SafeMoon price uninterested in recovery, heads for 25% downswing

- SafeMoon price has not been able to reverse the period of underperformance.

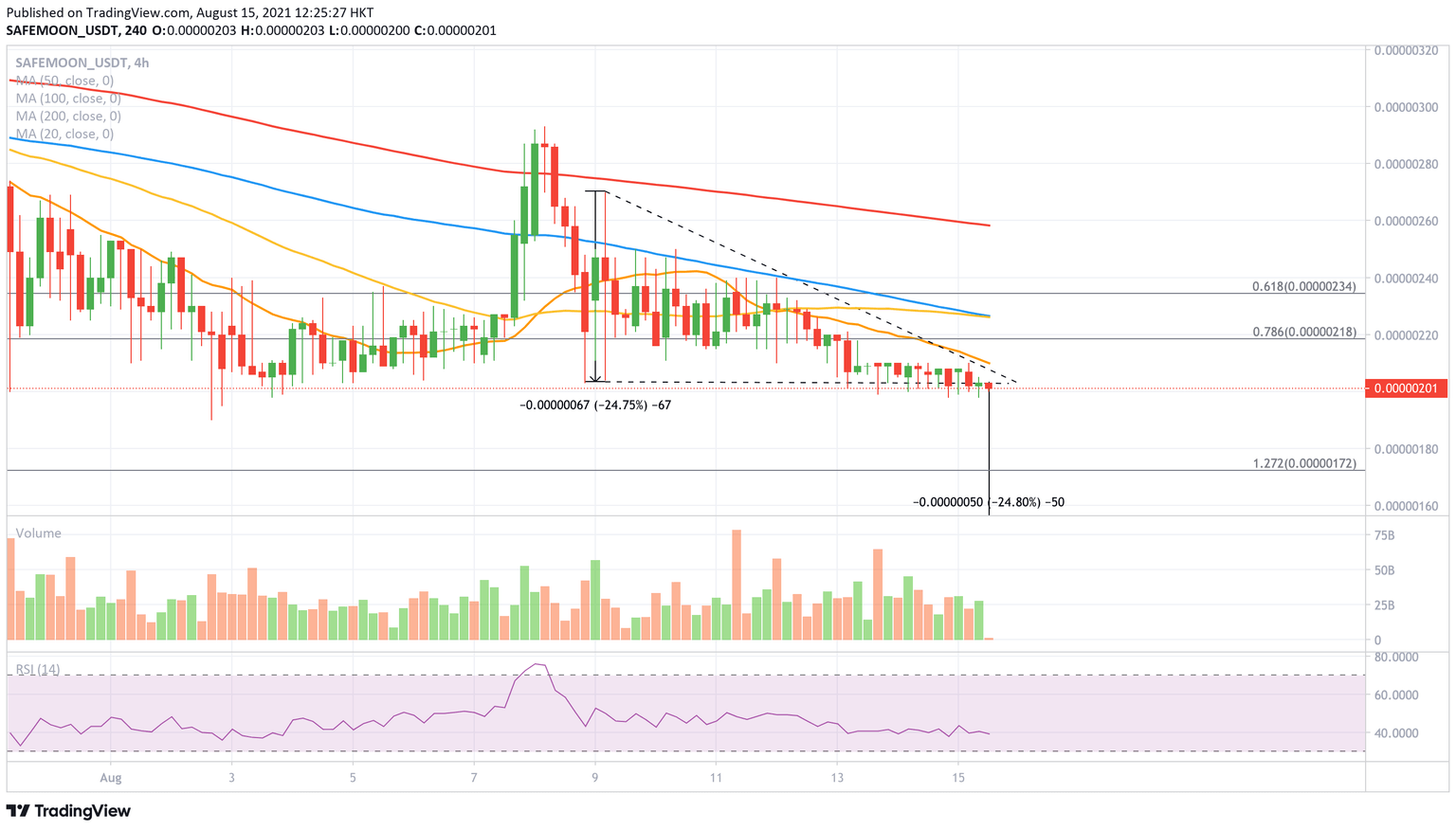

- SAFEMOON has presented a bearish chart pattern, suggesting a 25% move to the downside.

- $0.00000203 acts as critical support for the altcoin, and a close below this level could spell trouble for the bulls.

SafeMoon price action continues to be underwhelming as SAFEMOON carries on with making lower lows. The diminishing trading volume also suggests that interest in the altcoin has declined, leading to a development of a bearish chart pattern.

SafeMoon price at risk of a steep decline

SafeMoon price has collapsed a descending triangle pattern on the 4-hour chart, suggesting that SAFEMOON could be heading lower. Despite efforts to recover from the underperformance, the cryptocurrency lacked strength and is at risk of further decline.

The governing technical pattern suggests that SafeMoon price is prepared for a 24% drop, heading to $0.00000153. Failing to hold above the base of the triangle at $0.00000203 could spell trouble for the bulls.

Currently, SafeMoon price is indecisive, consolidating around the horizontal trend line of the prevailing chart pattern. The price action could quickly be shifted if SAFEMOON sees a spike in selling pressure, putting the bearish target on the radar.

SafeMoon price could also find support at the 127.2% Fibonacci retracement level at $0.00000172 before reaching the target given by the descending triangle. However, this line of defense remains weak as the diminishing trading volume may suggest that buyers are nowhere to be found and may struggle to lift prices higher against the overpowering distribution of the sellers.

SAFEMOON/USDT 4-hour chart

Should SafeMoon price witness a reversal of fortune, the altcoin would need to slice above the hypotenuse of the descending triangle and the 20 four-hour Simple Moving Average (SMA) at $0.00000210 to avoid the bearish outlook.

Further hope may arise for the bulls if SafeMoon price surges above the 78.6% Fibonacci retracement level at $0.00000218, as SAFEMOON could then target the next resistance at $0.00000277, where the 50 and 100 four-hour SMAs converge.

However, SafeMoon price is not expected to make further advances above the aforementioned resistance level given the lack of buying pressure and trading volume.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.