XRP sustains above $0.51, eyes further gain as whales accumulate Ripple tokens

- Ripple whales, holding between 1 million and 10 million XRP, continued accumulating in May.

- XRP holders digested the developments in the SEC vs. Ripple lawsuit and await court rulings.

- XRP is likely to extend gains to $0.60, testing resistance at $0.51 on Thursday.

Ripple (XRP) is being accumulated by large wallet investors as XRP holders await a court ruling in the Securities and Exchange Commission’s (SEC) lawsuit against the firm. The altcoin’s accumulation by whales is a positive sign for XRPLedger’s native token.

XRP price sustained above $0.51 on Thursday, likely to extend gains to the psychologically important resistance level of $0.60.

Daily Digest Market Movers: Ripple Whales buy 60 million XRP in May

- Ripple whales holding between 1 million and 10 million XRP have added 60 million tokens to their holdings in May, as seen on crypto intelligence tracker Santiment.

- Typically, whale accumulation is considered bullish for an asset, XRP price could rally in response to the rising buying pressure from market participants.

XRP price vs. XRP holdings of wallets that own 1 million to 10 million coins

- Santiment data shows that XRP holders have realized losses on their holdings in the past week.

- XRP traders have realized nearly $30 million in losses between May 7 and 15, which could be considered a sign of capitulation and a precursor to a recovery in the altcoin’s price. The Network Realized Profit/Loss metric helps identify the net profit/loss of all coins moved on a particular day on-chain.

XRP Network Realized Profit/Loss

- The two indicators point towards gains in XRP price.

- XRP holders are awaiting a ruling in the SEC vs. Ripple lawsuit after the two sides completed filing of their briefs, replies and opposition in the remedies-phase.

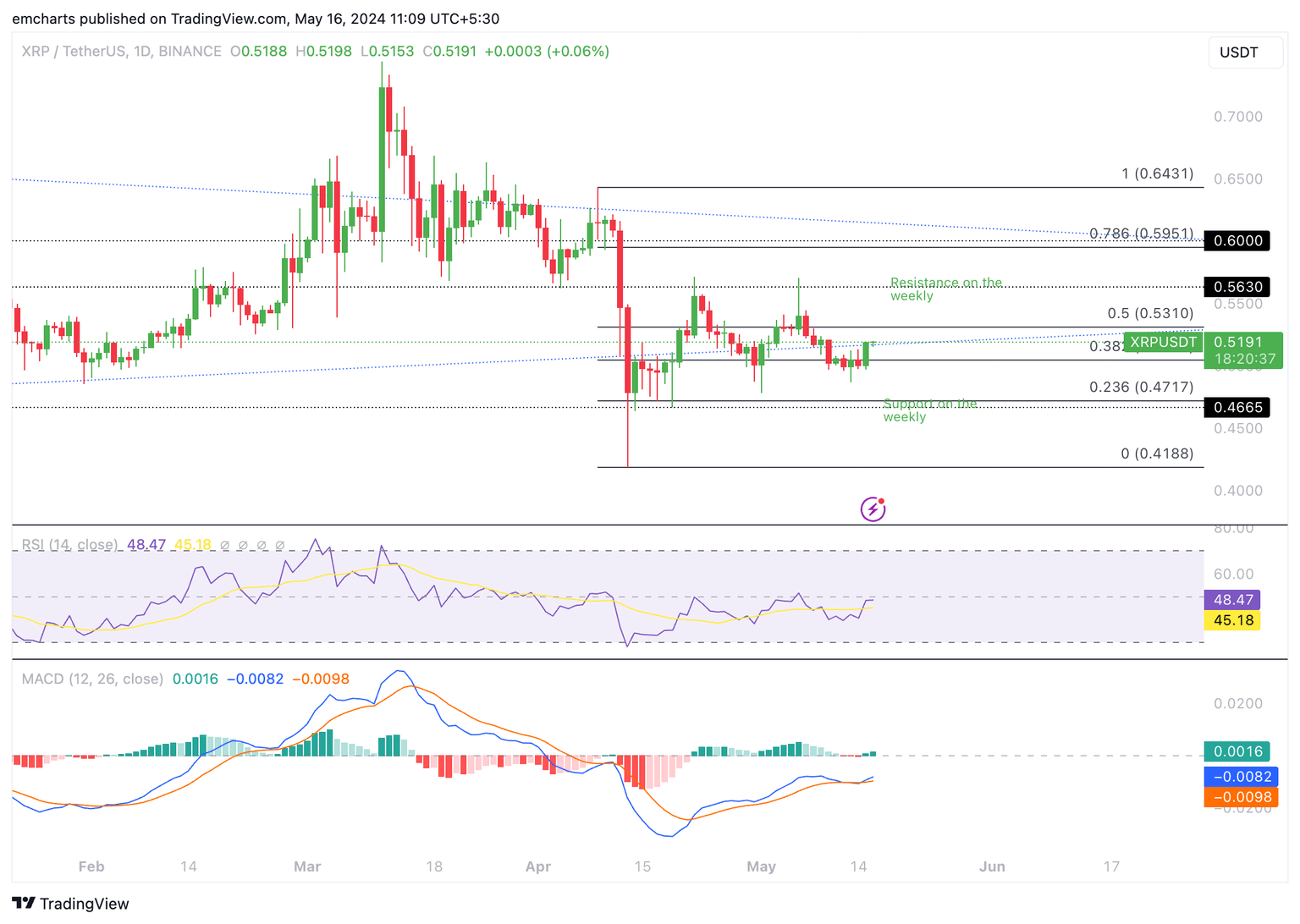

Technical analysis: XRP could test resistance at $0.60

On the 4-hour and 1-day timeframes, the XRP/USDT chart shows signs of recovery in the altcoin. Ripple has sustained above $0.51 on Thursday and is likely to test resistance at the psychologically important $0.60 level.

XRP faces resistance at $0.5310 and $0.5951, the 50% and 78.6% Fibonacci retracement levels of the decline from the April 9 top of $0.6431 to the April 13 bottom of $0.4188.

The green bars above the neutral line on the Moving Average Convergence Divergence (MACD) indicator support XRP gains. RSI, a momentum indicator, reads 48.47, inching closer to the neutral zone at 50, signaling an increasing balance between bullish and bearish positions.

XRP/USDT 1-day chart

If the XRP price fails to break past resistance at $0.53, the altcoin could sweep liquidity at $0.4665, a support level respected on the weekly XRP/USDT chart.

SEC vs Ripple lawsuit FAQs

It depends on the transaction, according to a court ruling released on July 14: For institutional investors or over-the-counter sales, XRP is a security. For retail investors who bought the token via programmatic sales on exchanges, on-demand liquidity services and other platforms, XRP is not a security.

The United States Securities & Exchange Commission (SEC) accused Ripple and its executives of raising more than $1.3 billion through an unregistered asset offering of the XRP token. While the judge ruled that programmatic sales aren’t considered securities, sales of XRP tokens to institutional investors are indeed investment contracts. In this last case, Ripple did breach the US securities law and will need to keep litigating over the around $729 million it received under written contracts.

The ruling offers a partial win for both Ripple and the SEC, depending on what one looks at. Ripple gets a big win over the fact that programmatic sales aren’t considered securities, and this could bode well for the broader crypto sector as most of the assets eyed by the SEC’s crackdown are handled by decentralized entities that sold their tokens mostly to retail investors via exchange platforms, experts say. Still, the ruling doesn’t help much to answer the key question of what makes a digital asset a security, so it isn’t clear yet if this lawsuit will set precedent for other open cases that affect dozens of digital assets. Topics such as which is the right degree of decentralization to avoid the “security” label or where to draw the line between institutional and programmatic sales are likely to persist.

The SEC has stepped up its enforcement actions toward the blockchain and digital assets industry, filing charges against platforms such as Coinbase or Binance for allegedly violating the US Securities law. The SEC claims that the majority of crypto assets are securities and thus subject to strict regulation. While defendants can use parts of Ripple’s ruling in their favor, the SEC can also find reasons in it to keep its current strategy of regulation by enforcement.

The court decision is a partial summary judgment. The ruling can be appealed once a final judgment is issued or if the judge allows it before then. The case is in a pretrial phase, in which both Ripple and the SEC still have the chance to settle.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.

%2520%5B10.56.45%2C%252016%2520May%2C%25202024%5D-638514357091236586.png&w=1536&q=95)

%2520%5B11.07.19%2C%252016%2520May%2C%25202024%5D-638514357391729742.png&w=1536&q=95)