SafeMoon price begins to climb as bulls re-enter the crypto markets

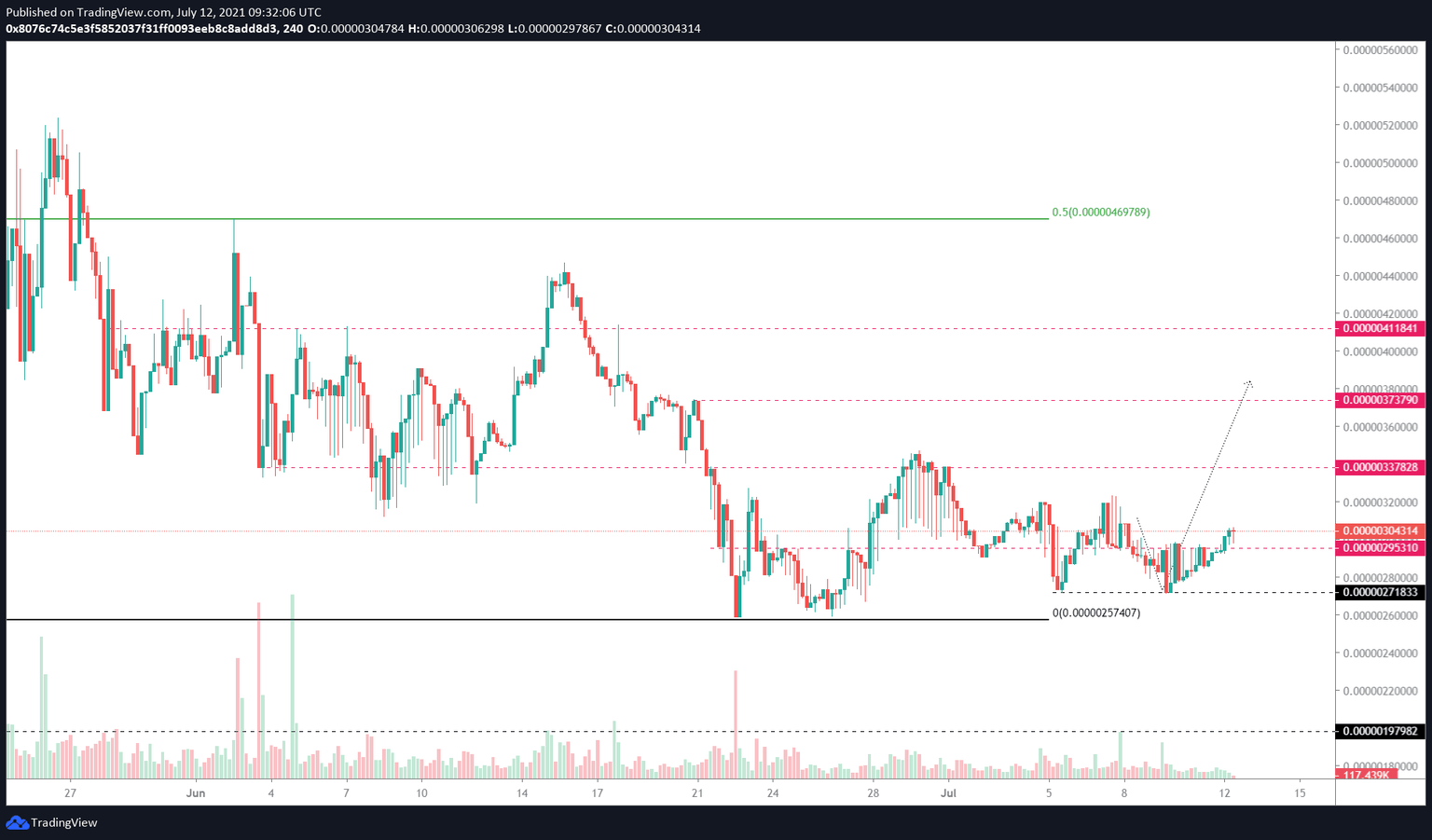

- SafeMoon price has bounced off the critical support level at $0.00000272 and rallied 12%.

- This run-up has breached the $0.00000295 resistance ceiling and shows signs of continuation.

- A 22% ascent to $0.00000374 seems likely, but a breakdown of $0.00000257 will invalidate the bullish thesis.

SafeMoon price is currently hovering above a recently flipped resistance level. A retest of this barrier followed by a rally appears to be likely.

SafeMoon price eyes a higher high

SafeMoon price sliced through the resistance barrier at $0.00000295 and flipped it into a support level. This 12% hike was triggered after SAFEMOON formed an equal low at $0.00000272 on July 9.

The likely course of action for SafeMoon price is a retest of $0.00000295 followed by a resurgence of buyers that pushes it to the immediate supply barrier at $0.00000338. If the bulls shatter this area, the logical target would be $0.00000374, roughly a 22% hike from the current position – $0.00000304.

A close above this level would be a crucial development since it indicates the formation of a higher high after nearly 21 days of a downswing. Such a move might trigger FOMO and catapult SAFEMOON to $0.00000412.

Clearing these levels would open the path for bulls to push the altcoin to retest the range high at $0.00000470.

SAFEMOON/USDT 4-hour chart

While the bullish narrative makes sense, investors should watch for a quick reversal that flips the $0.00000295 support into a resistance level. If this were to happen, market participants could expect a 7% downswing to $0.00000272.

However, if SafeMoon price breaches the range low at $0.00000257, it will invalidate the optimistic outlook, which might trigger a 22% crash to $0.00000198.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.