Ripple’s legal counsel takes shot at SEC while XRP price scrambles to find support

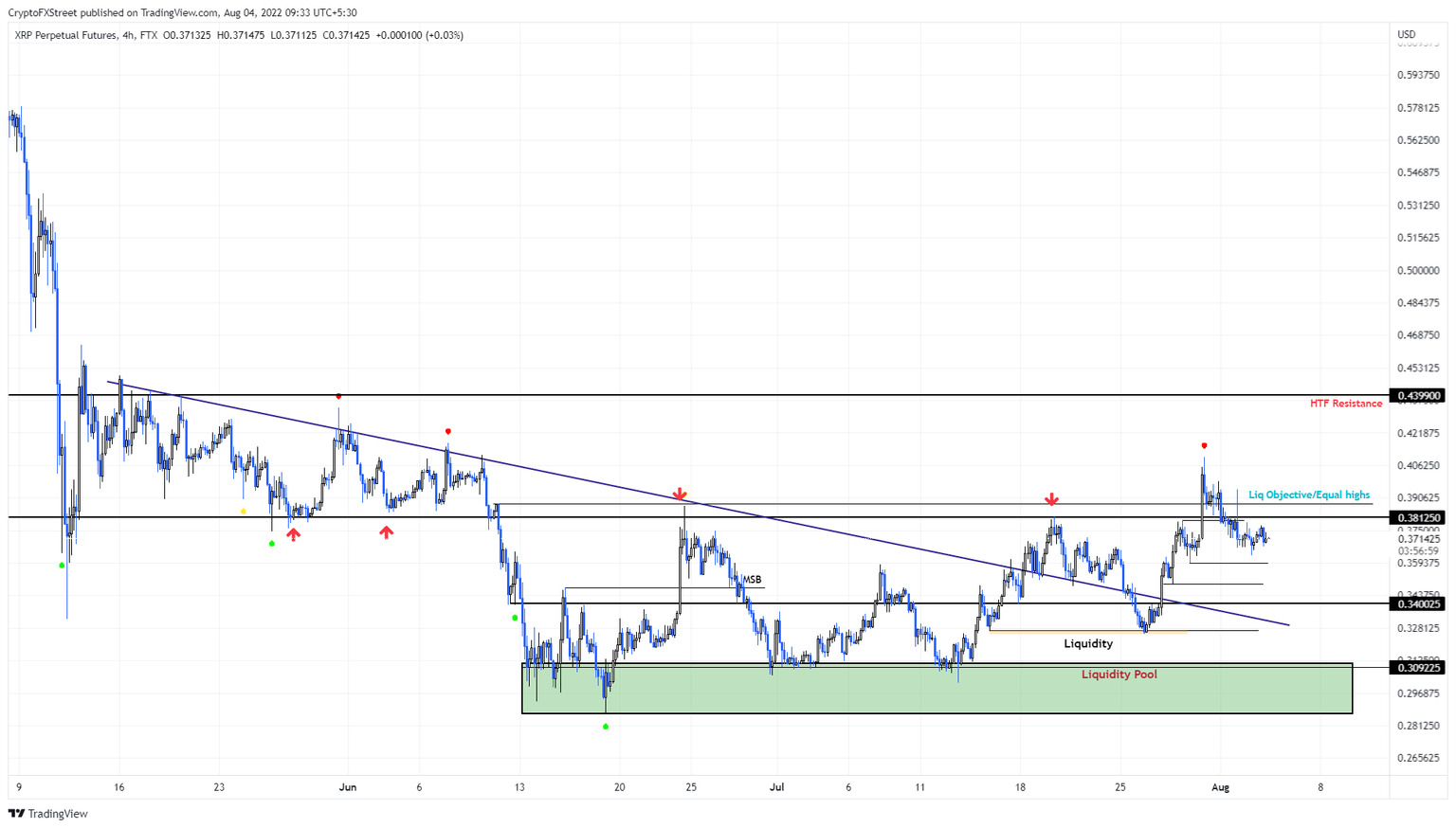

- XRP price shows no signs of slowing down after failing to stay above the $0.381 support level.

- This development has left the remittance token to find a harbor at $0.359, $0.349 or $0.340.

- A daily candlestick close above the $0.381 level will invalidate the bearish thesis.

XRP price remains at the mercy of the outcome of the lawsuit between the SEC and Ripple. While Ripple is fighting to get its hands on the former director of US Securities & Exchange Commission (SEC) William Hinman’s 2018 speech, the SEC is trying to shield it by crying “attorney-client” privilege.

As the ruling hangs in balance, Ripple’s legal counsel Stuart Alderoty took shots at the SEC on Twitter.

The SEC argued in LBRY: "Even if a fraction of people" buy a token for "investment purposes, you’re in securities land." Does every jeweler now book a one way ticket to "securities land" because a "fraction" of their customers are “investing” in the oldest commodity - gold?! 1/3

— Stuart Alderoty (@s_alderoty) August 3, 2022

He further added,

the regulators are attacking the projects to expand jurisdiction beyond “securities” by telling judges w/a straight face we’re the government so we must be right. Time for the industry to lock arms and defend this overreach together.

On the other hand, XRP price and its lackluster performance could see it slide lower before any meaningful upswing originates.

Ripple price lacks momentum

Ripple price failed to sustain its explosive move above the $0.381 and $0.387 resistance levels. This lack of momentum resulted in XRP price sinking lower to where it is currently trading to find a stable support level.

This down move is likely to continue before XRP price sweeps the $0.359 or $0.349 levels for liquidity. Here, bulls have a chance to make a comeback. However, failing at this point could send the remittance token back to the $0.340 support level.

The best case scenario is for buyers to step in and take control, triggering another attempt to move beyond $0.381.

XRP/USD 4-hour chart

While things are looking overall bearish for Ripple price, a move above the $0.381 barrier will confirm a resurgence of buying pressure. A flip of this level into a support floor will invalidate the bearish outlook and trigger a potential move up to $0.439.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.