SafeMoon price hits rock bottom, 45% advance likely

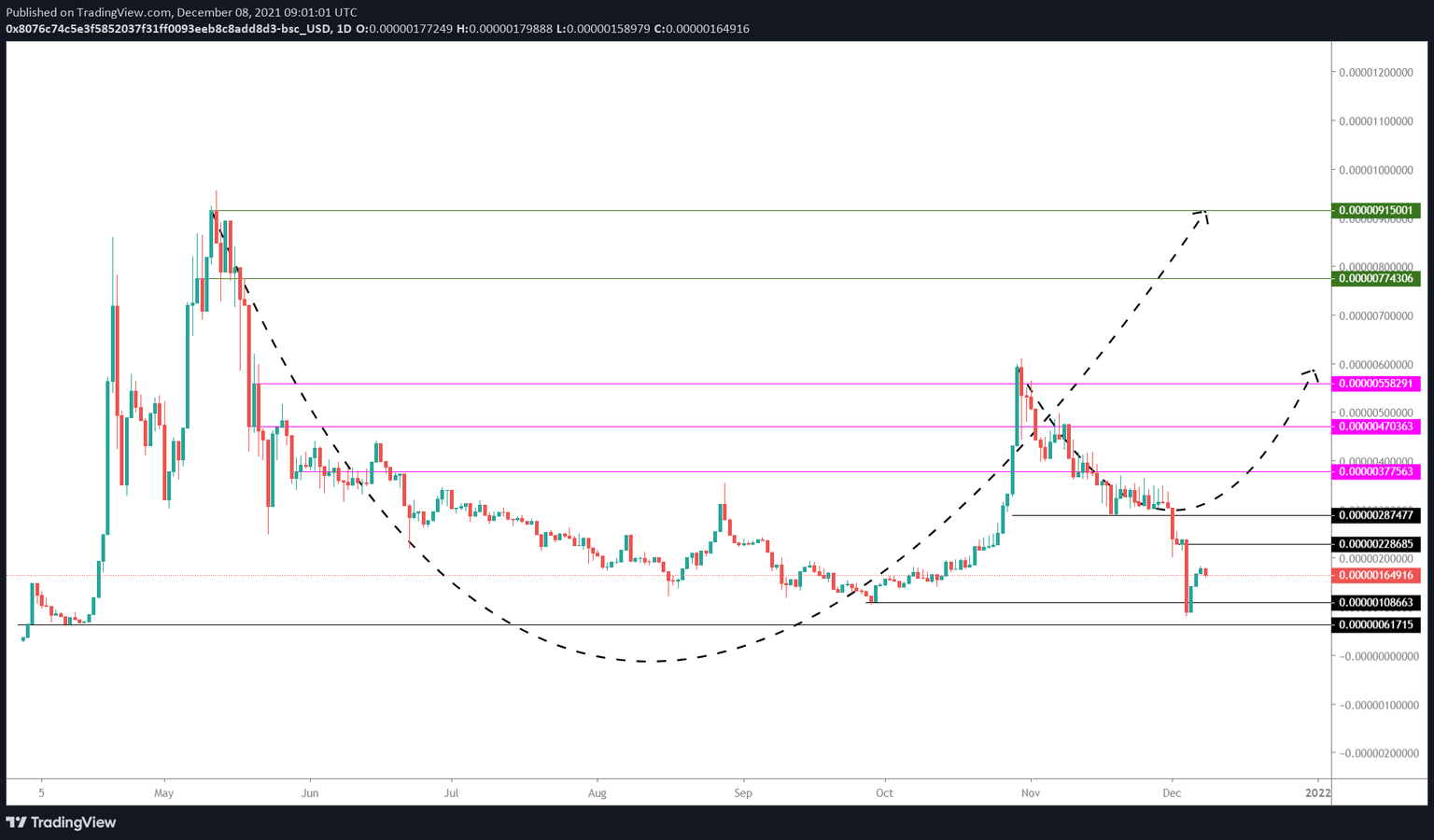

- SafeMoon price suffered a 63% fatal crash on December 4 and set up a swing low at $0.000000811.

- This downswing collected liquidity resting below $0.00000108 swing low, priming SAFEMOON for a 45% upswing to $0.00000228.

- A breakdown of the $0.000000617 support level will invalidate the bullish thesis.

SafeMoon price has failed to hold up as the market crashed on December 4. This downswing pushed the altcoin down below a crucial support floor and into an oversold territory, suggesting that a bullish outlook is around the corner.

SafeMoon price tries to recover

SafeMoon price crashed 63% on December 4 and sliced through the September 28 swing low at $0.00000104, collecting liquidity resting below it. The severe crash and the correction serve as a perfect combination to kick-start an upswing.

So far, SafeMoon price has rallied 103% to where it currently stands - $0.00000165. Going forward, investors can expect SAFEMOOON to continue recovering its losses and tag the immediate resistance level at $0.0000022. This run-up would constitute a 45% climb and indicate that the bulls are back.

In some cases, the climb could extend well beyond the said barrier, allowing SafeMoon price to revisit the $0.00000287 hurdle. In total, the advance from $0.00000165 to $0.00000287 would represent a whopping 80% gain.

Therefore, investors need to pay close attention to the SAFEMOON price action over the next few days as it could provide users with a huge opportunity to realize profits.

SAFEMOON/USDT 1-day chart

While things are looking up for SafeMoon price, the upswing could fail to sustain, knocking the altcoin back to $0.00000108. In this scenario, if the bearish momentum pushes SAFEMOON to produce a lower low below $0.000000617, it will invalidate the bullish thesis outlined above.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.