Ripple’s CEO addresses SEC’s allegations while XRP regains lost ground

- Brad Garlinghouse, CEO of Ripple has made a public statement on Twitter regarding the SEC allegations

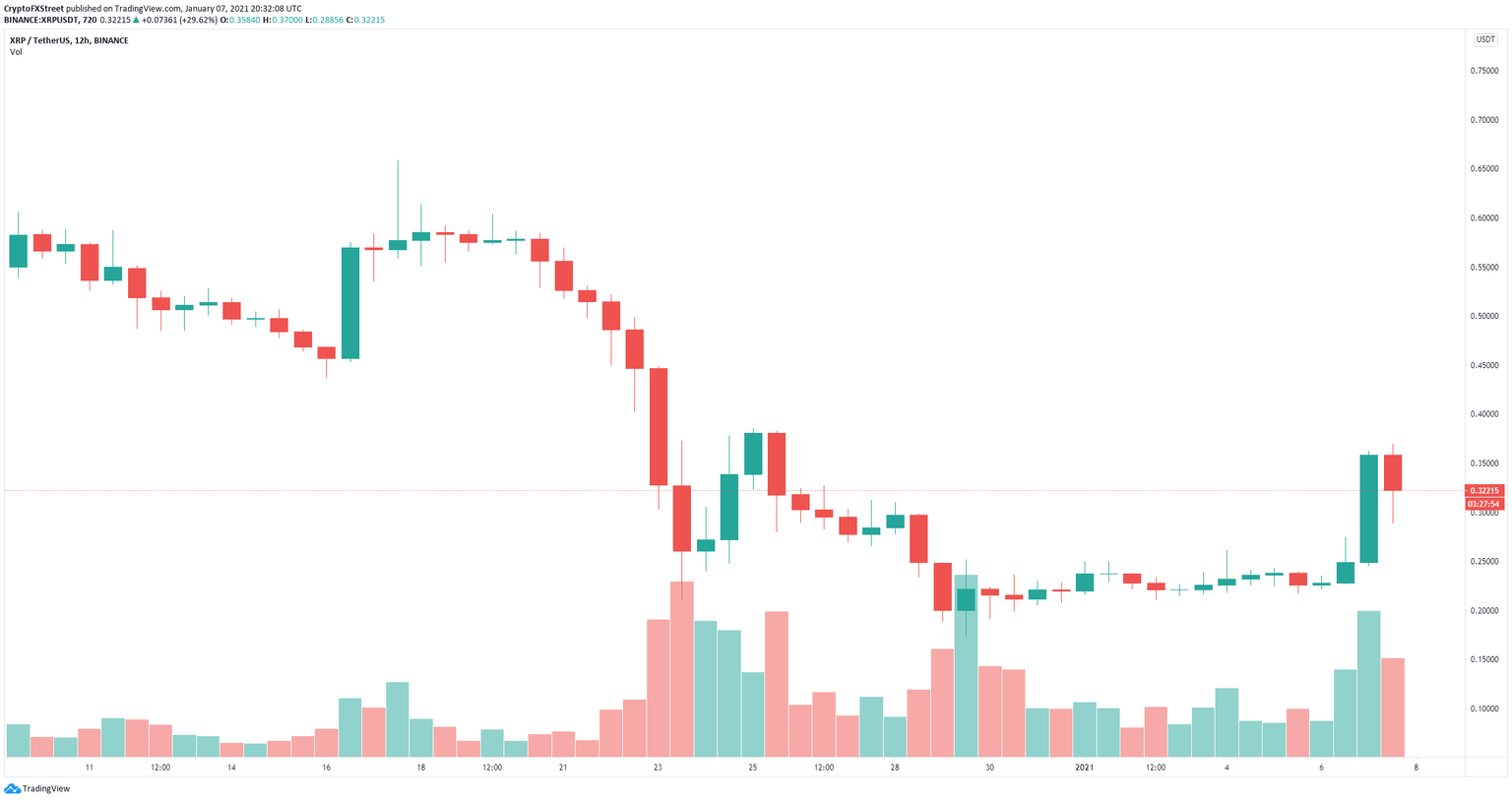

- XRP price already jumped by more than 30% in the past 24 hours hitting $0.369.

Brad Garlinghouse, the CEO of Ripple, issued a public statement on Twitter stating that although he can't talk about everything, he will address five key questions that he considers common among investors.

Garlinghouse states that Ripple did try to settle with the SEC and will try again now that the new administration is in place. Garlinghouse also explains that Ripple didn't pay most exchanges to list XRP as it is one of the most liquid and traded cryptocurrencies in the world. The CEO argues that Ripple has no control over most exchangs.

Additionally, Garlinghouse has also explained that although it might look like nothing is being done, a lot is happening behind the scenes. The legal process with the SEC has been rumored to last even until the end of 2021 and Garlinghouse has fueled those rumors stating that the process can be slow and that Ripple's initial response will be filled within the next few weeks.

And that’s what I have for you today! No one is being silent, nor will we give up this fight. We’re on the right side of the facts and of history, and look forward to our day in court - as well as engaging with the new SEC leadership once appointed. 10/10

— Brad Garlinghouse (@bgarlinghouse) January 7, 2021

XRP price jumps 50% but gets rejected at $0.37

Before Garlinghouse's statement on Twitter, XRP price was breaking out and sliced through several resistance levels on the 12-hour chart. Unfortunately, after peaking at $0.37, the digital asset plummeted down to $0.2885 and it's now trading at $0.32.

XRP/USD 12-hour chart

It's unclear if XRP bulls have enough strength to keep the digital asset above $0.30 as it seems Stellar is taking its place slowly.

Author

FXStreet Team

FXStreet