Sam Bankman-Fried serves jail time ahead of October fraud trial after federal judge Lewis Kaplan revoked bail

- Sam Bankman-Fried may spend the next two months in jail as he awaits the fraud trial scheduled for October.

- The speculation comes after federal judge Lewis Kaplan rejected his bail during the August 11 hearing.

- SBF transitions from house incarceration, where he had no visitors or internet access, to jail, with some seeing this as good for the community

- Meanwhile, the FTT price continues to slide south, down 30% so far in the month.

Sam Bankman-Fried (SBF), founder of failed cryptocurrency exchange FTX will spend the next two months in jail as he awaits trial in October on fraud charges. The news comes after a Friday hearing, where the federal judge in charge of the case deliberated between setting him free or sending him to jail.

Sam Bankman-Fried goes to jail

Sam Bankman-Fried, the infamous name in the cryptosphere right next to Terra's Do Kwon, is headed to jail as he awaits the October trial. Based on the latest report, federal Judge Lewis Kaplan has denied his bail application, ordering that SBF be held in jail until his trial.

U.S. JUDGE SAYS HE IS GOING TO REVOKE SAM BANKMAN-FRIED'S BAIL - RTRS

— Tree News (@News_Of_Alpha) August 11, 2023

Notably, SBF already had negative standing with the court after the prosecution called him out for witness tampering. Specifically, he leaked documents about Caroline Ellison, his ex-lover and former head of FTX sister firm Alameda Research, to the New York Times. This angered the court, given that Caroline was also a potential witness in SBF's trial.

The prosecution had built a case around witness tampering, using the news of the leak to their advantage and describing it as a deliberate attempt by SBF to intimidate Ellison and create an "impression" of her in the media. Accordingly, a prosecution team member had argued that detention was the only way "to ensure the safety of the community."

Witness tampering was not the only move by SBF to irk the prosecution and the court, as the former FTX executive also has a history of contacting the firm's general counsel with intentions to develop their relationship for mutual benefit and value addition.

Other concerning moves by SBF that kept beckoning his detention in court include using a VPN (Virtual Private Network) for internet access, which the judge had cautioned against unless when he was getting updates about the case. According to the prosecution, however, SBF may have been trying to conceal his use of the internet, thereby contravening court instructions.

It is worth mentioning that this development comes after the fourth FTX ex-official, Ryan Salame, pleaded guilty to criminal charges imposed by the prosecutors. Others who pleaded guilty include Gary Wang, Caroline Ellison, and Nishad Singh.

FTX token price implication

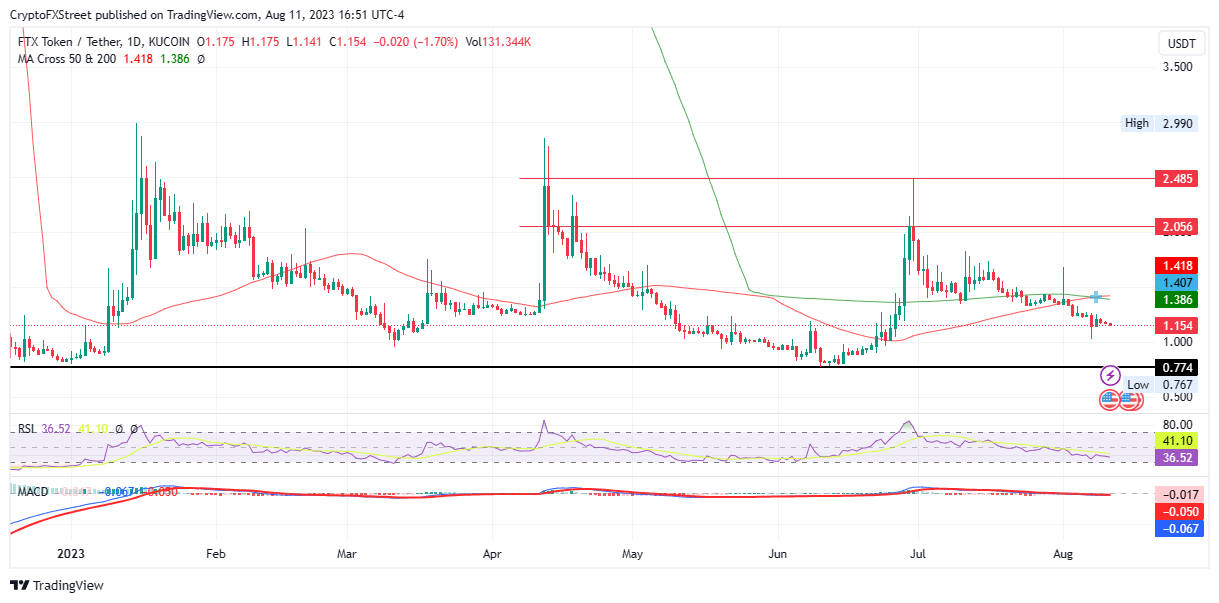

As SBF heads to jail, FTX token (FTT) continues trading with a bearish bias with a 55% drop in market value from the $2.482 resistance level recorded on June 30. At the time of writing, the altcoin is auctioning at $1.154, with a strong probability for a continued slump. An increase in selling pressure could send the altcoin an additional 30% to the support floor at around $0.774.

This is likely considering the current weakness in Bitcoin price that continues to harm altcoins, FTT included. With the lack of momentum coupled with the gloom in the FTT ecosystem, the FTT price could be on a course south.

The Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) also support the negative outlook, heading south and bordering in favor of the bulls. This suggests that bears are in control.

FTT/USDT 1-day chart

Conversely, with the bullish cross indicated when the 50-Moving Average (MA) crossed above the 200-MA, the FTX token could find footing for a breakout north. Likely targets if such an outcome manifests include the $2.056 level, or in a highly bullish case, the $2.845 resistance level.

Cryptocurrency metrics FAQs

What is circulating supply?

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. Since its inception, a total of 19,445,656 BTCs have been mined, which is the circulating supply of Bitcoin. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

What is market capitalization?

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value. For Bitcoin, the market capitalization at the beginning of August 2023 is above $570 billion, which is the result of the more than 19 million BTC in circulation multiplied by the Bitcoin price around $29,600.

What is trading volume?

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

What is funding rate?

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.