Sandbox continues to drift lower, bears to push SAND to $3.80

- Sandbox price down 14% from Monday.

- Buyers are entering and buying SAND near two-month lows.

- Downside pressure remains strong and the most likely direction.

Sandbox price has made a slight bounce during the Thursday trading session, attempting a bullish daily close after three straight days of losses. However, sellers remain in control, and bulls will need to make some significant gains to convert SAND back into a bull market.

Sandbox price recovers slightly but remains at risk for a more profound drop

Sandbox price is in a clear downtrend within the Ichimoku Kinko Hyo system. Furthermore, no daily support exists within the Ichimoku system, signaling a wide-open range to continue moving lower. However, downside risks should be limited to a confluence zone of support near $3.80, where the bottom of the bull flag and the 38.2% Fibonacci retracement sit.

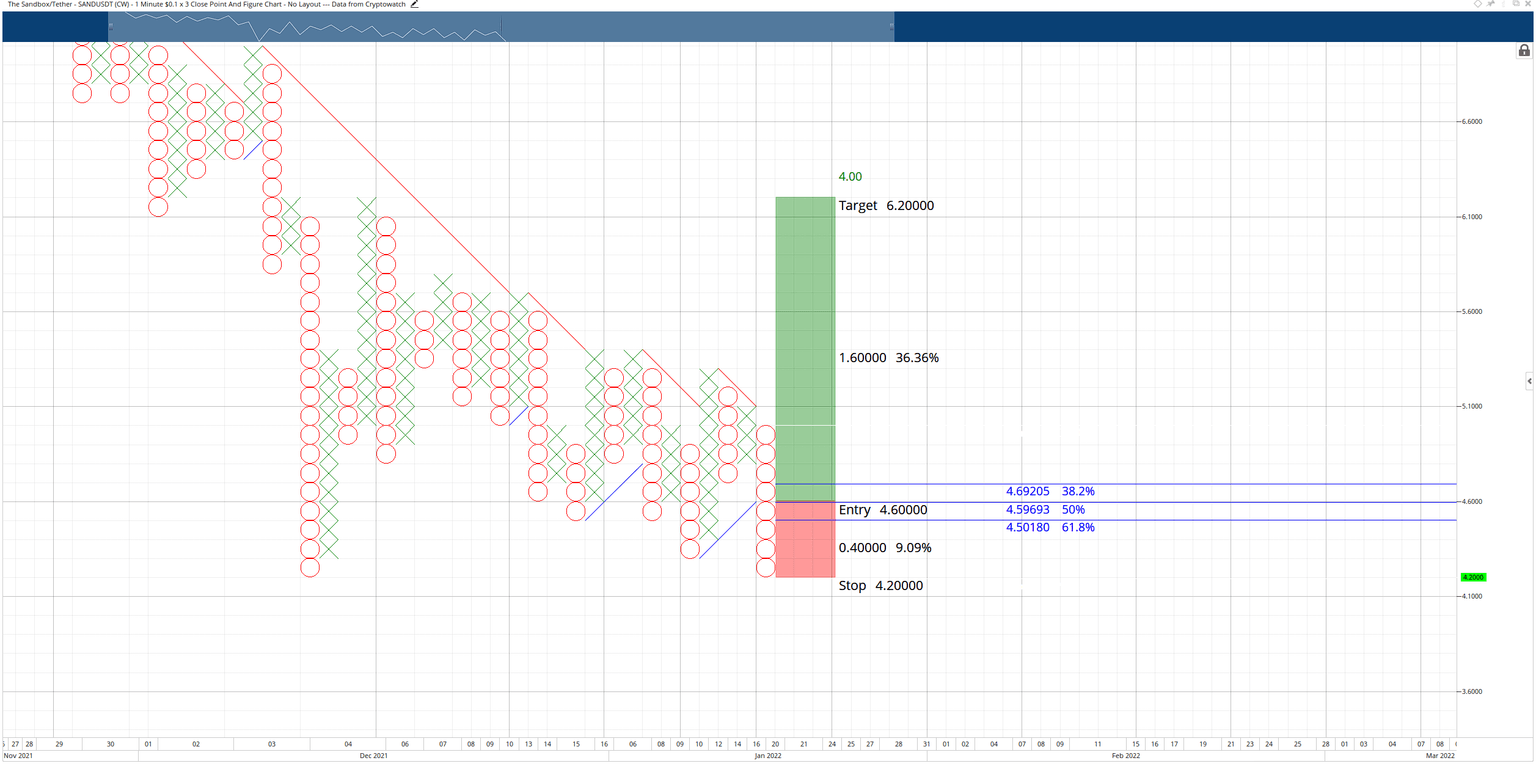

The current $0.10/3-box reversal Point and Figure chart presents a long trade opportunity based on a Pole Pattern. Pole Pattern entries require at least five boxes below the multiple top/bottom, but no more than fifteen boxes. The entry on a Pole Pattern is at the 50% retracement of the pattern. For Sandbox price, the 50% retracement is at $4.60.

The theoretical long trade is a buy stop order at $4.60, a stop loss at $4.20, and a profit target at $6.20. The trade represents a 4:1 reward/risk setup with an implied profit target of 36% from the entry. A two-box trailing stop would help protect any implied profit made after the entry.

SAND/USDT $0.10/3-box Reversal Point and Figure Chart

The long entry is invalidated if Sandbox price has a daily close at or below the $3.80 value area.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.