SafeMoon price targets 40% upswing despite recent pullback

- SafeMoon price shows restraint in its pullback as it arrives at $0.00118.

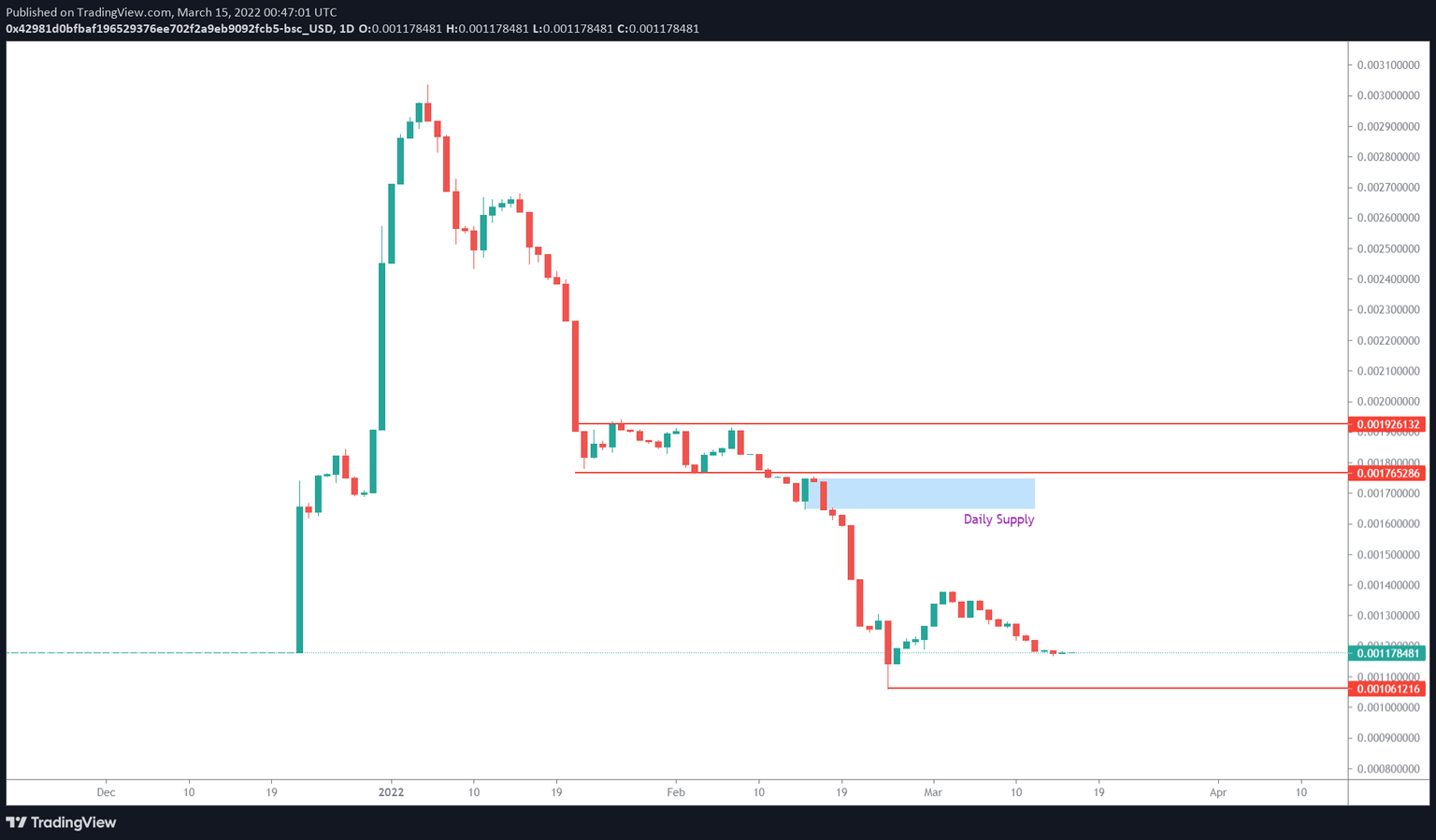

- A reversal around this level seems likely to trigger a 40% ascent to retest the $0.00165 to $0.00175 supply zone.

- A daily candlestick close below $0.00106 will create a lower low and invalidate the bullish thesis.

SafeMoon price seems to have run out of luck as it has been on a steep downtrend with no bullish reaction in sight. However, the recent run-up seems to have breathed a sigh of relief and hints that a minor rally to the immediate barrier is likely.

SafeMoon price takes another jab

SafeMoon price rallied 30% after setting up a local bottom at $0.00106. This run-up produced a swing high at $0.00137 but failed to maintain its momentum, resulting in a 14% retracement to where SAFEMOON currently trades - $0.00118.

As a result of the pullback, SafeMoon price is currently consolidating, hinting at a volatile move in the near future. A successful accumulation could see the altcoin spike to the immediate supply zone, extending from $0.00165 to $0.00175.

This move would constitute a 40% ascent from the current position and is likely where the upside for SafeMoon price is capped. However, in a highly bullish case, a daily candlestick close above $0.00175 will invalidate this blockade. Such price action will indicate that the rally is likely to extend to the next hurdle at $0.00175.

SAFEMOON/USDT 1-day chart

On other hand, if SafeMoon price fails to recover from the pullback, it will indicate that the bulls are unable to make do. In such a case, SAFEMOON will revisit the swing low at $0.00106. Here, buyers have another chance at recovery; failure here will lead to invalidation of the bullish thesis if SafeMoon price produces a daily candlestick close below $0.00106.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.