XRP on the brink of 27% rally amid surge in crypto ETF filing activities

- XRP shows signs of an uptick as asset managers could send a flurry of XRP ETF filings to the SEC next week.

- The NYSE Arca submitted a 19b-4 for the conversion of Grayscale's XRP Trust to a spot ETF.

- XRP continues consolidation within a bullish pennant amid a potential 27% rally.

Ripple's XRP is up 2% in the Asian session on Friday following the New York Stock Exchange (NYSE) Arca 19b-4 filing with the US Securities and Exchange Commission (SEC) for the conversion of Grayscale's XRP Trust into a spot ETF. The remittance-based token could see a 27% rally in the coming days as issuers will potentially send a flurry of XRP ETF filings to the SEC next week.

Grayscale to convert XRP Trust to spot XRP ETF

The race for new altcoin ETFs in the United States is gaining traction, with asset managers filing for new products with the SEC.

The NYSE Arca filed a 19b-44 for the conversion of the Grayscale XRP Trust to a spot XRP ETF.

“The Sponsors [...] believe that allowing Shares of the Trust to list and trade on the Exchange as an exchange-traded product (“ETP”) (i.e., converting the Trust to a spot XRP ETP) would provide other investors with a way to invest in XRP on a regulated national securities exchange,” the filing states.

Following Grayscale's move, FOX Business Eleanor Terrett noted that most issuers could begin filing for an XRP ETF next week. "Keep an eye out for possibly more filing activity by issuers with $XRP ETF applications next week," wrote Terrett in an X post on Thursday.

Bitwise, Canary Capital, 21Shares, WisdomTree and CoinShares have also filed for XRP ETFs with the SEC. Filings submitted during the old SEC's administration were automatically withdrawn as the agency failed to acknowledge them. Most asset managers are expected to resubmit their filings in the coming days.

If the new SEC administration approves XRP ETF filings, it could signal the end of its four-year legal battle with Ripple and spark a massive rally for the remittance-based token.

XRP continues consolidation within bullish pennant

XRP saw a tiny $1.78 million in futures liquidations in the past 24 hours, per Coinglass data. The total amount of liquidated long and short positions accounted for $842,000 and $941,000, respectively.

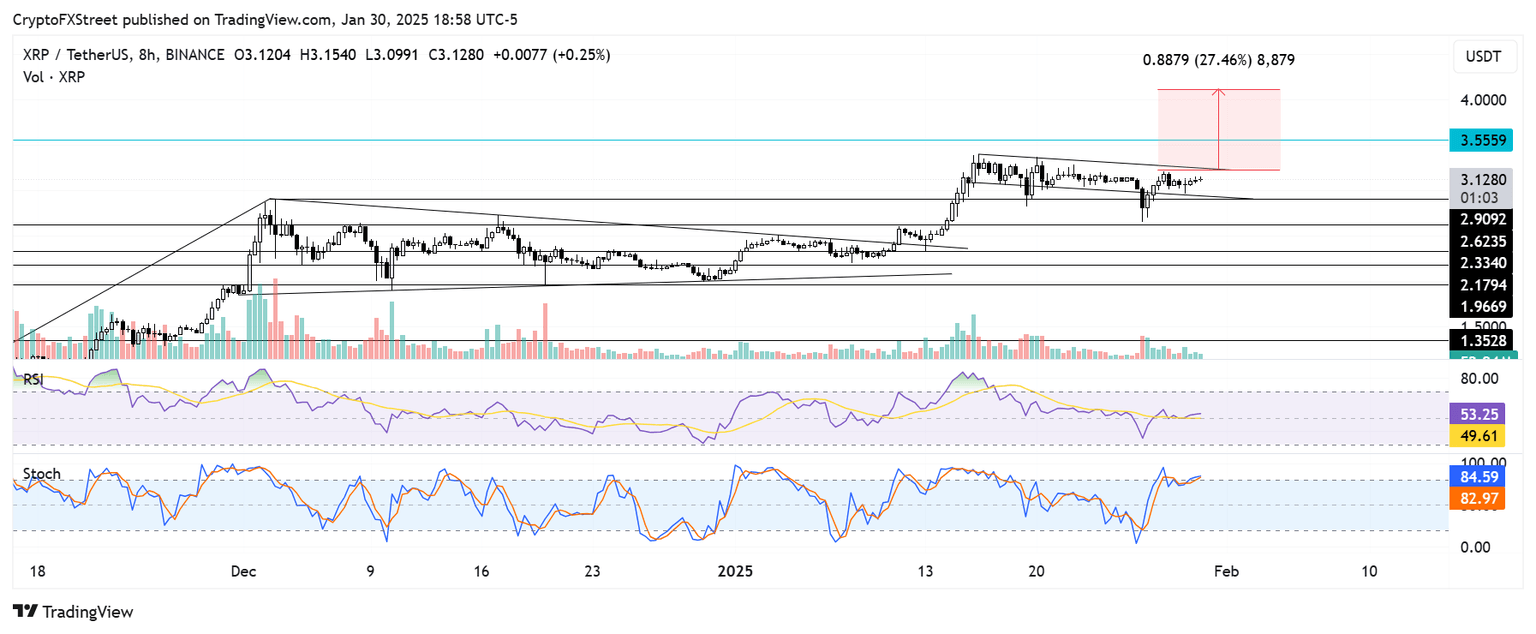

XRP continued its consolidation within a bullish pennant as it’s looking to break the pattern's upper boundary resistance. If XRP can break the resistance and hold it as a support, it could rally 27% to set a new all-time high at $4.10. However, it also has to overcome its all-time high resistance at $3.55 for such a move to materialize.

XRP/USDT 8-hour chart

The Relative Strength Index (RSI) is above its neutral level, indicating bullish momentum is dominant. However, the Stochastic Oscillator (Stoch) is in the overbought region, suggesting a potential reversal could be imminent.

A daily candlestick close below the $2.62 support level will invalidate the thesis.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi