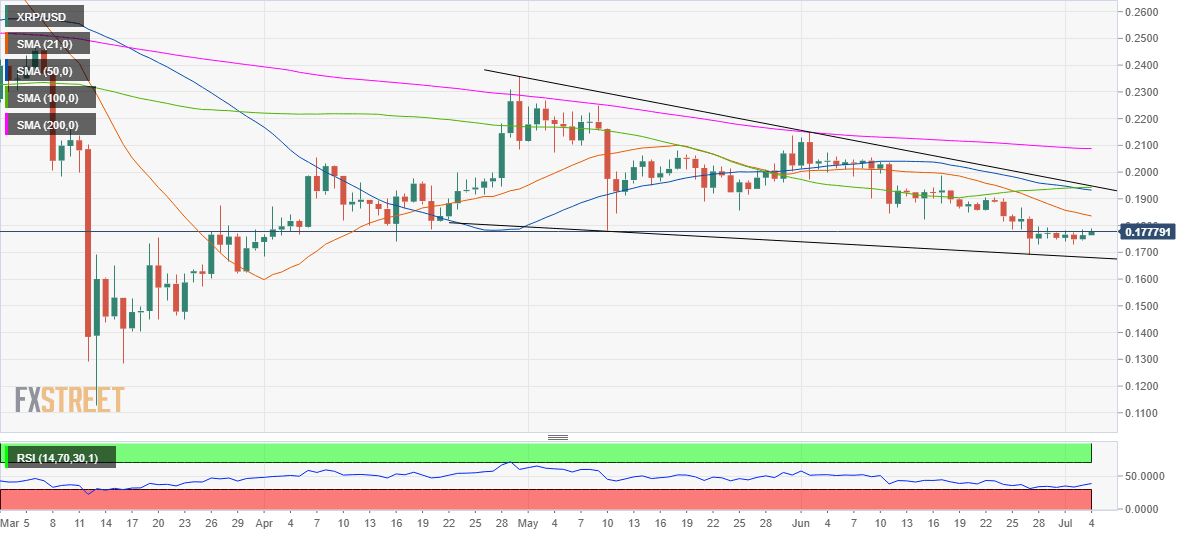

Ripple Technical Report: XRP/USD remains bearish while below 21-DMA

- Ripple’s range trade extends into the seventh day on Saturday.

- The spot looks promising but above the 21-DMA barrier.

- RSI on the daily chart holds in the bearish territory.

Ripple (XRP/USD) is trying hard to build onto Friday’s gains, as the week-long range paly extends into Saturday. The bulls lack vigor and await a fresh trading impetus to take on the upside. US traders are away, celebrating the Independence Day extended weekend. At the time of writing, the fourth-most favorite cryptocurrency trades with small gains around 0.1775 but remains on track to book about 2.50% weekly loss. Its market capitalization stands at $7.88 billion.

From a medium-term technical perspective, the No.4 is trending in a potential falling wedge pattern on the daily chart, suggesting the continuation of the previous uptrend should the formation get confirmed above the falling trendline resistance at 0.1948.

Until then the price is likely to remain range-bound to bearish, as long as it holds below the 21-day Simple Moving Average (DMA), now at 0.1835.

The daily Relative Strength Index (RSI) stays below the 50.0 midline but points upwards, suggesting that the price could challenge the 21-DMA in the coming days.

If the bulls manage to take out the latter, the No. 4 coin will see the buying pressure accelerating, as it looks to test the key supply zone around 0.1940, where the falling trendline resistance, 100 and 5-DMA coincide.

A decisive breakthrough will validate the pattern, calling for a test of the horizontal 200-DMA at 0.2088 en route the pattern target above 0.2500, which could likely be reached over the coming quarter.

It’s going to be an uphill task for the XRP buyers, as they will have face a stack of key healthy resistance levels on the way north.

Meanwhile, any pullbacks are likely to meet strong demand at the falling trendline support of 0.1680.

XRP/USD daily chart

XRP/USD key levels to consider

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.