- Ripple whales have accumulated over $1.8 billion worth of XRP tokens amid a 200% rise in weekly active addresses.

- WisdomTree filed an S-1 registration with the SEC for an XRP ETF.

- XRP investors across several cohorts realized over $2.7 billion in profits in past three days following heavy Ripple token unlock.

- XRP eyes a new all-time high at $3.57 after sweeping the $2.58 resistance level.

Ripple's XRP continued its rally with a 25% surge on Monday, stretching its monthly gains to over 430%. Following the recent uptrend, the remittance-based token now ranks #3 among top cryptocurrencies despite witnessing a mix of bullish and somewhat bearish investor actions in the past few days.

XRP key updates to watch out for amid recent bullish charge

According to Santiment data, XRP has been seeing heightened buying activity from investors in the past three weeks following its recent surge.

Whales holding between 1M-10M of the remittance-based token bought 679.1 million XRP, now worth ~$1.8 billion. This comes as the non-empty XRP wallets surged above 5.5M for the first time since launch.

XRP investors have also woken up as weekly active addresses on the XRP Ledger increased nearly 200% to 307K in the past month — its highest level since August 2023.

XRP Supply Distribution (1M-10M), Weekly Active Addresses & Holders | Santiment

The bullish view is also evident in XRP Coinbase premium, which showed that US traders have likely been fueling the recent price surge. In November, the exchange's XRP premium ranged from 3% to 13%. However, Upbit, which holds the largest XRP reserve, maintained a moderate premium level.

Meanwhile, asset manager WisdomTree filed an S-1 registration statement with the SEC for an XRP ETF on Monday after an initial registration in the state of Delaware last week. With the latest filings, XRP has joined. Bitwise, 21Shares and Canary Capital.

This follows rumors of the New York government approving Ripple's stablecoin trending across several investment subgroups on social media platform X, with many speculating on how it could fuel the current XRP bull run.

However, market activity hasn’t been all green for XRP. Following the recent price surge over the weekend, XRP investors realized more than $2.7 billion in profits — the highest in the past eight years. This shows despite the recent whale accumulation, investors are increasingly booking profits as they ride the wave.

XRP Network Realized Profit/Loss | Santiment

The Mean Coin Age metric, which measures investors' accumulation/distribution activity, has been trending downwards across all age cohorts. This shows that selling activity has been constant among short-term and long-term investors in the past three weeks.

XRP Mean Coin Ages | Santiment

Additionally, Ripple unlocked 500 million XRP tokens worth over $1.35 billion on Sunday as part of its escrow unlock system. If this supply enters the market immediately, the current bullish momentum will slow down.

XRP bulls could target a new all-time high at $3.57

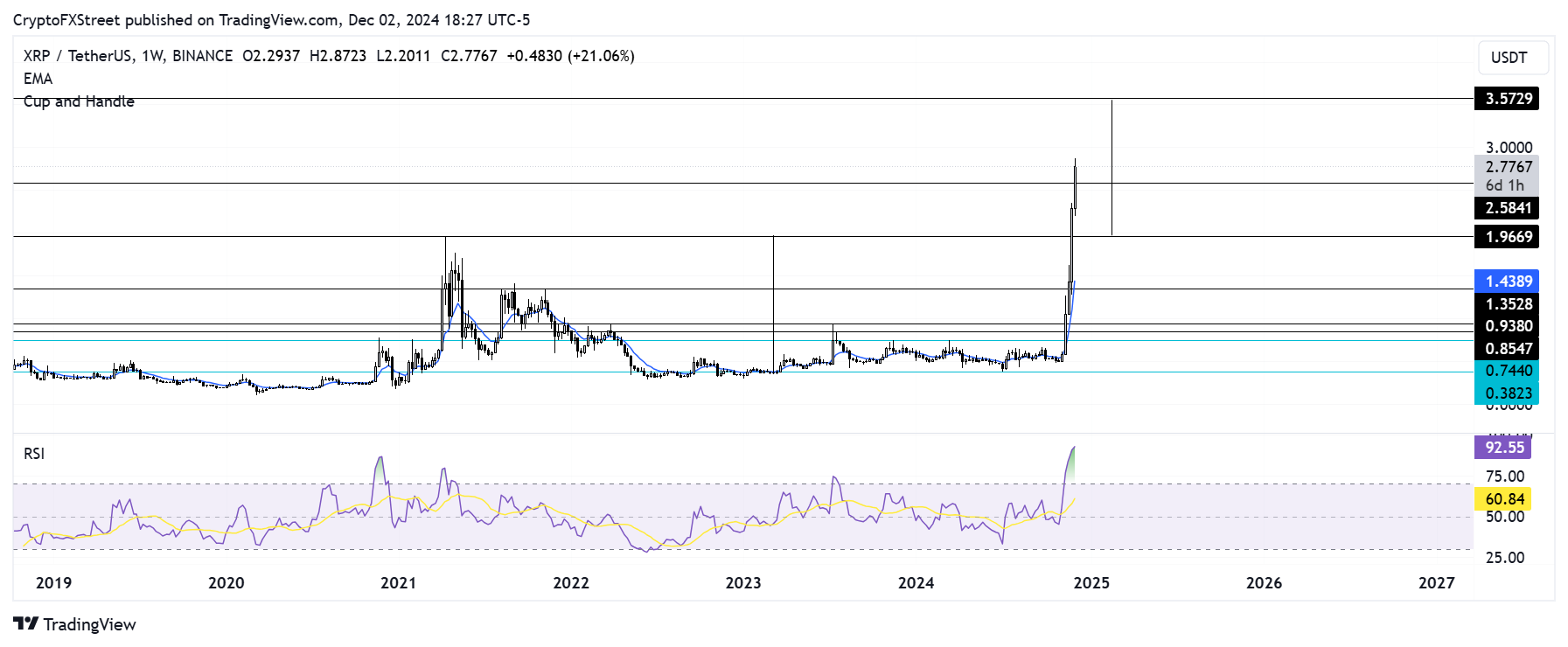

Ripple's XRP smashed the $2.58 resistance on Monday, sparking liquidations of more than $91 million in the past 24 hours, per Coinglass data. Liquidated long and short positions accounted for $38.67 million and $52.47 million, respectively.

XRP/USDT weekly chart

If XRP maintains the uptrend above the $2.58 level, it could rally as high as $3.57 to complete the maximum profit target of a rounded bottom pattern. The remittance-based token validated the pattern after rallying above the $1.96 level last week.

The bullish momentum is strengthened by XRP futures open interest (OI) surge to a new all-time high of $4.24 billion on Monday.

Open interest is the total amount of outstanding contracts in a derivatives market. An increase in OI during a price uptrend signifies new money is coming into the market in support of the bullish momentum.

XRP Open Interest | Coinglass

The Relative Strength Index (RSI) has remained at elevated levels in the oversold region in the past week, indicating a correction is imminent due to overheated prices.

A weekly candlestick close below $1.96 will invalidate the bullish thesis.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin rebounds as South Korea martial law proves short-lived

Bitcoin recovers slightly, trading above $96,000 on Wednesday, after its recent dip on Tuesday due to the political strife in South Korea. With the crisis seeming to be mostly over, BTC recovered more as the reversal of the martial law restored confidence in crypto markets.

Curve DAO price surges above $1, highest level since April 2023

Curve DAO extends gains by more than 30% on Wednesday, rallying 70% so far this week and reaching levels not seen since April 2023. On Tuesday, the announcement of CRV’s scrvUSD stablecoin launch on the Spectra ecosystem fueled the ongoing rally.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Cryptomarket stabilizes after South Korea reverses martial law

Bitcoin hovers near $95,700 on Wednesday, signaling potential weakness as technical indicators suggest a decline, while Ethereum and Ripple stabilize near key levels, hinting at a possible rally following South Korea's reversal of martial law.

Ripple's XRP sees over $4 billion in profit-taking following surge in whale activity

Ripple's XRP is down 5% on Tuesday after news of South Korea declaring martial law sparked a surge in selling activity and significant profit-taking among investors. However, whales have stepped up buying pressure as the remittance-based token looks to stage a recovery.

Bitcoin: A healthy correction

Bitcoin (BTC) experienced a 7% correction earlier in the week, dropping to $90,791 on Tuesday before recovering to $97,000 by Friday. On-chain data suggests a modest rebound in institutional demand, with holders buying the dip. A recent report indicates BTC remains undervalued, projecting a potential rally toward $146K.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.

%20[00.25.15,%2003%20Dec,%202024]-638687814960789599.png)

%20[00.26.34,%2003%20Dec,%202024]-638687816442403868.png)

%20[00.26.28,%2003%20Dec,%202024]-638687817110360896.png)