SafeMoon continues to slide south, recovery dependent on Bitcoin’s performance

- SafeMoon price crashes nearly 30% between February 23 and February 24, 2022.

- A modest recovery began but has stalled during the US afternoon trade session.

- SafeMoon’s performance is tied to Bitcoin’s performance.

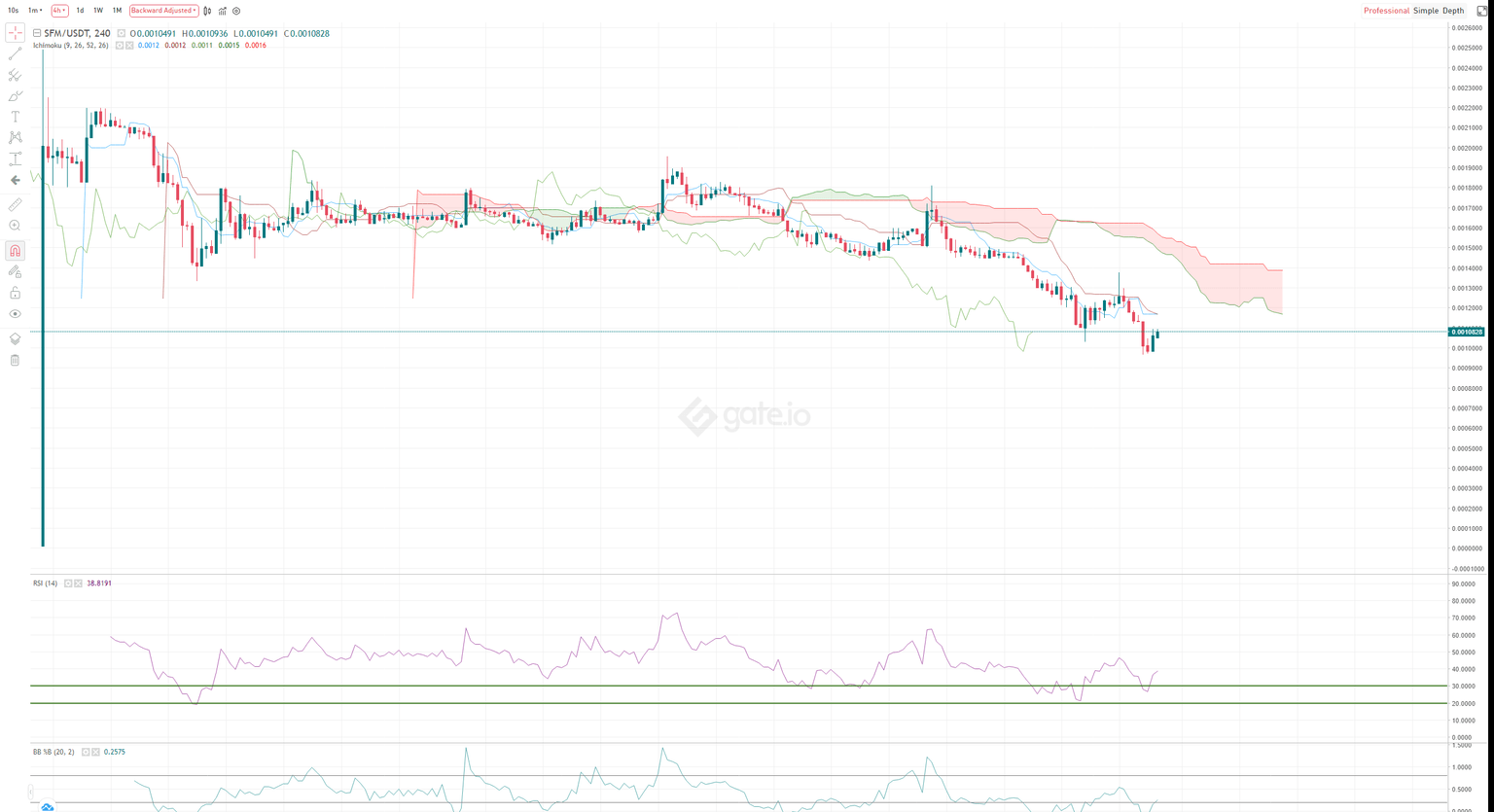

SafeMoon price has made new 2022 lows and pushed below the critical $0.0010 value area into $0.0009. In addition, it continues to trade below all primary Ichimoku levels, indicating further selling pressure ahead.

SafeMoon price must close above $0.0014 to prevent or mitigate further selling pressure

SafeMoon price had one of the most extensive and most severe drops out of the entire altcoin market. The drop was double to triple the losses suffered by other cryptocurrencies. The double-whammy of a pending class-action lawsuit against SafeMoon price and its promoters, along with the Russian invasion of Ukraine, has created a perfect storm of uncertainty.

The Tenkan-Sen and Kijun-Sen share the same price level at $0.0012. Therefore, if bulls wish to deter any further selling pressure, they need to push SafeMoon price to a close above that level.

It is more likely that SafeMoon’s price is contingent on Bitcoin’s moves. The whole cryptocurrency market has seen a gradual decline in aggregate volume and participation every since November 2021. SafeMoon, in particular, has seen a significant drop in participation and interest.

SFM/USDT 4-Hour Ichimoku Kinko Hyo Chart

For a clear beginning of a new bull run, the road is tricky because SafeMoon price would need to close at or above the $0.0016 value area.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.