Ripple whales buy 300 million XRP in two days, altcoin holds steady above key support

- Ripple whales holding between 10 million and 100 million XRP tokens have accumulated the altcoin in the past two days.

- XRP whales added 300 million tokens between July 12 and 15, per Santiment data.

- XRP extended gains by nearly 3% on Monday, trades above $0.5300.

Ripple (XRP) noted the highest weekly gains in 2024 over the weekend as XRP holders celebrated the one-year anniversary of Judge Torres’ ruling in the SEC vs. Ripple lawsuit. XRP rallied to a peak of $0.5661 on Saturday, July 13.

The altcoin extended gains by nearly 3% on Monday and trades at $0.5333 at the time of writing.

Daily digest market movers: Ripple whales buy 300 million XRP in two days

- Data from on-chain intelligence tracker Santiment shows that Ripple’s large wallet investors added 300 million XRP to their holdings between July 12 and 15.

- The accumulation of the altcoin by whales is typically considered bullish for an asset, therefore, it supports a thesis of further gains in XRP.

- While the cohort of large wallet investors holding between 10 million and 100 million tokens added 300 million XRP, another cohort holding between 100,000 and 1 million XRP accumulated 10 million tokens in the same timeframe.

XRP supply distribution

- XRP army or the traders holding the altcoin celebrated the one-year anniversary of Judge Analisa Torres’ ruling that XRP is not a security in its secondary market sales.

- XRP Army celebrates first anniversary of Judge Torres ruling, XRP rallies 10%

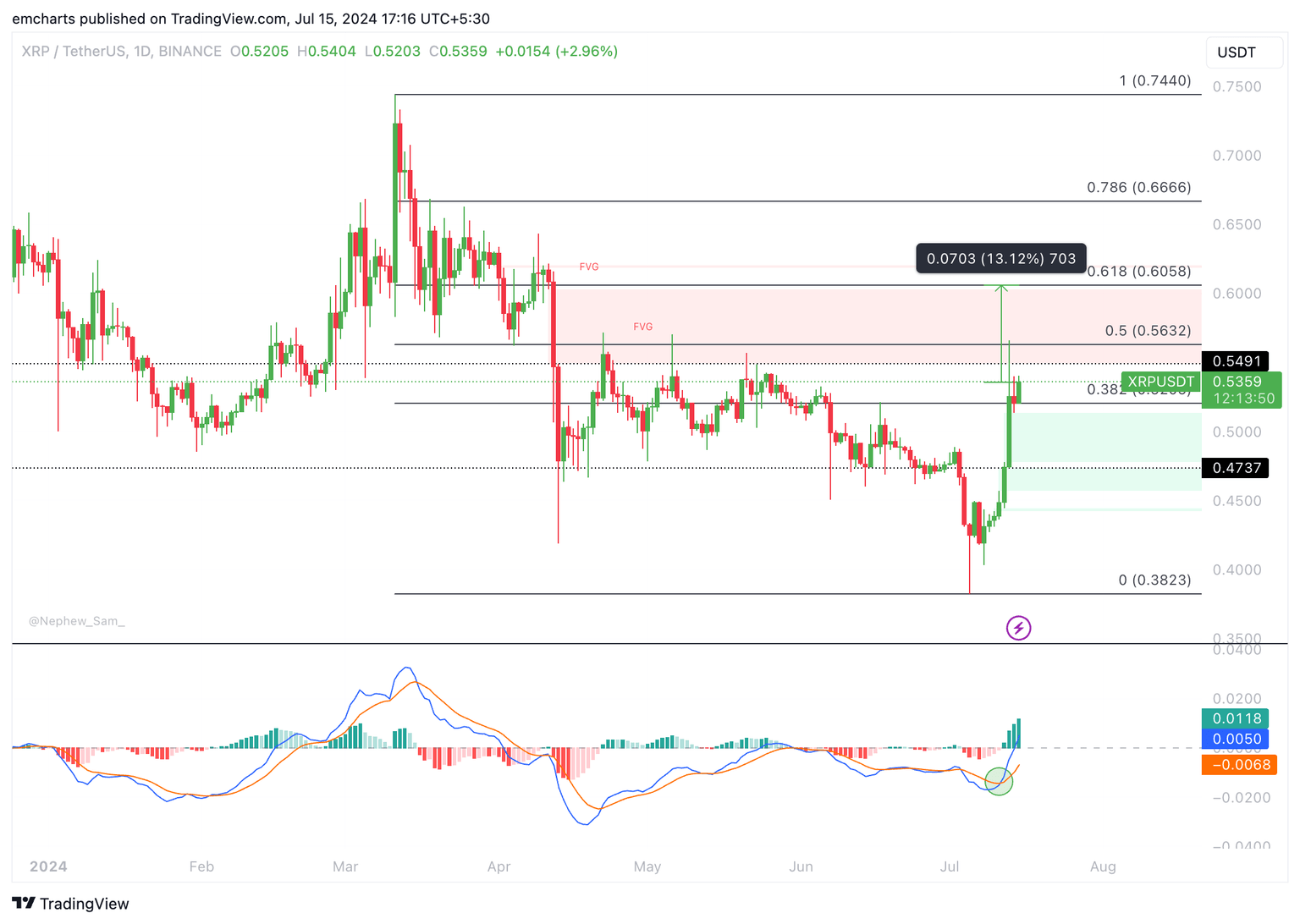

Technical analysis: XRP could extend gains by 13%

XRP trades around $0.5330 on Monday, July 15. XRP Ledger’s native token erased losses from May 26 and sustained above the key psychological support at $0.50.

The momentum indicator, the Moving Average Convergence Divergence (MACD), supports the recent gains and flashes green histogram bars above the neutral line. It is a sign that the underlying momentum in XRP price trend is positive.

XRP could extend gains by another 13% and rally to $0.6058, the 61.8% Fibonacci retracement of the decline from the March 11 top of $0.7440 and the July 5 low of $0.3823.

XRP/USDT daily chart

A daily candlestick close under $0.5205 could invalidate the bullish thesis. XRP could then find support at the July 12 high of $0.4870, the lower boundary of a Fair Value Gap (FVG) in the chart above.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.

%2520%5B17.04.51%2C%252015%2520Jul%2C%25202024%5D-638566441630846036.png&w=1536&q=95)