Ripple traders hope for win in SEC lawsuit as regulator backs down on security status of SOL, ADA, MATIC

- Ripple lawsuit ruling is expected this week as July draws to a close.

- SEC retracted its request for security status of Solana, Cardano and MATIC among other assets.

- XRP extended gains by nearly 3% early on Tuesday, climbing to $0.6183.

Ripple (XRP) traders expect the lawsuit brought by the Securities & Exchange Commission (SEC) to end this week. A pro-crypto attorney, Fred Rispoli, had predicted the end of SEC vs. Ripple lawsuit by July 2024.

The SEC’s move to retract the request for “security status” of Solana, Cardano and MATIC has filled XRP traders with hope for a positive development in the lawsuit.

XRP trades above the key psychological level of $0.60.

Daily digest market movers: Ripple ruling could see positive turn as SEC backs down on security status for these cryptos

- The SEC has retracted its request for “security status” of Solana (SOL), Cardano (ADA) and Polygon (MATIC).

- XRP has legal clarity on its status as a non-security in secondary market transactions, meaning that when traded on exchanges the altcoin is not a security.

- The gray area is the institutional sales of the asset, and this is likely to be addressed in the final ruling in the SEC vs. Ripple lawsuit.

- Judge Analisa Torres had granted a partial victory to Ripple when XRP was declared a non-security in July 2023.

- XRP traders are closely watching the lawsuit for key developments and an end or outcome this week.

- Ripple update: What to expect from XRP and Ripple lawsuit this week.

- Attorney Fred Rispoli, a pro-crypto lawyer, set a deadline of July 31 in his prediction for the lawsuit ruling.

- The Judge is expected to rule on the issue of “fines” or “settlement” to be imposed on the payment remittance firm for the alleged violation of securities laws.

- It also remains to be seen whether the SEC accepts XRP as a non-security or appeals Judge Torres ruling at a later time.

- Rumors of a settlement between the two parties were doing the rounds prior to the closed door meeting on July 25.

- There is no further update in the lawsuit since the two parties filed their letters and responses on the matter of “supplemental authority” or Judge Amy Berman Jackson accepting the XRP ruling as precedent in the SEC vs. Binance lawsuit.

Technical analysis: Ripple could extend gains by 10%

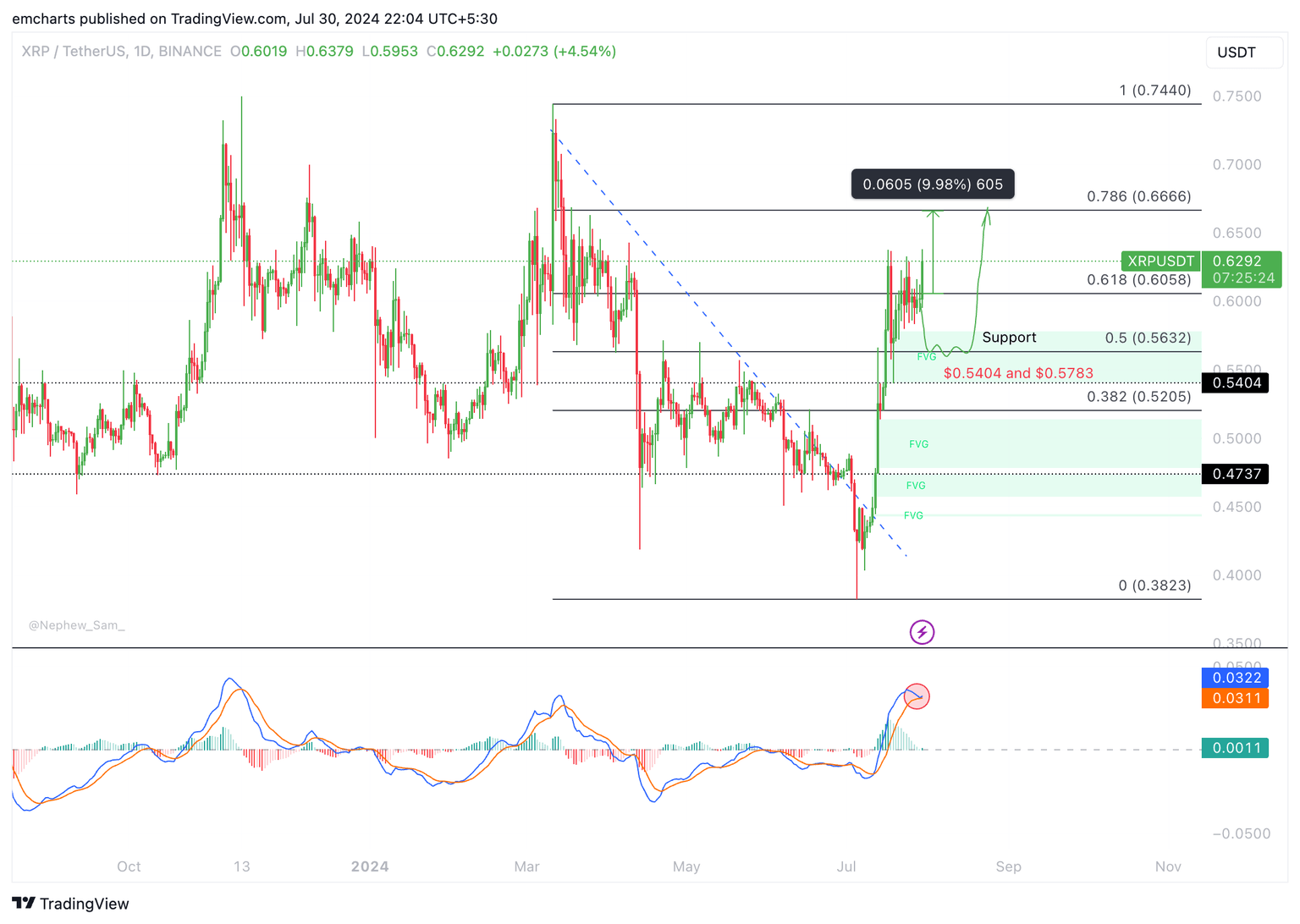

Ripple is trending higher, forming higher highs and higher lows since July 12, as seen in the XRP/USDT daily chart. XRP is likely to sweep support at $0.5632, collect liquidity and extend gains by nearly 10% after. The target is $0.6666, the 78.6% Fibonacci retracement level of the decline from the March 11 peak of $0.7440 to the July 5 low of $0.3823.

Ripple faces resistance at $0.6058, the 61.8% Fibonacci retracement level and the March 25 high of $0.6629.

The Moving Average Convergence Divergence (MACD) indicator supports the thesis of a decline in XRP price since the MACD line crossed under the signal line, marked by a circle in the chart below. This signals underline negative momentum in Ripple’s price trend.

XRP/USDT daily chart

Ripple could sweep lows of $0.5205, the 38.2% Fibonacci retracement on the daily time frame.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.