Ripple's XRP could rally 50% following renewed investor interest

- Ripple’s XRP has risen nearly 20% following a 75% growth in its futures open interest.

- Options traders could defend the $0.72 level as a large pool of call options is concentrated on that price.

- XRP could rally nearly 50% if it breaks above the neckline resistance of an inverted head and shoulders pattern.

Ripple's XRP rallied nearly 20% on Tuesday, defying the correction seen in Bitcoin and Ethereum as investors seem to be flocking toward the remittance-based token. On the technical side, XRP could rally nearly 50% if it sustains a firm close above the neckline resistance of an inverted head and shoulders pattern.

XRP open interest spikes amid 20% rise

XRP has seen the highest gains in the top ten cryptocurrencies by market capitalization after Dogecoin in the past 24 hours. While Bitcoin, Ethereum, and Solana struggled to post gains on Tuesday, XRP rose by nearly 20%, suggesting renewed investor interest.

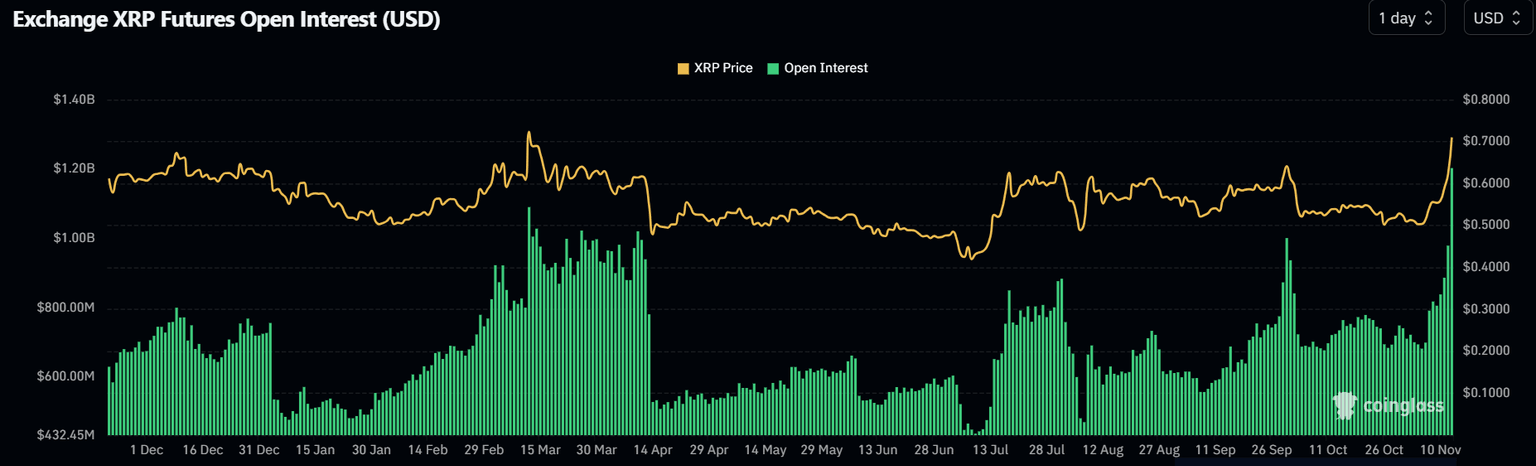

The optimism among investors is visible in XRP's futures open interest, which has surged by over 75% from $681 million on November 5 to over $1.2 billion on November 12.

XRP Open Interest | Coinglass

Open interest (OI) is the total number of outstanding contracts in a derivatives market. When OI grows alongside prices, it indicates an influx of new capital from investors to support the price uptrend.

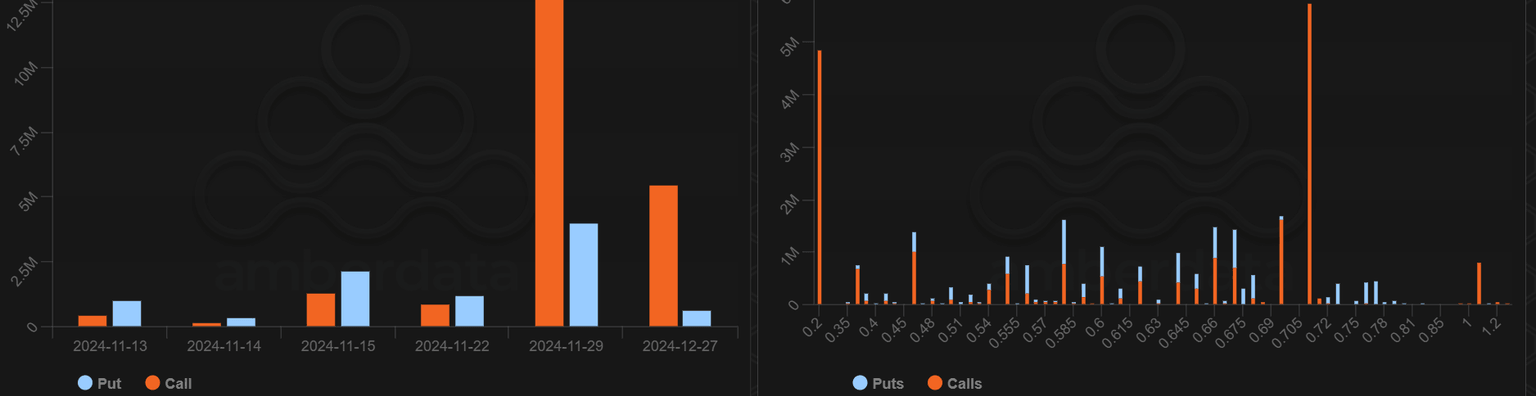

A similar bullish trend is visible in XRP's options market on the Deribit exchange. According to Amberdata, 5.6 million call contracts are concentrated on the $0.72 strike price at the November 29 expiry.

XRP Options data | Amberdata

Call options are contracts that give an investor the right to buy an asset at a predetermined price within a specific timeframe. Traders buying call options at the $0.72 strike price indicate expectations that prices will rise beyond this level on or before the November 29 expiration. Hence, the huge pool of call traders is incentivized to defend this price level.

Ripple Price Forecast: XRP could rally 50% if it overcomes key resistance

Ripple's XRP is trading near $0.7300 after recording $21.38 million in liquidations in the past 24 hours. Liquidated long and short positions accounted for $14.37 million and $7.01 million, according to Coinglass data.

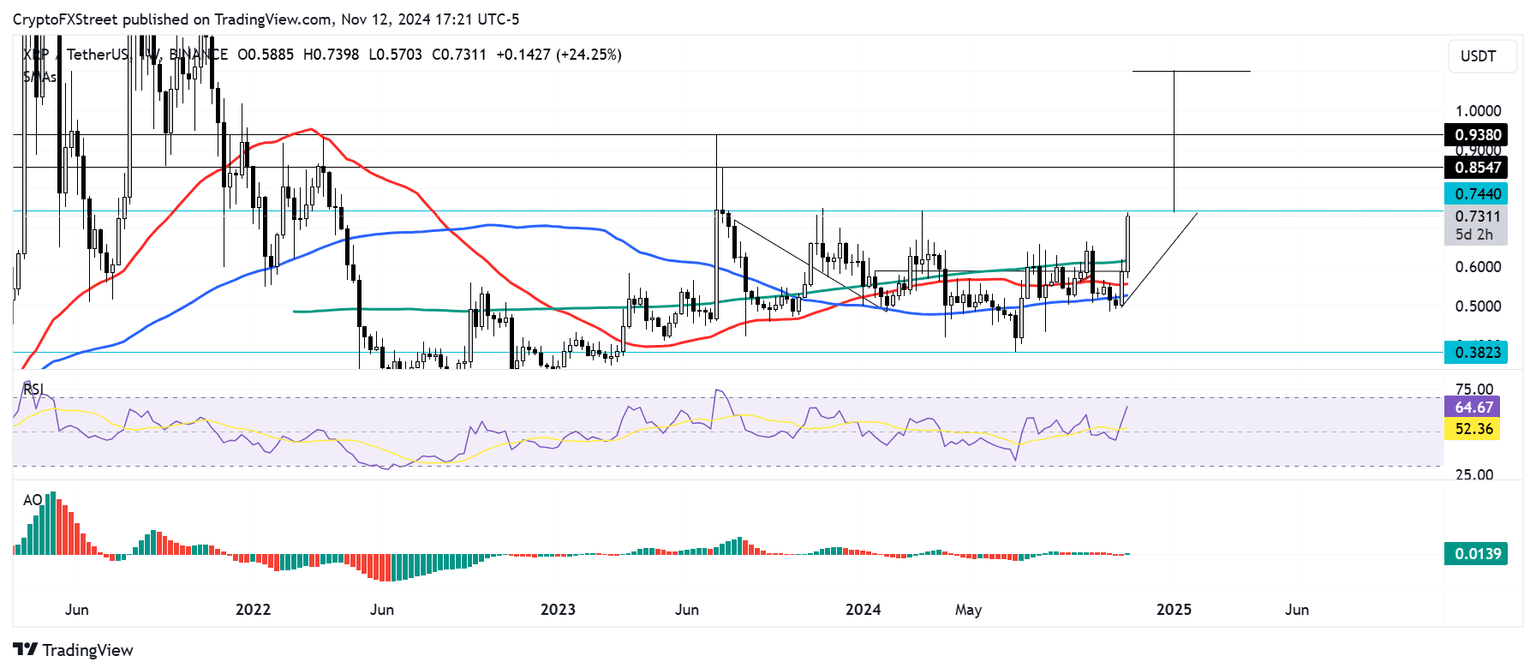

On the weekly chart, XRP is showing signs of a massive breakout after breaking above the 100-day Simple Moving Average (SMA) and testing the neckline resistance of an inverted head and shoulders pattern.

XRP/USDT weekly chart

This neckline resistance at $0.7440 is also its yearly high resistance. If XRP sustains an extended breakout above this level, it could rally nearly 50% to a three-year high of $1.100, last seen in November 2021.

On its way up, the remittance-based token must overcome the $0.8547 and $0.9380 key resistance levels to complete the potential 50% rally.

The Relative Strength Index (RSI) and Awesome Oscillator (AO) are above neutral levels, indicating rising bullish momentum.

A daily candlestick close below $0.4893 will invalidate the bullish thesis.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi