SafeMoon price poised for another 20% drop as bulls jump ship

- SafeMoon price continues to slide further south, trading in exceptionally bearish conditions.

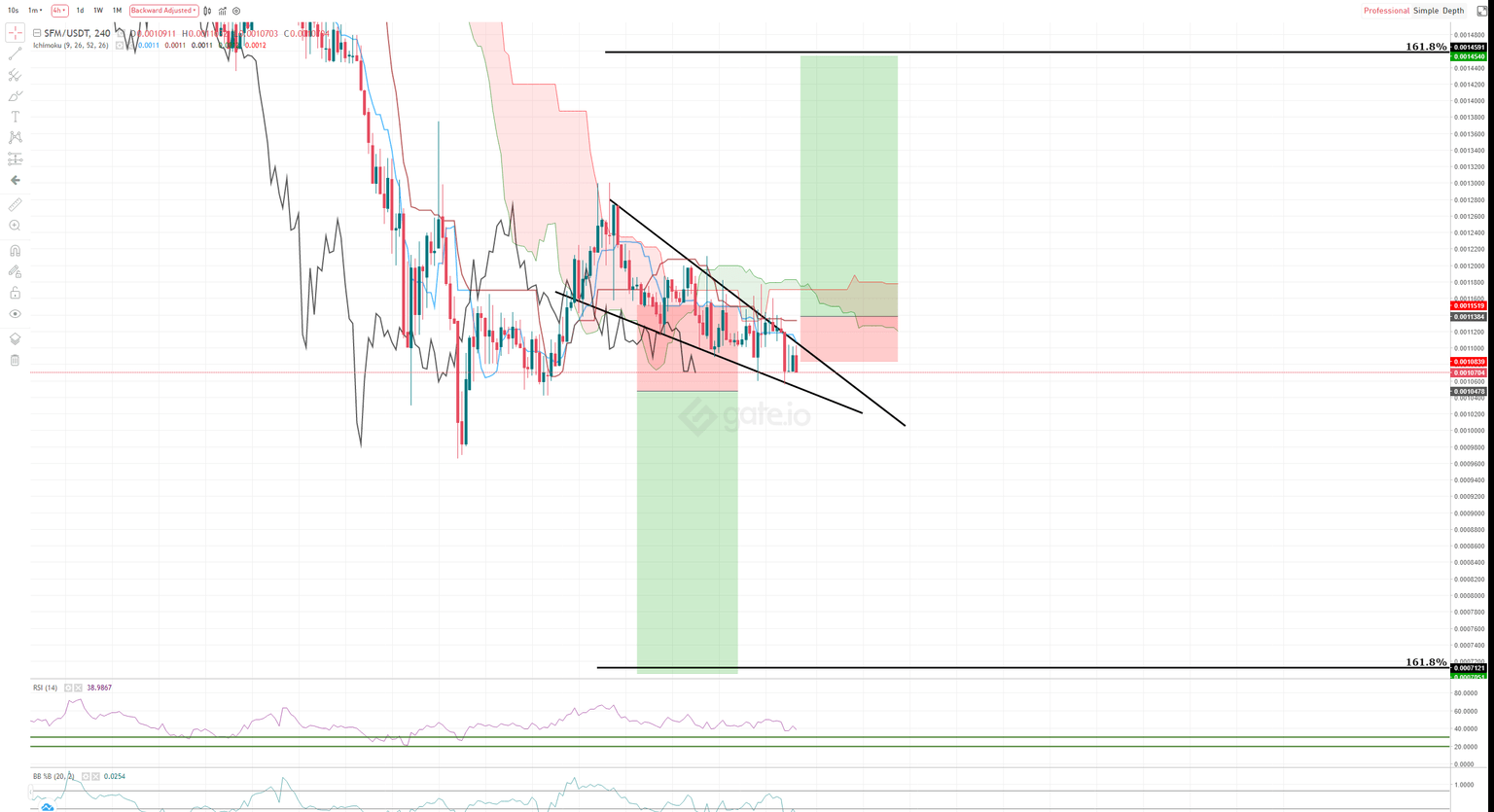

- An upcoming Ichimoku time cycle and bullish reversal pattern could change the current trend.

- Downside pressure still likely as price action remains weighted heavily to the bearish side of the market.

SafeMoon price is currently trading below the Ichimoku Cloud and continuing its slide south after repeated Ideal Bearish Ichimoku Breakout confirmations. It remains above the most recent swing lows at $0.00097 made on February 24, 2022, but continuation lower is likely unless buyers step in to support SafeMoon.

SafeMoon price action, while decidedly bearish in the near term, presents opportunities for bulls and bears.

SafeMoon price has an early and aggressive long opportunity present upon a successful 4-hour close above the falling wedge pattern, the Tenkan-Sen and the Kijun-Sen. The hypothetical long entry is a buy stop order at $0.00114, a stop loss at $0.00108, and a profit target at $0.00145. The trade represents a 5.79:1 reward for the risk setup. The entry is only valid on the close of a 4-hour candlestick.

The long entry idea for SafeMoon price is an aggressive entry because it occurs below the Ichimoku Cloud. However, due to the proximity of a Kumo Twist and a very thin Ichimoku Cloud, momentum is likely to carry SFM higher if the entry is confirmed.

The hypothetical long idea is invalidated if the short entry below is triggered first.

SFM/USDT 4-hour Ichimoku Kinko Hyo Chart

On the short side of the market – and the most probable to play out – there is a theoretical short trade for SafeMoon price with a sell stop order at $0.00105, a stop loss at $0.00112, and a profit target at $0.000071. The short idea represents 3.3:1 rewards for the risk.

The theoretical short entry confirms two bearish events. The first is a close below the falling wedge. The second is a close below the prior swing low close at $0.00104.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.