SafeMoon price has no chance of going to the moon anytime soon

- SafeMoon price is shaking off the profit-taking from Monday.

- SAFEMOON is trying to break to the upside, but too many factors are pointing to further downside.

- A retest of the double bottom at $0.00000259 is set to be complete by the end of this week.

SafeMoon price alongside the top cryptocurrencies has been able to reverse the negative sell-off that happened on Monday. It even entered in further bullish patterns, breaking specific bearish indicators or levels.

SafeMoon price lacks strength

SafeMoon price has been in a similar pattern as Bitcoin and other majors since this past weekend. SafeMoon made a new high, but that was taken down again on profit-taking and is now looking to pair those losses again.

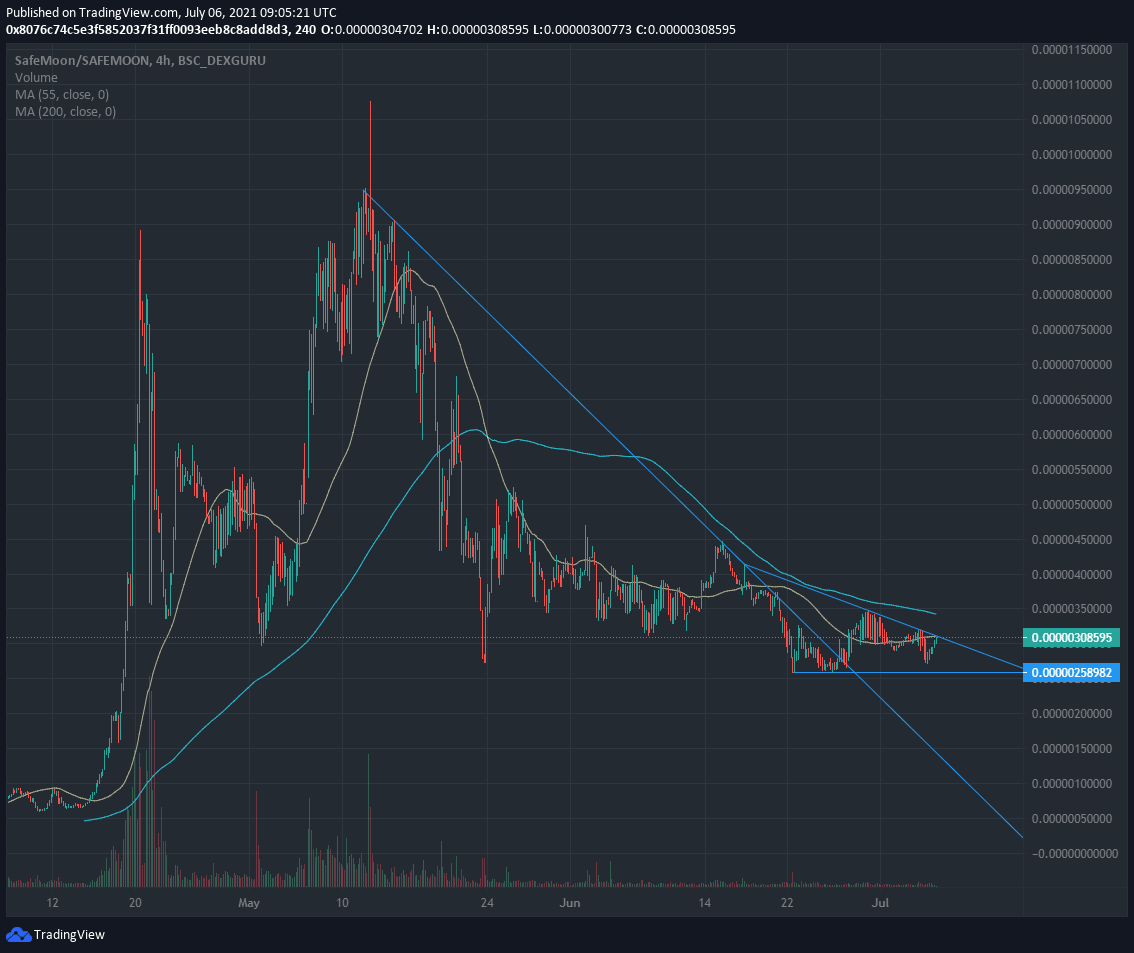

Nevertheless, the image looks rather grim to the upside for SafeMoon. A close look at the 4-hour chart shows a cluster of significant forces just above it, all in the $0.0000030-to-$0.0000035 region.

The descending trendline is limiting the upside on SafeMoon price as well as the 55 Simple Moving Average (SMA) on the 4-hour chart around $0.0000031.

If buyers could overcome those two short-term caps, the 200 SMA on the 4-hour chart at $0.0000034 would come into play. Both SMAs are also forming a death cross that is still very much in play.

SAFEMOON/USD 4-hour chart

On the flip side, buyers need to step in properly and drive prices beyond this resistance area so SafeMoon price can jump towards $0.000044. But the technical indicators are so strong and meaningful that SafeMoon should instead go for the retest of $0.0000026 and might break further to the downside.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.