SafeMoon price to crumble under pressure and make a new low for 2022

- SafeMoon price sees bulls trying to get away from the $0.001778 level.

- Instead, bears keep a lid on upside price action with a break to the downside still on the cards.

- Should the Nasdaq close the week with a loss, expect bulls to flee the scene in SafeMoon.

SafeMoon (SAFEMOON) price has been starting a new version since the back end of 2021, but V2 looks to be just a copy-paste of V1 with price action falling to low levels and investors interest fading by the day. For the moment, bulls are looking to try one last time, but with volume wearing thin SafeMoon bulls are on their last legs before folding. Expect a break to the downside to be on the cards with a possible 10% loss.

SafeMoon reboot in V2 is simply a copy-paste of V1

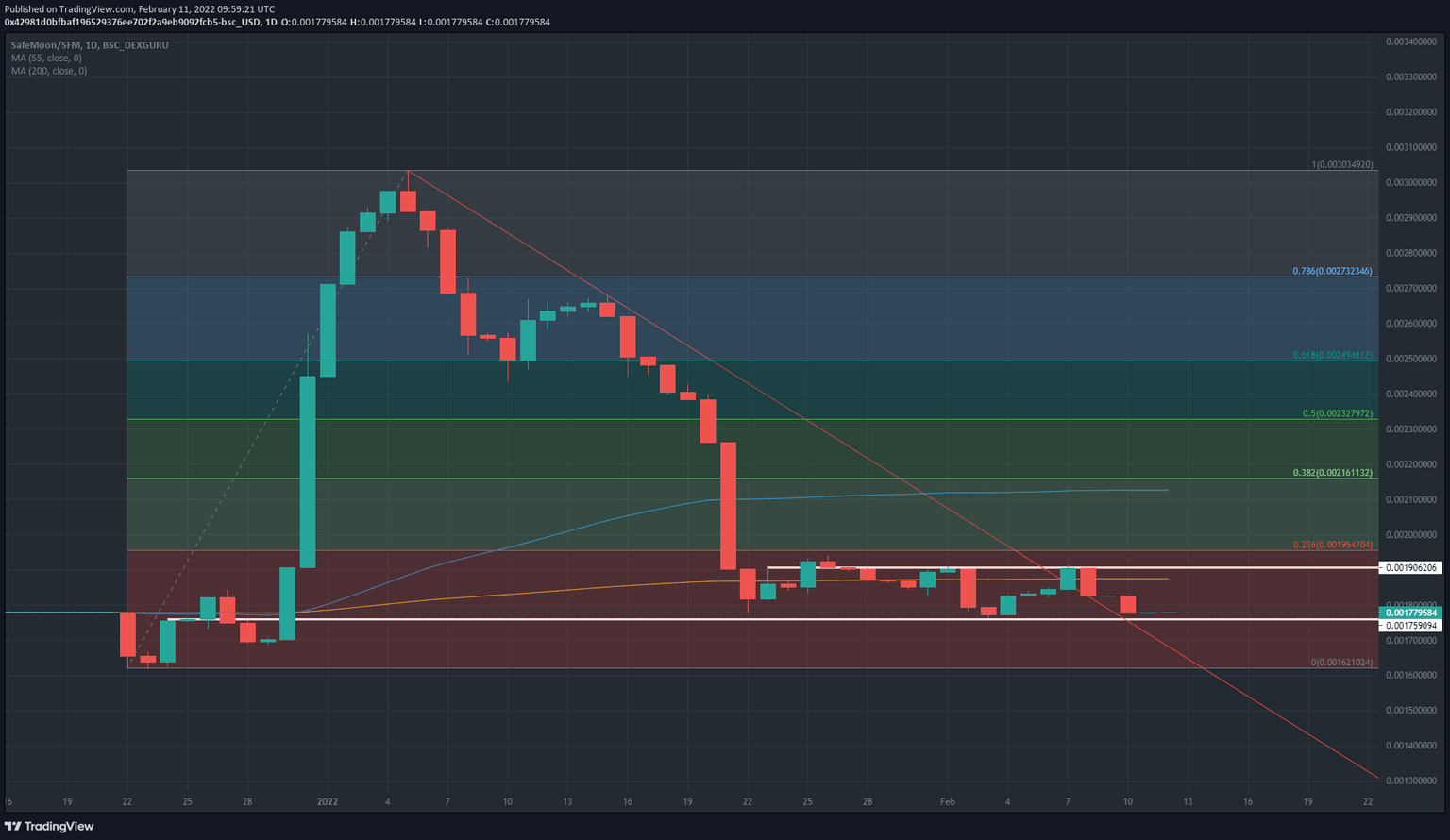

SafeMoon price action is not favouring any long-term investors since it decided to start a reboot version of the initial SafeMoon V1. With a vast inflow and uptick, all-time highs got set at early January around $0.003000. But since then, price action has been one-directional to the downside for over a month now.

SafeMoon bulls, however, have been trying to fight the trend by breaking the red descending trend line on Monday but that attempt saw a firm rejection of the $0.001906 historical level. With that rejection, bulls got squeezed out of their positions by a bearish candle that broke the low of Monday, the next day. In the meantime, price action has touched base at $0.0017960 but still looks heavy, although two bullish candles are forming against the tide of market sentiment after a significant inflation number that is stirring up markets again.

SAFEMOON/USD daily chart

Expect the market situation to deteriorate further and see bears break the $0.001760 level, opening up the last area of support before making new lows at $0.001621. Should Nasdaq, as a leading indicator, be able to tie up the week with a gain and positive close, expect some mild interest coming back to SafeMoon price action with a pop above $0.001800 towards the 200-day Simple Moving Average (SMA) at $0.001875, this week. That would mean that bulls hold the key for an attack at $0.001965 in the week to come.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.