XRP price spikes with increase in capital inflow from institutional investors

- Ripple XRP funds saw $0.5 million in inflows this week, marking the sixteenth consecutive week of institutions pouring capital in the altcoin.

- The total assets under management for XRP funds has climbed 127% since the beginning of 2023.

- Ripple's partial victory implies $728 million worth of institutional sales contracts constitute unregistered securities sales.

Ripple investment products have witnessed an increase in the inflow of capital from institutional investors. While the crypto market remains largely Bitcoin dominant, XRP funds have seen $0.5 million in inflows this week, marking nearly four consecutive months of inflows in Ripple-based investment products.

Capital injection by institutional investors is typically considered bullish for an asset. Ripple’s partial win against the US Securities & Exchange Commission (SEC) emerged as a bullish catalyst for the asset and related funds.

Ripple funds receive capital inflows for sixteenth consecutive week

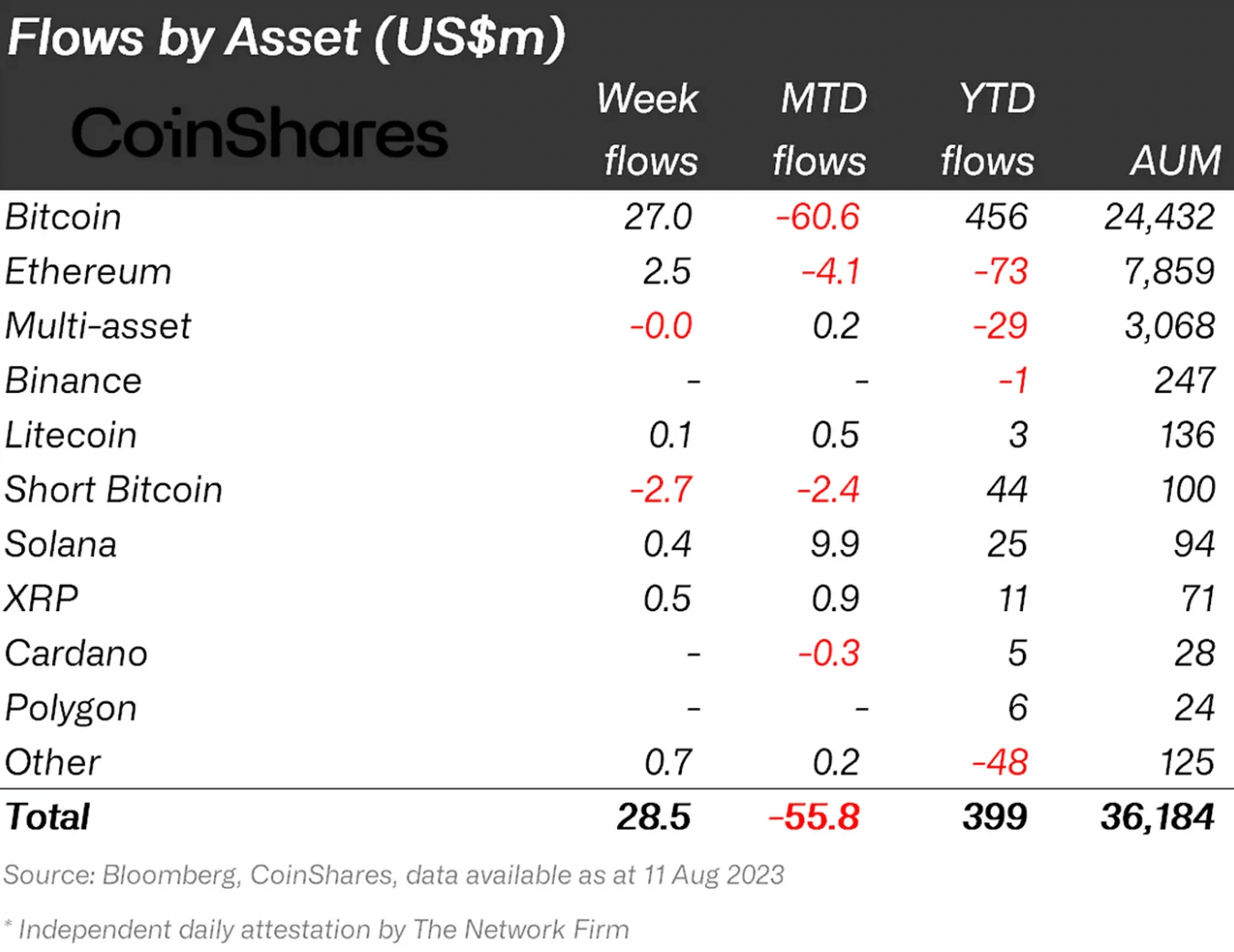

Based on data from cryptocurrency Exchange Traded Products (ETP) company CoinShares, institutional investors moved $29 million into digital asset investment products last week. CoinShares analysts say this move is likely due to the recent US inflation data coming in below market expectations.

The macroeconomic developments have made a September rate hike less likely, thereby fueling enthusiasm among investors. XRP saw $0.5 million in inflows, marking nearly four consecutive months of capital flowing into related funds.

The assets under management (AUM) for XRP funds have increased 127% since the beginning of 2023.

Fund flows by assets as seen in the CoinShares report

XRP funds have received a total of $11 million in inflows since the beginning of 2023, owing to various catalysts, including Ripple’s partial win against the SEC, XRPLedger’s partnerships with payment firms and financial institutions, and rising adoption of the altcoin.

In response to Ripple’s partial victory against the SEC, several cryptocurrency exchange platforms, including Gemini, relisted the altcoin and cited regulatory clarity. These catalysts have driven inflows to XRP funds.

It's important to note that despite the future of $728 million worth of institutional XRP sales contracts hanging in constituting unregistered securities, the ruling is being interpreted as positive.

At the time of writing, XRP price is $0.6294 on Binance. The altcoin is in a multi-month uptrend that started in the beginning of 2023.

Cryptocurrency prices FAQs

How do new token launches or listings affect cryptocurrency prices?

Token launches like Arbitrum’s ARB airdrop and Optimism OP influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

How do hacks affect cryptocurrency prices?

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

How do macroeconomic releases and events affect cryptocurrency prices?

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence risk assets like Bitcoin, mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

How do major crypto upgrades like halvings, hard forks affect cryptocurrency prices?

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs. This has been observed in Bitcoin and Litecoin.

Like this article? Help us with some feedback by answering this survey:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.