recent sideways price action has formed a consolidation and the next move is likely to be a minor retracement before any meaningful bias appears.

Sandbox price needs to reestablish momentum

Sandbox price exploded by 41% in the last five days, rallying from $3.49 to $4.93. This ascent seems to have hit a ceiling on February 7 and the altcoin has been moving sideways ever since. As SAND continues to consolidate, a retrace needs to emerge, allowing investors to purchase the token at a discounted price.

The immediate support level at $4.20 – or the trading range’s midpoint – is the perfect place for the retracement to halt. A resurgence of buyers around this level seems plausible. In some cases, Sandbox price could slide lower and retest the 62% retracement level at $4.02 or the next foothold at $3.91 before making a U-turn.

Regardless of the level, what’s critical is that an increase in bullish momentum leading to a reversal should be the outcome. The resulting uptrend will push Sandbox price to slice through to the range high at $4.93 and collect the liquidity resting above $5.25.

The most likely place for a local top to form is around the $5.41 hurdle, bringing the total climb to 30%. Interested individuals can open a long position at $4.19 or $3.91 and book profits around $4.93, $5.25 and $5.41.

SAND/USDT 4-hour chart

While a retracement is needed for Sandbox price to continue the uptrend, a breakdown of the 79% retracement level will trigger fear among sidelined buyers reducing the likelihood of them kick-starting a new uptrend. A four-hour candlestick close below $3.49 will create a lower low and completely invalidate the bullish thesis for SAND.

In such a scenario, Sandbox price could tag the $3.31 support level, where buyers may eventually give the uptrend another ago.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.