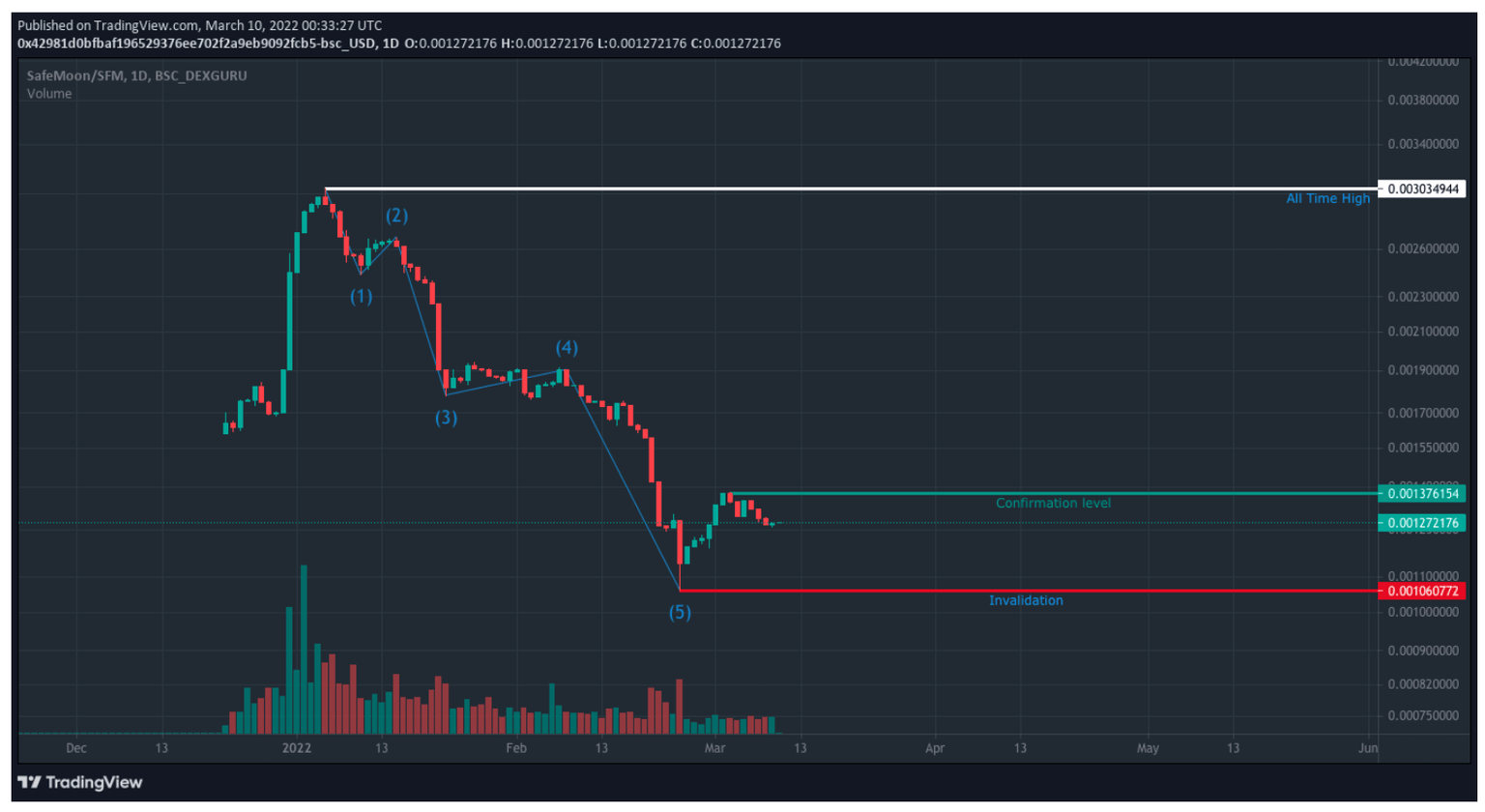

SafeMoon price aims for a 50% recovery to $0.003

- SafeMoon has completed 5 clear impulse waves down.

- Its next retracement target is 50% above the current price.

- A break below $0.00106 will invalidate the bullish thesis.

SafeMoon price action shows potential for a price surge of up to 50%. The altcoin is currently fluctuating 20% above the all-time low of $0.00106.

SafeMoon price bound for a big move

According to Elliot Wave Theory, impulse waves, which come in 5 waves, are followed by 3 corrective wave structures. Since the all-time high of $0.003 was put in on January 5, it is relatively easy to identify five impulse waves down into the all-time low on January 4.

Another rule known amongst Elliot Wave analysts is that corrections usually retrace back into the 4th wave of one previous degree. The 4th wave is currently in the $0.0016 to $0.0018 zone, 50% away from the current price.

SafeMoon Daily Chart

Buying countertrend is very risky, considering how much power bears have had on SafeMoon price. It is essential to remember that a double bottom is a very probable scenario for the digital asset.

Since SafeMoon bulls are only supported by one definitive low, being an early buyer is not advised. The best way to approach this trade is to place a buy-stop above SafeMoon’s current consolidation.

The invalidation for the bullish thesis sits 17% below the current price at the all-time low of $0.00106. If bulls cannot put in a double bottom as support, then future targets for SafeMoon price could be pretty severe. Bears would likely send SafeMoon price somewhere between $0.0001 and $0.0002, a potential 80% drop from the current price.

Author

FXStreet Team

FXStreet