XRP price is coming up on an important directional breakout as Ripple fills multi-year triangle

- Ripple price is consolidating within the confines of a symmetric triangle on the daily as well as the three-day timeframes

- XRP could breakout if this neutral technical formation is activated, with the next directional bias to be revealed after absconding.

- Investors looking to enter long or short positions should wait for the breakout, with $0.6873 and $0.5773 being critical.

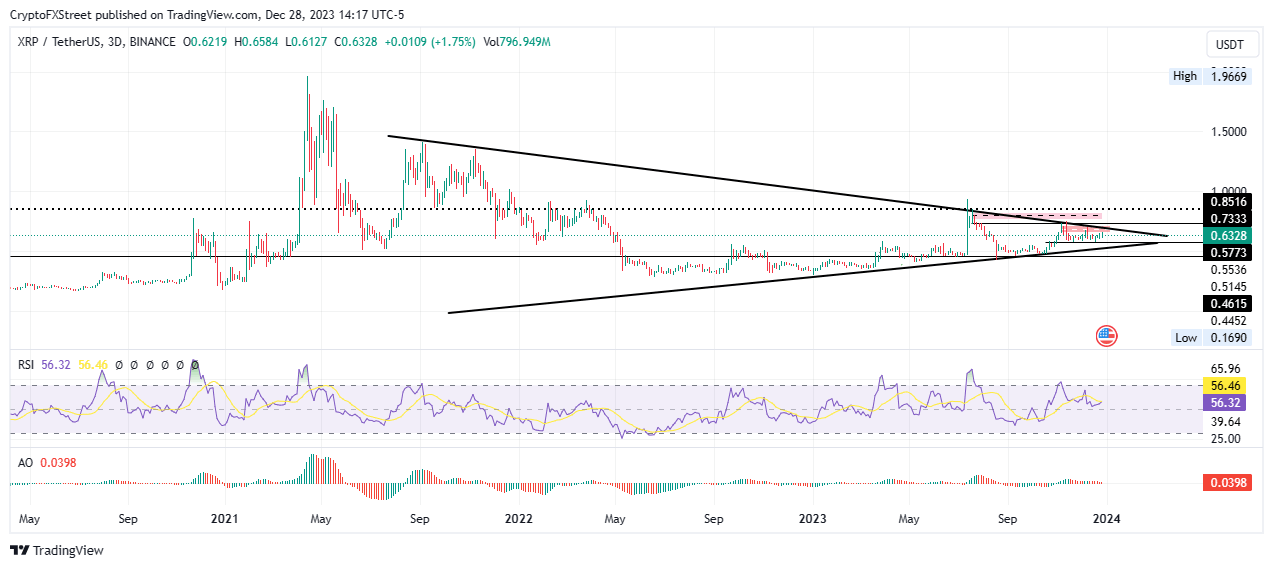

Ripple (XRP) price is holding above the $0.6000 psychological support level, with a look at the three-day timeframe for the XRP/USDT trading pair showing that XRP price is consolidating within a multi-year symmetric triangle, extending through 2021. Considering that it is approaching towards filing up the technical formation, a breakout could happen soon.

XRP/USDT 3-day chart

Also Read: XRP price consolidates after failing crucial breach even as Binance announces Ripple-USDC listing

Ripple defends $0.6 support as US politicians coalesce to fire SEC Chair Gary Gensler

Emmer coalesces with Ohio congressional representative Warren Davidson in the bill to fire the SEC Chair, with his contention being that “Gensler’s SEC sides with Wall Street, not Main Street.”

Gensler’s SEC sides with Wall Street, not Main Street.

— Tom Emmer (@GOPMajorityWhip) December 28, 2023

I’m proud to join @WarrenDavidson as a co-lead on his bill, the SEC Stabilization Act, so we can #FireGaryGensler.

This is not the first time Emmer takes a jab against Gensler, with a recent citing where the Congressman is as “ineffective as he is incompetent.”

The negativity comes as lawmakers say Gensler has demonstrated impartiality in the commission’s decisions on matters crypto. Case in point, according to Congressman Davidson, is the witnessed delays in Spot Bitcoin ETF (ETF) applications and crypto regulations.

Ripple price prediction

On the daily timeframe, Ripple price is testing the upper boundary of the symmetric triangle, with the position of the Relative Strength Index (RSI) above the 50 level, coupled with the presence of green histogram bars of the Awesome Oscillator (AO) suggesting that the upside potential remains alive.

Increased buying pressure could see XRP price overcome the upper boundary of the triangle to confront the supply barrier between $0.6544 and $0.7195. To confirm the continuation of the uptrend, the price must record a daily candlestick close above its midline of $0.6873.

In a highly bullish case, the gains could extend for Ripple price to flip this order block into a bullish breaker, confirmed by a move above the $0.7333 barricade. In extremely ambitious cases, the climb could extend for the price to venture into the second supply zone between $0.7651 and $0.8234. A break and close above its midline at $0.7954 would confirm the continuation of the uptrend.

XRP/USDT 1-day chart

On the other hand, increased seller momentum could see Ripple price drop below, losing the support offered by the lower boundary of the channel. A break and close below the $0.5773 support level would invalidate the bullish outlook, setting the tone for a continued fall to the $0.4615 support floor.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.