Ripple surges to a six-year high just below $2.50

- Ripple price extends its gains on Monday, trading above $2.40 after rallying more than 60% the previous week.

- On-chain data supports the bullish outlook as XRP’s daily trading volume, active addresses and open interest reach record levels.

- The resignation announcement of SEC Chair Gary Gensler and the launch of WisdomTree Physical XRP ETP in Europe in mid-November fueled the rally.

Ripple (XRP) price extends its gains, trading above $2.40 at the time of writing on Monday after rallying more than 60% the previous week and surging almost four times in November. On-chain metrics support this bullish price action as XRP’s daily trading volume, active addresses, and open interest reach record levels.

Additionally, the resignation announcement of US Securities and Exchange Commission (SEC) Chair Gary Gensler on November 21 and the launch in Europe of an XRP exchange-traded product (ETP) by asset management company WisdomTree the same day further added bullish credence to the Ripple price.

XRP on-chain metrics look promising

Ripple price has experienced a significant rally, surging almost four times in November. XRP reached a new six-year high of $2.49 on Monday, breaking above its January 8, 2018 high of $2.45. According to CoinGecko, XRP is now the third-largest cryptocurrency by market capitalization, overtaking Tether (USDT). This impressive performance has sparked excitement among investors, with many speculating that XRP could continue to rise, potentially reaching $3 or even higher soon.

Looking down on its on-chain metrics provides a clearer bullish outlook. Santiment’s Daily Active Addresses index, which tracks network activity over time, rose from 45,409 on Saturday to 109,070 on Monday, the highest level since mid-August 2023. This indicates that demand for XRP’s blockchain usage is increasing, which bodes well for Ripple’s price.

%2520%5B12.02.26%2C%252002%2520Dec%2C%25202024%5D-638687263106469427.png&w=1536&q=95)

XRP Daily Active Addresses chart. Source: Santiment

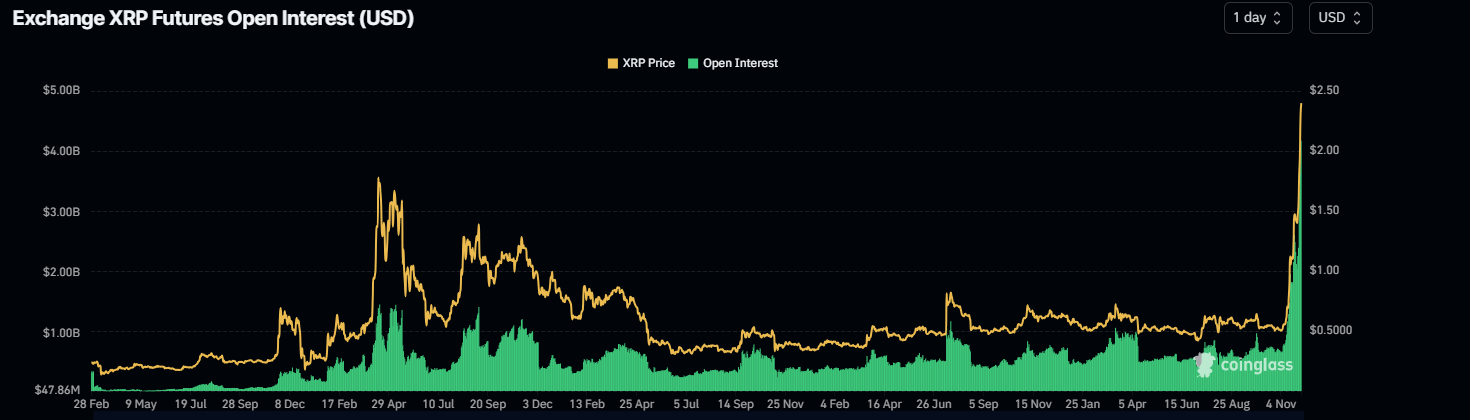

Ripple’s Open Interest (OI) also supports the bullish outlook. Coinglass’s data shows that the futures’ OI in XRP at exchanges rose from $2.27 billion on Saturday to $4.18 billion on Monday, almost doubling in two days. An increasing OI represents new or additional money entering the market and new buying, which suggests a rally ahead in the Ripple price.

XRP Open Interest chart. Source: Coinglass

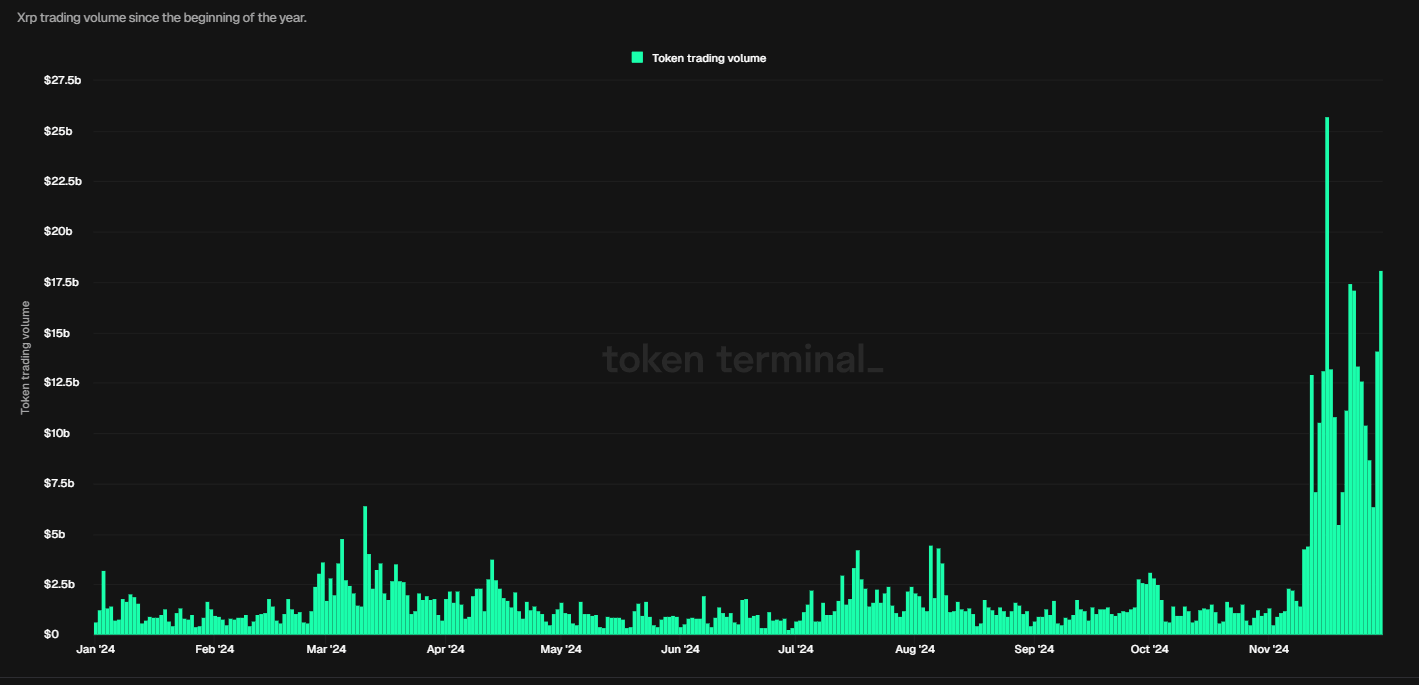

Another aspect bolstering the platform’s bullish outlook is a recent surge in traders’ interest and liquidity in the XRP chain. Token terminal data shows that XRP’s daily trading volume reached the highest yearly volume of $25.75 billion on November 16 and has been constantly showing strength since then.

XRP trading volume since the beginning of the year. Source: Token Terminal

Other optimism for XRP bullish rally

The victory of Donald Trump’s crypto-friendly candidate in the US election in early November supported Ripple’s bullish outlook. Additionally, the official announcement of SEC Chair Gary Gensler on November 21 that he would resign from the agency on January 20, 2025, added fuel to Ripple’s ongoing rally as investors anticipate an end to the SEC’s stringent “regulation by enforcement” approach, which has heavily impacted Ripple and the broader crypto sector.

Analysts consider that a new, more pro-crypto SEC chair could lead to a favorable outcome in the legal battle between the SEC and Ripple, unlocking XRP’s full potential and broader acceptance in the financial ecosystem.

On January 20, 2025 I will be stepping down as @SECGov Chair.

— Gary Gensler (@GaryGensler) November 21, 2024

A thread ⬇️

Moreover, the WisdomTree Physical XRP ETP launched in Europe in the same day added more credence to the bullish outlook. The launch allows investors to gain exposure to the native token on the XRP Ledger through regulated European markets. This is a positive sign for the token’s accessibility and liquidity, as seen in the above-mentioned on-chain metrics. This renewed interest attracted investors and traders to the XRP token and anticipated the equivalent XRP ETF products could be launched in the US.

We’re excited to announce the launch of the WisdomTree Physical XRP ETP, now listed on Börse Xetra, SIX Swiss Exchange, and Euronext Paris and Amsterdam.

— WisdomTree in Europe (@WisdomTreeEU) November 21, 2024

The WisdomTree Physical XRP ETP offers a simple, secure, and low-cost way to gain exposure to XRP, one of the largest… pic.twitter.com/30VAQVau8t

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.