Ripple escrow unlocks one billion XRP on Monday as altcoin ranges above $0.47

- Ripple escrow timelock expired on Monday, and one billion XRP tokens were unlocked.

- The one billion token unlock is part of Ripple’s unlocks scheduled till January 2025.

- XRP hovers around $0.48 on Tuesday, adding more than 1% to its value on the day.

Ripple (XRP) escrow unlocked 1 billion tokens on Monday as part of the planned unlock until January 2025. XRP hovers around $0.48 early on Tuesday, adding more than 1% to its value on the day.

With no new developments in the SEC vs. Ripple lawsuit, market participants closely watch escrow unlocks and on-chain metrics to identify where XRP is headed next.

Daily Digest Market Movers: Ripple unlocks 1 billion XRP from escrow, social dominance rises

- As part of scheduled routine unlocks, the escrow timeline for 1 billion XRP tokens expired on Monday, according to Bithomb data.

- The unlock occurred in three tranches of 400 million, 100 million, and 500 million XRP, respectively.

- As seen in previous instances in February and May, the scheduled unlocks do not significantly impact the XRP price.

- On-chain data from crypto tracker Santiment shows that social dominance, a metric used to identify the relevance of XRP among traders, hit a three-month peak.

- The rise in social dominance of an asset is associated with increasing mentions on social media and higher demand for XRP among traders.

- The chart below shows a spike in social dominance, bringing it above levels previously seen in the last week of March.

XRP social dominance vs. price

- XRP holders realized over $63 million in losses on Monday, a large negative spike in the Santiment’s Network Realized Profit/Loss (NPL) metric. This is consistent with capitulation among retail traders and signals a recovery in the altcoin is likely.

XRP Network Realized Profit/Loss vs. price

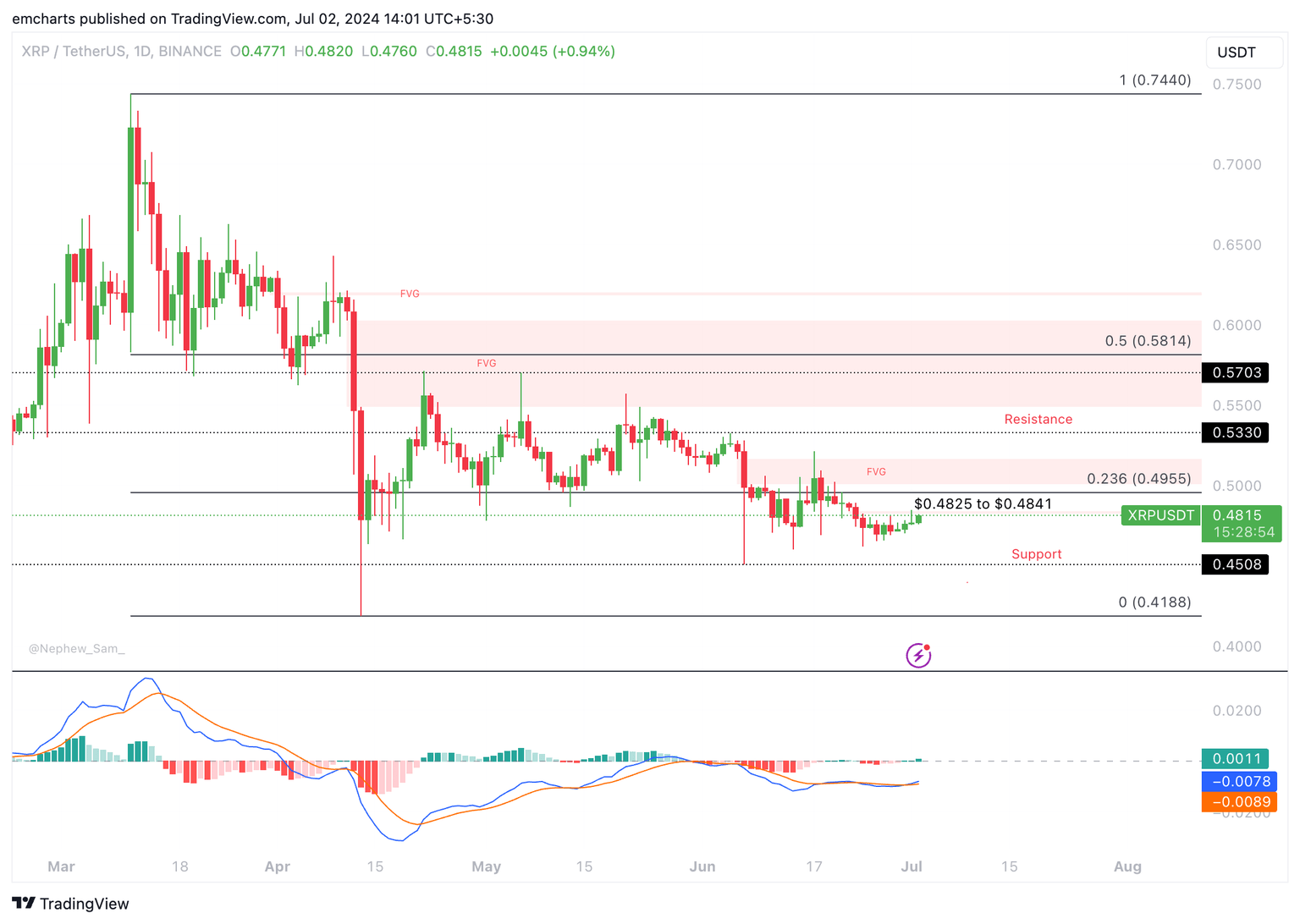

Technical analysis: XRP hovers around $0.48 on Tuesday

Ripple has been in a state of decline since March 11, but XRP is hovering around $0.48 on Tuesday. The altcoin could climb toward the Fair Value Gap (FVG) between $0.4825 and $0.4841. Further up, XRP faces resistance at the psychologically important $0.50 level.

XRP/USDT daily chart

If selling pressure resumes, XRP could correct to the June 7 low support at $0.4508.

SEC vs Ripple lawsuit FAQs

It depends on the transaction, according to a court ruling released on July 14: For institutional investors or over-the-counter sales, XRP is a security. For retail investors who bought the token via programmatic sales on exchanges, on-demand liquidity services and other platforms, XRP is not a security.

The United States Securities & Exchange Commission (SEC) accused Ripple and its executives of raising more than $1.3 billion through an unregistered asset offering of the XRP token. While the judge ruled that programmatic sales aren’t considered securities, sales of XRP tokens to institutional investors are indeed investment contracts. In this last case, Ripple did breach the US securities law and will need to keep litigating over the around $729 million it received under written contracts.

The ruling offers a partial win for both Ripple and the SEC, depending on what one looks at. Ripple gets a big win over the fact that programmatic sales aren’t considered securities, and this could bode well for the broader crypto sector as most of the assets eyed by the SEC’s crackdown are handled by decentralized entities that sold their tokens mostly to retail investors via exchange platforms, experts say. Still, the ruling doesn’t help much to answer the key question of what makes a digital asset a security, so it isn’t clear yet if this lawsuit will set precedent for other open cases that affect dozens of digital assets. Topics such as which is the right degree of decentralization to avoid the “security” label or where to draw the line between institutional and programmatic sales are likely to persist.

The SEC has stepped up its enforcement actions toward the blockchain and digital assets industry, filing charges against platforms such as Coinbase or Binance for allegedly violating the US Securities law. The SEC claims that the majority of crypto assets are securities and thus subject to strict regulation. While defendants can use parts of Ripple’s ruling in their favor, the SEC can also find reasons in it to keep its current strategy of regulation by enforcement.

The court decision is a partial summary judgment. The ruling can be appealed once a final judgment is issued or if the judge allows it before then. The case is in a pretrial phase, in which both Ripple and the SEC still have the chance to settle.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.

%2520%5B13.05.17%2C%252002%2520Jul%2C%25202024%5D-638555136923538912.png&w=1536&q=95)

%2520%5B13.06.44%2C%252002%2520Jul%2C%25202024%5D-638555137225711199.png&w=1536&q=95)