Russian ruble is now available as a funding currency at Binance

- Binance announced support for Ruble deposits and withdrawals.

- The trading platform discusses potential partnerships with local banks.

The Malta-based cryptocurrency exchange Binance added Russian Ruble (RUB) to the list of fiat currencies that can be used to buy digital assets such as BTC, ETH, and XRP.

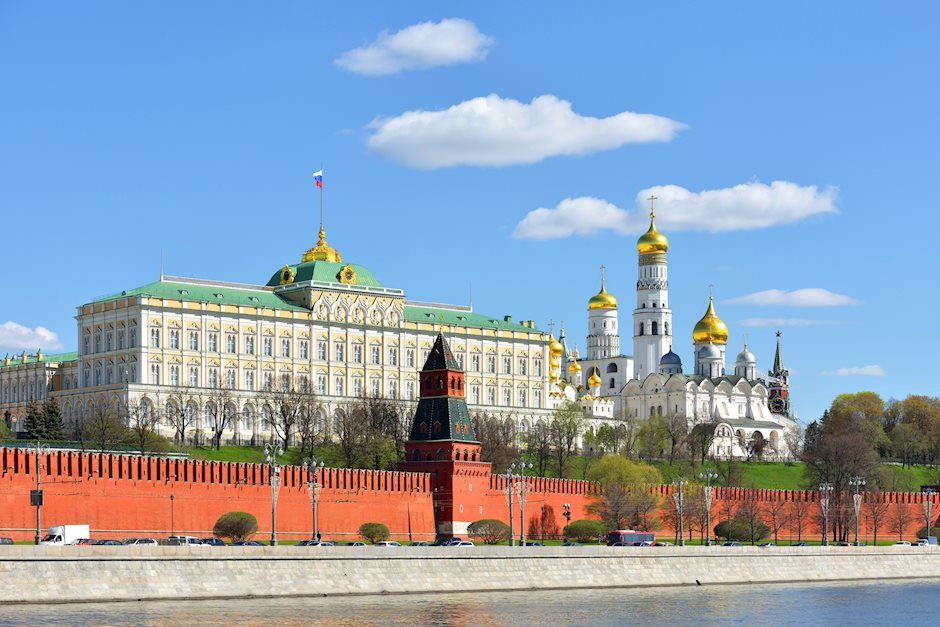

The announcement is made after Binance CEO Changpeng Zhao (aka "CZ") met with Russian users of the cryptocurrency platform at Binance meetup in Moscow that took place earlier this month.

According to Changpeng Zhao, the company plans to open a new office in Moscow to capitalize on the talented human resources of the country.

"There is a very strong programmer talent [here]. On this trip, it is very clear to me that we should look into the developers’ office, not the commercial office, not just yet," he said in the reecent interview with Coindesk.

Cryptocurrency has no legal status in Russia, which means that the company may face regulatory issues on its Russian expansion quest. The country is still waiting for the Digital Assets Law to be adopted by Duma (The lower chamber fo the Russian parliament).

"We’re basically doing what other exchanges are doing here, in Russia. We are discussing with banks, but it’s not official yet. The banks are at a very early stage. Payment services will probably come up first," Changpeng Zhao explained.

Meanwhile, Binance enabled RUB deposits and withdrawals via payment solution provided by Gibraltar-based ADV Project. The platform users can fund their Binance Cash Wallets with the Russian currency to buy Bitcoin (BTC), Ether (ETH), and XRP.

Notably, users can deposit Rubles via credit cards provided that they are issued by a Russian bank. The transaction fee amounts to 3% for deposits and 2.5% for withdrawals.

Author

Tanya Abrosimova

Independent Analyst