Ripple's XRP Price Forecast 2020: The glimpse of hope

- Ripple (XRP) drab performance in 2019 leaves investors gasping for air and looking forward to a better 2020.

- The 2020 forecast places XRP/USD price above $0.30 with a chance of jumping above $1.0.

- On-Demand Liquidity gains traction with key players like MoneyGram coming on board.

- Ripple's XRP price correlation with Bitcoin is expected to continue in 2020.

The bearish hostility across the cryptocurrency market leaves nothing but scarred faces in its wake. However, as they say, ‘it gets darker just before dawn.’ Besides, Ripple's XRP loss consolidation is beckoning amid sounds of the bullish train approaching the station. In other words, get ready, lest the train aiming for $1.00 in 2020 leaves the station before you arrive. Meanwhile, XRP’s recovery above $0.3 is imminent with a possible higher consolidation.

The festive season is dawning on us. It is time we reviewed how rewarding or demoralizing 2019 was for the cryptocurrency trader, investor and enthusiast. 2019 promised the sky following the end of the 2018’s downtrend in December. The first and second quarters of the year were extremely fruitful for the entire cryptocurrency market. Recovery and remarkable price-performance headlines brightened the cryptocurrency space month-over-month gains until the end of June.

Ripple's XRP price 2019 performance analysis

After hitting yearly lows of $0.2548 on August 31, 2018, XRP significantly recovered to highs, almost hitting $0.80 on September 21, 2018. The recovery was unique to XRP, driven mostly by the Ripple’s 2019 Swell conference. Unfortunately, the losses that followed erased most of the gains, pushing XRP close to 2018.

The cryptocurrency market prices are largely correlated with Bitcoin price action. The largest cryptocurrency hit the ‘bottom’ in December 2018 near $3146 and commenced what came to be the biggest rally BTC had experience in over a year. Ripple's XRP also reacted positively to the market impacted by Bitcoin price action during the first and second quarters of 2019.

The strong bull rally from the beginning of the year saw XRP scale the levels above $0.2, $0.30 as well as $0.4. Further thrust upwards recovered the ground slightly above $0.5 and formed a 2019 high at $0.5139 in June. However, since then, Ripple's XRP has been continuously put between a rock and a hard place. Whereby recovery is limited and the struggle to stay afloat above crucial support levels gets tougher.

Performance in the last six months has seen bulls painfully endure intense battering. For instance, after giving up the support at $0.4 in July, it became challenging for the bulls to sustain XRP above $0.3. Besides, the increasing selling activity across the market in October and November has pushed Ripple against $0.20 crucial support. At the time of writing, XRP is teetering at $0.1969 after testing $0.1960.

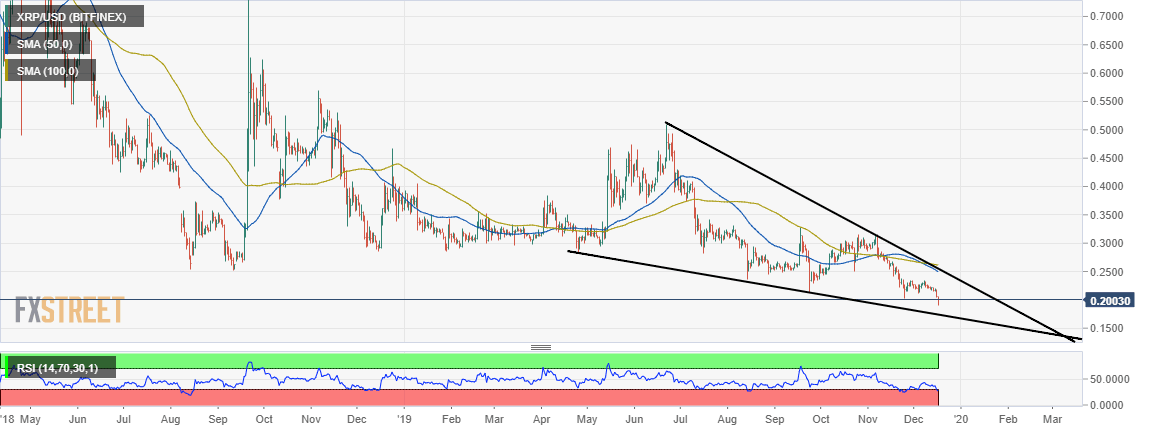

XRP/USD daily chart

Pre-Christmas volatility

Barely a week before Christmas, Ripple's XRP is exploring the lows below $0.20. The third-largest cryptocurrency has not only fallen below its 2019 target but also trading under the lows posted in 2018.

On the contrary, the daily chart shows a few developing positive technical pictures. First, the RSI is oversold, but Bitcoin is ignoring this fact. However, a reversal is in the offing and could have the potential to not only blast XRP above $0.20 but also correct towards $0.30.

Secondly, the formation of the falling wedge pattern hints at a breakout in the coming sessions. XRP bulls will need a catalyst, the right volume and confidence to exceptionally take advantage of the wedge pattern.

Ripple 2019 Development recap

Ripple has had a stellar performance as far as partnerships are concerned in 2019. The San Francisco blockchain-based startup expanded some of its key payment solutions to strategic regions around the world, including Mexico, Brazil, Asia and the Philippines.

RippleNet expands with over 300 customers

In November, Ripple announced that its banking solution that connects commercial banking institutions, RippleNET’s customer base surged surpassing 300 members. Moreover, the platform posted a ten times year-over-year growth in transactions.

Key global banks partnering with Ripple

Ripple has, over the years, signed partnerships with leading banks around the world, including Japan’s SBI Holdings, American Express, Standard Chartered, HSBC, Barclays, the Bank of England (BoE) and the Spanish multinational Santander.

Ripple’s On-Demand Liquidity (ODL): The success story of 2019

During the Swell conference in 2018, Ripple announced the introduction of ODL as the transformation of the xRapid product. ODL leverages Ripple’s native token XRP in support of faster, cheaper and reliable cross-border payments. Ripple has, in less than 12 months, witnessed tremendous growth, with ODL volume hitting a new month-over-month high in Mexico.

ODL has welcomed a significant number of customers, including MoneyGram, Viamericas, goLance, Interbank Peru and FlashFX. ODL customers, according to Ripple, are more than two dozen. Besides, the transactions recorded have grown more than 10x since the levels recorded in the first quarter of the year. Apart from the initial payment corridors in Mexico and the Philippines, ODL has expended to Australia and Brazil. Plans are underway to add new corridors APAC, EMEA and LATAM in 2020. Brad Garlinghouse, Ripple’s CEO, said about ODL:

“This year has been our strongest for Ripple yet. In 2019 we’ve seen continued momentum with customers, growth of RippleNet and adoption of On-Demand Liquidity. In just a year since we launched ODL, we are already making an impact on the bottom line for our customers.”

Alex Holmes, MoneyGram’s CEO, categorically added that:

“One of the core strengths of MoneyGram is our global liquidity and settlement engine that enables our customers to send money in over 200 countries and territories. Our partnership with Ripple has helped us to improve this strength, and we’ve already started seeing the product’s potential to streamline our back-end capabilities.

XRP and regulation

Ripple has particularly struggled with regulation for its XRP cryptocurrency, especially in the United States. The Securities and Exchange Commission (SEC) is torn between categorizing XRP as a security token or leave it to ride along as crypto. However, XRP has gained traction in the United Kingdom, which recently referred to it as crypto, just like Ethereum. Many experts and enthusiasts believe that unclear regulations for the industry are stifling innovation.

“That’s the part (regulatory clarity) that unfortunately is missing and in the U.S. market. It’s still too confusing, too inconsistent. There are just too many question marks and that really hurts innovation”, Ripple’s co-founder Chris Larsen said.

Larsen added that “the best system is going to be one that takes into consideration consumer protection (for the innovators), and also recognize the importance of the job that other regulators (Federal Reserve and Treasury) have.”

Ripple's XRP Price Forecast 2020

Ripple is moving towards a drab start in the new year following a rough ride lasting more than six months. The company, Ripple, has hit incredible milestones, but XRP has been adamant in reaction to the news. For this reason, I think XRP's price action will continue independent of the developments Ripple makes as a company.

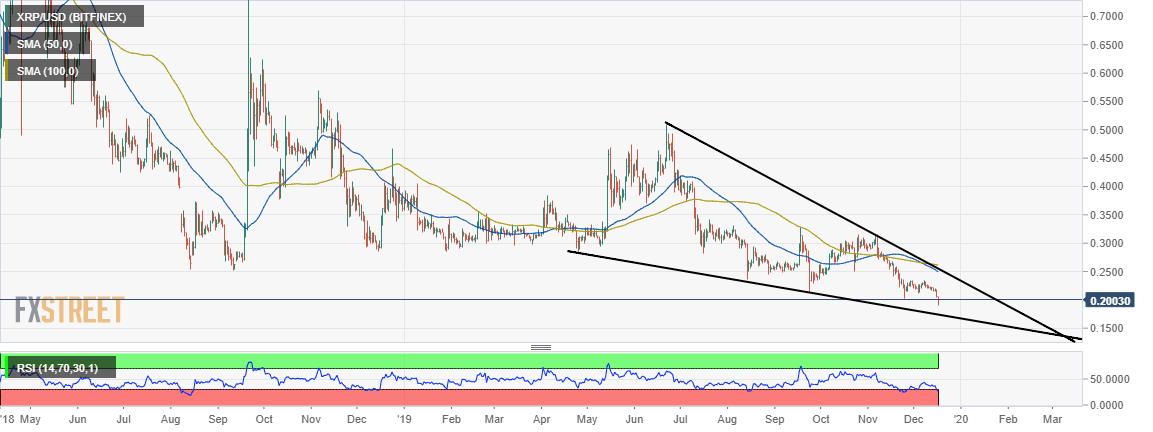

XRP/USD daily chart

Declines across the crypto landscape have characterized the last couple of weeks. XRP bulls have given up the support at $0.20 and the price is dancing at $0.1974. However, the formation of a falling wedge pattern suggests that a recovery will soon come into play in the near future. However, XRP must correct from the short term downtrend first and then shift the focus to $0.30.

Ripple’s price action in 2020 will largely depend on the movement in Bitcoin’s market. For instance, the 2020 Bitcoin halving event is expected to drive the price to highs above $20000. The correlation between the assets will impact XRP into a bullish rally and could pull the price to levels above $1.0. However, I still believe $1.0 is a very conservative price for XRP. Besides, according to D.I.Y Investing, a renowned cryptocurrency trader, XRP has the potential to hit $28 in the next bull cycle:

“Cyclical Time Frames with $XRP. You guys have seen me post this chart before, but now I have added cyclical time frames to paint an even clearer picture. $XRP follows cycles of 6 months to one-year Bull Cycles followed by two year Bear Cycles. 2020 will be the next Bull Cycle: $28.”

Speaking to Master The Crypto, analysts at Exante, a European investment company with an online trading platform, having access to 50+ global markets had these to say:

“The XPR rate in 2019 is very stable compared to other major tokens. It remained in the $0.24-$0.48 range (twofold magnitude of variation), while the ETH and BTC rates varied threefold and fourfold, respectively. XRP is temporarily on the decline, yet with moderate dynamics. In September, it lost 7%, while the overall crypto market lost 15%. Steady rate is a key showing for many investors (especially institutions), so in the long run, they may have a greater interest in XRP than BTC.”

Exante’s analysts also predict that XRP will trade around $0.5 by the end of 2020:

“In the future, the stability factor may boost XRP prices over classic crypto. Predicting asset prices in the volatile crypto market is a daunting task. Think of the Bakkt trade start as an example. That said, I believe XRP will remain in the $0.2-$0.3 range for the next few weeks, possibly rising over $0.5 by the end of the year.”

Final word

The coming year is one that will set the base for the next rally in 2021. Bitcoin halving will start stirring the bull rally towards the end of 2020 and throughout 2021. Therefore, in my opinion, XRP will recover price levels above $3.0 and consolidate between $0.3 and $0.50 for most of 2020. Towards the end of 2020, a bull cycle will blast XRP into new levels above $1.0 while maintaining the focus on $3.0.

Gregor Horvat projects a bearish outlook for Ripple's XRP on his Elliott Wave analysis:

XRP/USD Weekly Log-scale Elliot Wave Analysis

Ripple is moving lower, now reaching some very low price levels, but from an Elliott Wave perspective applied on a Log scale, we think that 2020 can be a decision point regarding a potential new turning point. We see a w-x-y decline right into the current fourth wave support zone.

Related 2020 Forecast Articles

EUR/USD: Lean times soon to turn into flush times for euro dollar

GBP/USD: Pound may continue to fall on hard Brexit deadline

USD/JPY: A journey from trade fears to high-stakes elections

AUD/USD: May the aussie live in interesting times

USD/CAD: Canada and loonie are well positioned but not in control

Gold: XAU/USD bulls likely to remain in control

Crude Oil: WTI bulls to hold their horses despite tighter market, rosier economy

USD/INR: Domestic factors barely support a turnaround for Indian rupee

Bitcoin: BTC, the ultimate store of value

Ethereum: Calm on ETH/USD after the storm is over

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren