- The declines are taking center stage in spite of the Coinbase Pro support for XRP.

- XRP must come out of the bear range to pave the way for sustained upside correction.

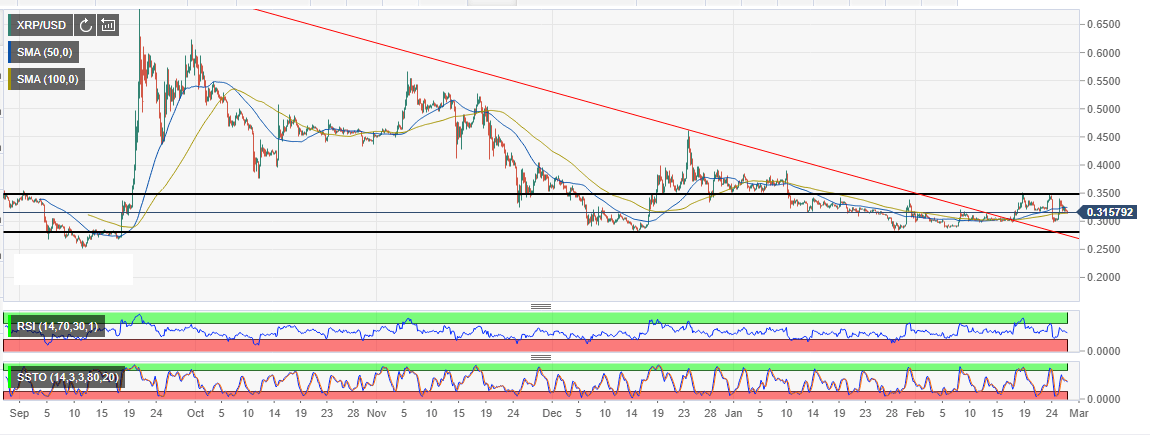

Cryptocurrencies are still drowning in the sea of red rough waters for the third day in a row. Ripple’s XRP is still stuck between the range resistance we discussed yesterday at $0.28 and $0.35. In this current tug of war between the sellers and buyers; the sellers appear to be winning. XRP/USD trends 1.5% lower on the day while valued at $0.3147.

The declines are taking center stage in spite of the groundbreaking news that the largest exchange by adjusted daily trading volume, Coinbase has finally decided to add a buy and sell support for XRP. The news hit the market on Monday 25 via a blog post shared by the company on Twitter. XRP will start trading on Coinbase Pro as soon as the listing process is successfully completed.

Meanwhile, Ripple’s XRP immediate upside is limited by the 50-day Simple Moving Average (SMA) 1-hour chart currently at $0.3271. The downtrend is likely to continue as the Relative Strength Index (RSI) on the same chart at 48.71 continues to head south. The slow stochastic oscillator is showing the same trend at 47.22 to indicate that the bears are gaining traction. XRP must come out of the bear range to pave the way for upside correction towards the psychological $0.40. If the rage support at $0.28 fails to hold, XRP will seek solace at $0.26 supply zone.

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Crypto Today: BTC climbs to $97K, SHIB demand dips, TON lifted by Tornado Cash verdict

Bitcoin price rose 4% on Thursday, breaching the $97,000 mark after opening at $91,947 on Wednesday. Amid the BTC rally, privacy-inclined projects like Monero (XMR) and Toncoin (TON) received a major boost alongside crypto AI coins such as Render (RNDR) and Artificial Super Intelligence Alliance, (FET).

Marathon Digital acquires 700 BTC as Bitcoin reserve strategy gains momentum

Marathon Digital (MARA) has solidified its position as a major corporate Bitcoin holder, acquiring 703 BTC in November, increasing its total to 6,474 BTC.

Paul Atkins tipped to lead pro-crypto shift at SEC

Paul Atkins, a veteran regulator and pro-crypto advocate, is reportedly a top contender to lead the US Securities and Exchange Commission (SEC) under President-elect Donald Trump’s administration.

Dogecoin Price Forecast: Technical indicators show bearish divergence as holders book profits

Dogecoin (DOGE) price hovers around the $0.40 level on Thursday after recovering from a pullback earlier this week. The technical outlook suggests a downward trend for DOGE, as the Relative Strength Index (RSI) shows a bearish divergence in the daily chart, and the Moving Average Convergence (MACD) indicator suggests a selling signal.

Bitcoin: Rally expected to continue as BTC nears $100K

Bitcoin (BTC) reached a new all-time high of $99,419, just inches away from the $100K milestone and has rallied over 9% so far this week. This bullish momentum was supported by the rising Bitcoin spot Exchange Traded Funds (ETF), which accounted for over $2.8 billion inflow until Thursday. BlackRock and Grayscale’s recent launch of the Bitcoin ETF options also fueled the rally this week.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.