SafeMoon Price Prediction: SAFEMOON hints at reversal of its downswing

- SafeMoon price is on a downtrend that looks likely to retest the swing low at $0.00000273.

- If SAFEMOON produces a decisive close above $0.00000399, an uptrend is expected to gain steam.

- In that case, a 22% upswing to the lower limit of the supply zone at $0.00000490 would commence.

SafeMoon price is currently undecided on its directional bias and could sway either way. However, going by the general market structure of most cryptocurrencies, it is likely SAFEMOON will head higher.

SafeMoon price at crossroads

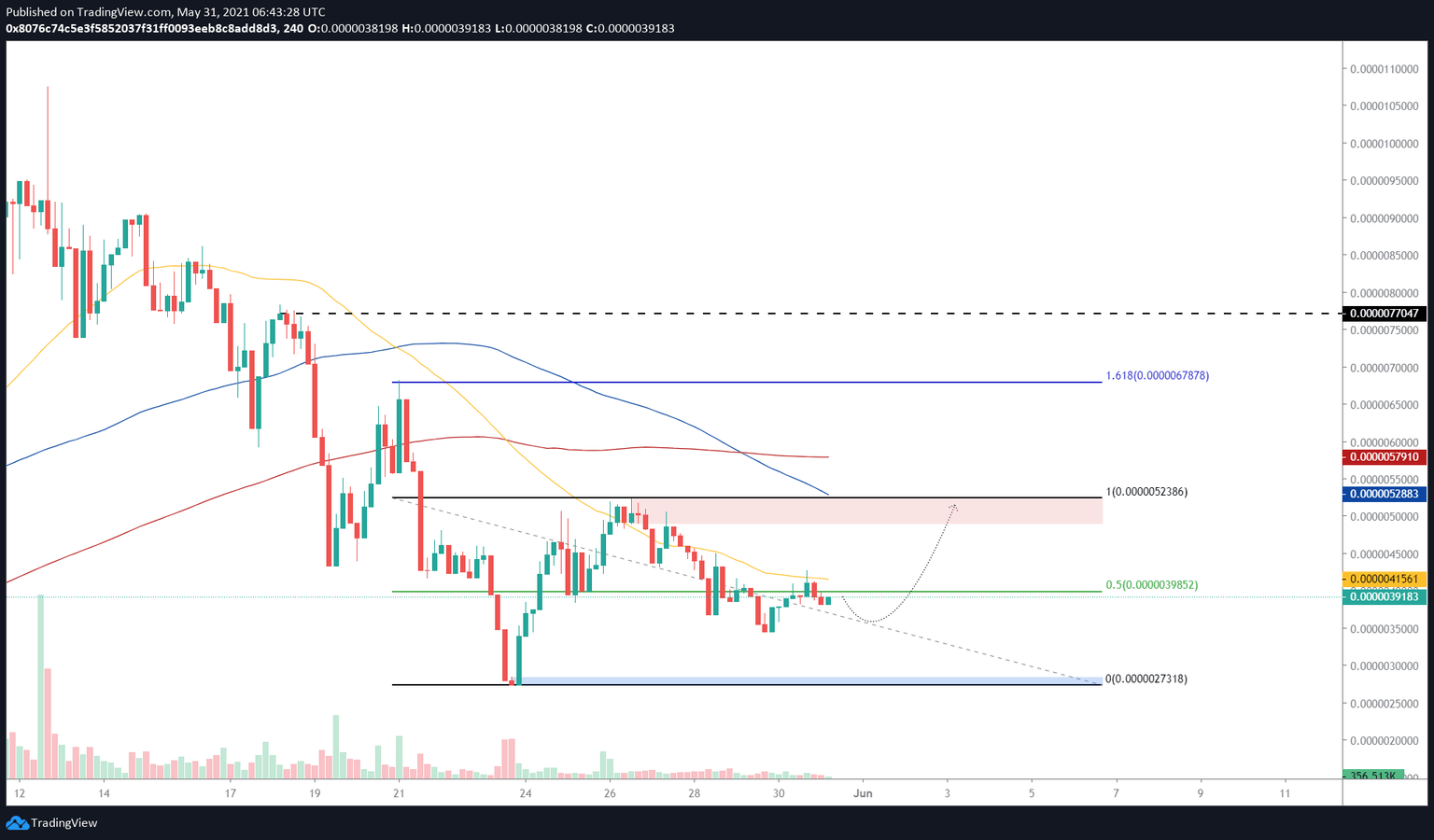

SafeMoon price is currently trading below the 50% Fibonacci retracement level at $0.00000399 after a 25% downswing from the swing high at $0.00000524. As SAFEMOON tries to overcome the said supply barrier, it remains indecisive.

A failure to muster up the bullish momentum here could lead to a retest of the swing low at $0.00000273 formed on May 23. However, a bullish spike in buying pressure from the current position ($0.00000392) that produces a decisive close above $0.00000416, coinciding with the 50 four-hour Simple Moving Average (SMA), will confirm the start of an up-trending rally.

In that case, SafeMoon price might rally an additional 17% to tag the lower boundary of the supply zone that extends from $0.00000273 to $0.00000524, which almost coincides with the 100-day SMA at $0.00000529.

Beyond this point, SAFEMOON has the potential to tag the 200 four-hour SMA at $0.00000579.

This rise in SafeMoon price is also likely after a bounce from the swing low at $0.00000273.

SAFEMOON/USDT 4-hour chart

On the flip side, if SafeMoon price slices through $0.00000198, it would invalidate the bullish thesis explained above and trigger a 22% downtrend to $0.00000157.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.